Most Popular

Most Popular

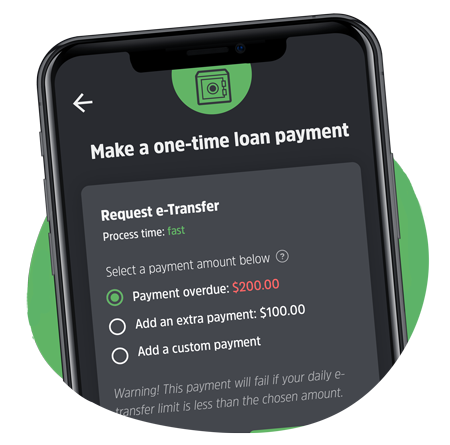

E-Transfer is now available for one-time Credit Builder Loan payments

A few months ago we released a major new update to the Secured Card product, adding e-Transfer Request Money into the dashboard for making faster-secured card balance payments, and for increasing secured card limits. The feedback was overwhelmingly positive and vastly improved the experience Refresh customers had with our secured card product. As a result, […]...more

Latest article

Post by category

Want to build your credit by saving money (instead of spending)? We can help.