10 Tips For Saving A Down Payment For A House

Making the decision to buy a house is a difficult one, especially in the current Canadian housing climate. It means you’re going to be taking on a huge amount of debt and you’ll be committing yourself to years of monthly payments. You’re also going to have to manage to scrape together a huge down payment, which is one of the top reasons many Canadians aren’t homeowners yet - they simply have not been able to afford a down payment.

Saving for a down payment is something that most of us have the option to do, though. Sure, it takes a lot of sacrifices and a whole lot of self-discipline, but it’s true: most Canadians can do it if they really commit themselves to a plan.

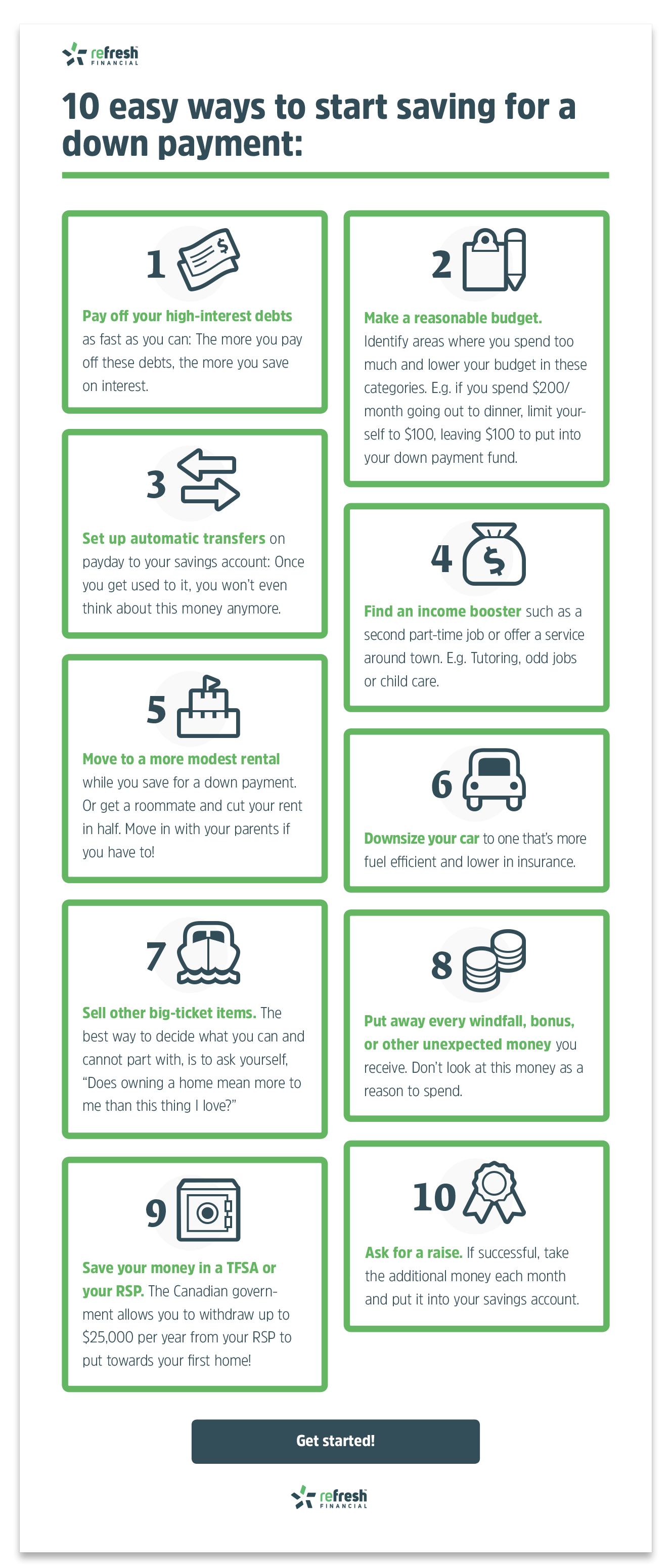

So, with that in mind, I thought we could go over some tips for saving your first down payment on a house. Here are ten relatively easy ways to start your saving:

1. Pay off your high-interest debts as fast as you can

The more you pay off these debts, there more you save on interest. Also, once you get these debts out of the way, every cent you were paying them down with can now go towards your down payment. This extra money can also go towards paying off your mortgage sooner with higher payments.

2. Identify areas where you spend too much

Some of us dine out a lot, others have expensive hobbies or taste in clothes. Whatever your money weaknesses are, identify them. Be honest with yourself, denial will only delay your homeownership. Once you’ve got them identified, give yourself a much lower budget in these categories and calculate the difference. For instance, if you spend about $200/month going out to dinner with friends, limit yourself to $100 - the difference is then $100. That’s $100 you can put into savings every month by just opting to stay in for a homemade meal.

3. Set up automatic transfers

Your online banking should allow you to set up an automatic transfer after payday to send a certain amount of cash from your chequing account to your savings account. Once you get used to it, you won’t even think about this money anymore.

4. Make a reasonable budget for yourself and your household

Get all parties in your home to agree to it and stick to it. If you are used to living paycheque to paycheque, try to reach the goal of having some money leftover from the last paycheque when you get your next paycheque.

5. Move to a more modest rental

If you’re currently paying high rent in a large unit, consider downsizing and saving the difference in rent every month. You can then transfer the difference to your down payment savings account. Alternatively, you could get a roommate and cut your rent in half!

6. Sell or downsize your car

If you’re close enough to work, you could ride a bike instead of driving. If you’re near a bus line, take transit instead. If your significant other has a car, downsize to one - sell your car and use the proceeds to begin your down payment savings. Or you could sell your car and downsize to a smaller vehicle that's more fuel efficient and lower in insurance. Put the profit you make on the sale plus your savings in expenses every month into your savings, and watch your down payment soar.

7. Sell other big ticket items

The best way to decide what you can and cannot part with, is to ask yourself, “Does owning a home mean more to me than this thing I love?” If the answer is yes, and you will survive without it, get it on Craigslist and boost your savings with the cash.

8. Put away every windfall, bonus, or other unexpected money you receive

Don’t look at this money as a reason to spend. Before you buy anything with it, ask yourself if that item is more important than being a homeowner. If the answer is no, get your bonus money into your savings account faster than you can even think about spending it.

9. Save your money in a TFSA or your RSP

A TFSA is a tax-free savings account and just like the name suggests, you can earn interest on your savings here without having to pay any income taxes on it. With a Retirement Savings Plan (RSP) the amount you contribute to it each year is deductible from your taxes. This helps you save money by reducing your taxable income for that year, which allows you to pay less tax now. And RSPs aren't just for retirement - the Canadian government allows you to withdraw up to $25,000 per year from your RSP to put towards your first home!

10. Get approved for a credit building program

Most Canadians are approved and you don’t need any money up front. In the end, you have cash in hand and you’ve also boosted your credit score. Refresh Financial's secured savings loan can boost your credit score to that 700+ range and put savings into your bank account for a down payment. Both will be necessary in order to get approved for a mortgage.

When you break it down like this, saving for a down payment on a home doesn’t seem so daunting. It’s totally doable for most Canadians and it all comes down to how committed to homeownership you are. And if you're in BC and are looking for your first home, don't forget about the BC government's interest-free loans for your down payment. Check out all the information in our post here.

And once you've got that down payment and are in your new home, you can start to plan how you can pay down your mortgage faster! Check out this story on Sean Cooper, who paid off his mortgage in Toronto in 3 years. He's even written a book on his experience, called Burn Your Mortgage.

What are some other tips for saving a down payment on a house you can think of? Let us know in the comments!

Leave a Reply