[Infographic] What is the Average Credit Score in Canada and How Do You Compare?

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe it’s worse?

First, let's answer the question you are here to find out:

What is the average credit score in Canada?

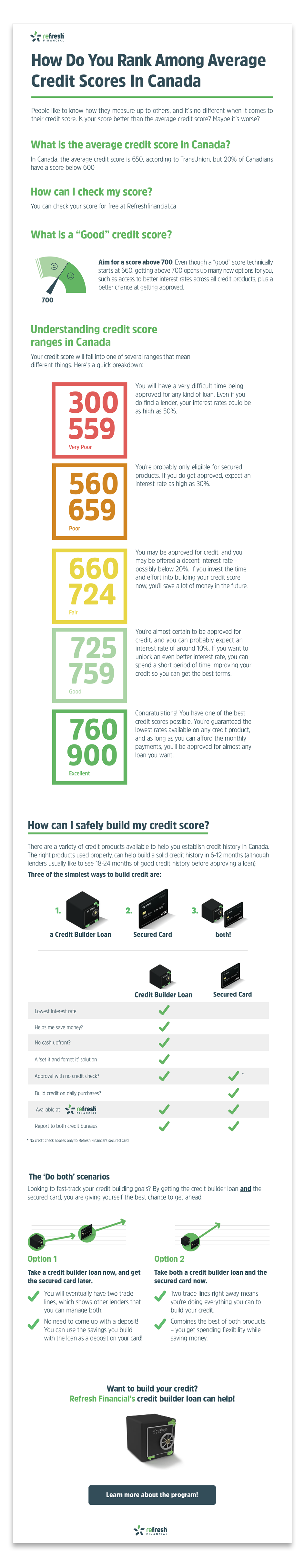

While credit scores in Canada range from 300 - 900, the average is around 650, according to TransUnion, though it varies from province to province. Once you've reached a credit score of 650 or higher, you'll be able to qualify for more financial products. A credit score below 650 is going to make it hard to qualify for new credit, and anything you are approved for will likely come with very high-interest rates.

Do you know your credit score? You can use Borrowell to get your credit score in Canada for free. With Borrowell, you'll get weekly credit score updates, see exactly what's impacting your credit score, and get personalized tips on how to improve your score. You can also find your free credit score here.

Check out this infographic that shows the average credit scores in Canada:

What Is A Good Credit Score in Canada?

To have what is considered a good credit score in Canada, you want to aim for a credit score above 700. Even though “good” technically starts at 660, getting your credit score above 700 is going to open up many new options for you. People with a good credit score in Canada have access to far better interest rates across all credit products, plus a better chance of getting approval for the credit products you apply for.

Understanding The Credit Score Range In Canada

The credit score range in Canada is between 300 and 900, with the higher the better. Here’s a quick breakdown of what each credit score range in Canada means:

Excellent credit (A credit score of 760-900)

If your score falls within the Excellent credit score range in Canada, the world is pretty much your oyster. You’re almost guaranteed approval for any financing you apply for should your income support the payments. You’re also going to be offered the best interest rates and be able to save loads of cash on your borrowed money.

Good credit (A credit score of 725-759)

If your score is in the Good credit score range in Canada, you’re still going to get decent interest rates but it’s worth it to spend a short period of time working your way up to excellent credit, just to be able to unlock even better interest rates. The few months of being patient and disciplined could save you thousands of dollars in the long run.

Average credit (A credit score of 660-724)

Similar to a good score, you’re probably going to get approved for credit if you're within the Average credit score range in Canada, and you might get some okay interest rates, but it wouldn’t take you that long or very much pain to get up there to better score. Take the time to build your score from here, then apply for credit. You’ll save a ton.

Poor credit (A credit score of 560-659)

You likely won’t be approved for much within the Poor credit score range. You might be approved for some secured credit products but the interest rates you’re offered will be high.

Very Poor credit (A credit score of 300-559)

Similar to the poor range, a score in the Very Poor credit score range is going to limit you to secured credit products with very high-interest rates.

Ways to Build Credit

If you’re on the lower end of the credit score spectrum, the first thing you need to realize is that your situation is not hopeless. Even those who’ve been through a bankruptcy or consumer proposal can recover and they can do it quicker than you might realize. You can rebuild your credit with a little discipline, sacrifice, and determination and you might even accomplish this faster than you expect.

The first step is making the decision that you’re committed to improving your credit score. From there, you can make several choices. A secured card will require some funds upfront, but will do wonders to improve your score pretty quickly. It’s the same with a secured line of credit from your bank or credit union.

The best method to improving your credit score in Canada is saving, paying off debts, and a little help from a Refresh Financial credit builder program.

Apart from that, the rest is really a no-brainer. Pay your bills on time and in the correct amount, don’t over-apply for credit and keep your usage down. If you do all this you’re going to have a great credit score in no time. Yes, even if you’ve been through bankruptcy or consumer proposal.

Leave a Reply