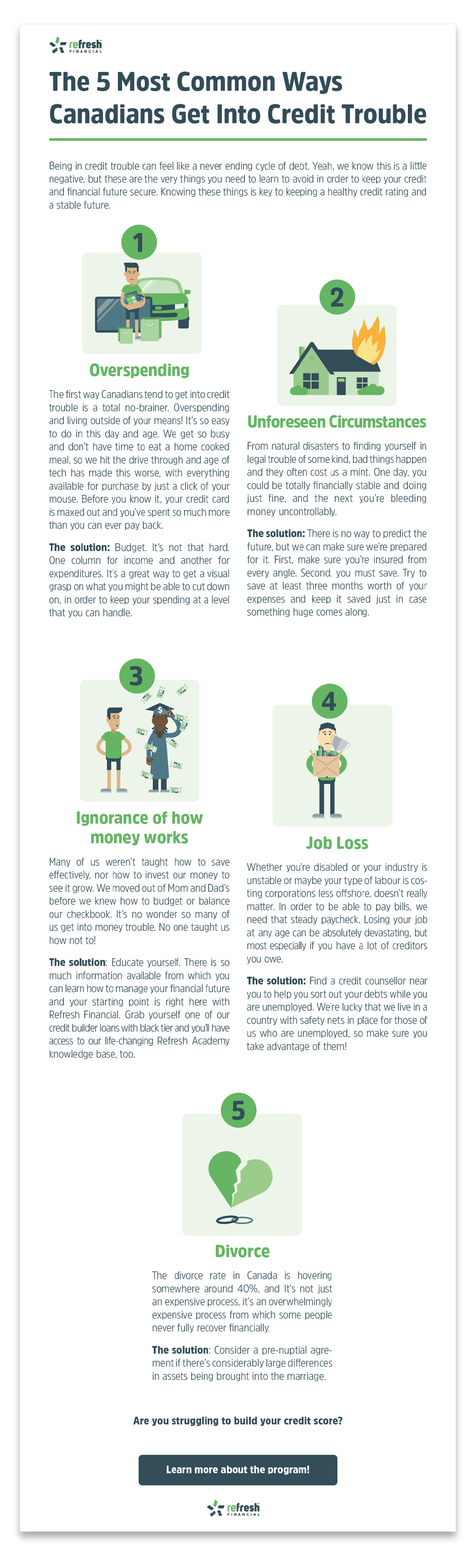

What Causes Bad Credit? 5 Common Causes of Credit Trouble

Yeah, we know this is a little negative and we don’t like to rehash our mistakes any more than you do, but these are the very things you need to learn to avoid in order to keep your credit score and financial future secure. You can’t avoid it if you don’t know about it, so we’re gonna lay some knowledge on you.

Some of these you may know about already; some of you may have experienced one or two of them, and some of you might not even recognize that a point or two listed below has had an effect on your financial security. Whatever your story is, knowing these things I am about to tell you, is key to keeping a healthy credit score and a stable future.

1. Overspending

The first way Canadians tend to get into credit trouble is a total no-brainer. Every last one of you reading this knows it, which is why it’s so surprising that it still affects so many of us. Overspending, charging too much to your credit card and living outside of your means! It’s so easy to do in this day and age. We get so busy and don’t have time to eat a home cooked meal, so we hit the drive through. We become dependent on our vehicles and our smart phones and our computers. We want to spoil our kids at Christmas and birthdays and take them to all the fun places they hope to go. The age of tech has made this worse, with everything available for purchase by just a click of your mouse. It’s easy to just add things to your virtual cart and checkout without a second thought. It’s fun to get the packages delivered to your door. Before you know it, your credit card is maxed out and you’ve spent so much more than you can ever pay back. Some Canadians find themselves overspending after their income has decreased and no adjustments to their spending was made.

What are some common ways that Canadians overspend?

- Overspending With Credit Cards: People dig themselves into holes with their credit cards all the time. Make sure to avoid this common mistake by making sure you can afford to pay back everything you charge to your card. Make a rule that you’ll pay your entire balance off in full every month.

- Buying A Home They Can’t Afford: Many Canadians make the mistake of taking on mortgage payments that eat up the majority of their month to month cash flow. If mortgage payments leave you without any wiggle room, then it means you’re susceptible if interest rates ever jump. The new mortgage stress test is a good preventative tool when it comes to this problem. Always calculate higher interest rates into your home purchasing budget.

- Purchasing A Vehicle Above Their Means: Maybe you got swindled at the dealership, or perhaps you had your heart set on that Mustang. Whatever the case, it’s important to have the same responsible mindset as you would with a mortgage. Leave yourself with financial wiggle-room when it comes to payments, and pick a car that is truly affordable for you. Read our article on 5 Ways To Ensure You're Getting A Good Deal On Your Car

- Entrepreneurial Ventures: It's incredibly common for businesses to fail, and many Canadians find themselves in overwhelming debt after an unsuccessful venture. Avoid this by making use of small business grants and waiting until you have a healthy amount of savings behind you when you start. This way, even if your business isn’t making any money right away, you can still make ends meet at home.

The solution: Budget. It’s not that hard. One column for income and another for expenditures. It’s a great way to get a visual grasp on what you might be able to cut down on, in order to keep your spending at a level that you can handle. Here’s a super simple video that can walk you through making a basic household budget and earning yourself a fresh start: https://youtu.be/K9eVqqFjcJ0

2. Divorce

Divorce is next. The divorce rate in Canada is hovering somewhere around 40%, so I know a lot of you are going through it. It’s not just an expensive process, it’s an overwhelmingly expensive process from which some people never fully recover financially. Obviously, divorce is a difficult thing to go through for so many reasons, but destroying your credit score is near the top.

The solution: There is none really. Of course, the obvious thing to say here is that you need to be careful with marriage and make sure the person you’re tying yourself to is the person you’ll stay with forever. It’s a great sentiment, but none of us have a wayback machine. Divorce happens. If you’re faced with it, you can make it easier on yourself by cooperating, being communicative and using mediation.

3. Job Loss

The third most common reason Canadians find themselves deep in credit trouble, is that they have lost their job or been unable to hold one down. Whether you’re disabled or your industry is unstable or maybe your type of labour is costing corporations less offshore, doesn’t really matter. In order to be able to pay bills, we need that steady paycheck or we're charging it all to a credit card. Losing your job at any age can be absolutely devastating, but most especially if you have a lot of creditors you owe.

The solution: There are lots of solutions here that, when combined, can really save your behind. The first thing is, of course, try to find employment. In the meantime, you should apply for employment insurance. You can also check to see if you have any mortgage payment insurance or credit card balance insurance, which you pay for in case of this very situation. If you’re insured, make your claim as soon as possible. Find a credit counsellor near you to help you sort out your debts while you are unemployed. We’re lucky that we live in a country with safety nets in place for those of us who are unemployed, so make sure you take advantage of them! When you find employment again, make use of this fresh start by saving an emergency fund and sticking to a budget.

4. Ignorance over how money works

Ignorance of how money works. In my opinion, this should be one of the most important subjects taught at school, especially how to use a credit card responsibly. Unfortunately, we all grew up learning about money from our parents, our peers and what little information we picked up from other sources throughout the years. None of us really have a solid foundation of money or credit card knowledge on which to build our credit. If you want to know about money, you have to either teach yourself or head to business school. Many of us weren’t taught how to save effectively, nor how to invest our money to see it grow. We moved out of Mom and Dad’s before we knew how to budget or balance our chequebook. It’s no wonder so many of us get into money trouble. No one taught us how not to!

Some common issues we see based on a lack of financial education include:

- Avoidance is also a common problem - don’t avoid credit card and bank statements or credit reports even if they’re not fun to look at. As you already know, avoidance will only compound the problem, and sooner or later you’ll have to face the music. Keeping this reality at the forefront of your mind will make you more conscious of what you’re spending.

- Pay Day Loans are notorious for drawing you into a vicious cycle. The borrowing fees are astronomical which means that when you go back to pay off your loan, you’re sucked into borrowing again. The best advice when it comes to PayDay loans is to avoid them altogether.

- Using Credit To Pay Debt. "Robbing Peter to pay Paul” is an old saying that refers to the act of using one credit source to pay off another. The problem with this strategy is that it turns into a cycle that will grow worse over time. Interest will accumulate regardless of where you carry your balance each month. Don’t use credit to pay credit, instead reassess your budget, cut down where you can and use actual money to pay off your debts.

The solution: Aside from lobbying the government to make sure money education ranks in importance up there right next to reading, you must find a way to educate yourself. I’m going to fill you in on a secret though. You’re doing that very thing in reading this. There is so much information available from which you can learn how to manage your financial future and your starting point is right here with Refresh Financial. Grab yourself one of their secured loans and you’ll have access to their credit score boosting F.I.T. knowledge base, too. Learning how to manage your money can be the fresh start you need.

5. Unforeseen circumstances

Finally, Canadians find themselves in debt often due to major unforeseen expenses. From natural disasters to finding yourself in legal trouble of some kind, bad things happen and they often cost us a mint and destroy our credit score. One day, you could be totally financially stable and doing just fine, and the next you’re bleeding money uncontrollably and charging up your credit card.

The solution: There is no way to predict the future, but we can make sure we’re prepared for it. First, make sure you’re insured from every angle. Second, you must save. Illnesses or disabling events can occur to anyone, and the best way to be prepared is to have an emergency fund. Typically three to six months’ worth of living costs prepare in advance is a great emergency fund to back you up in case the unforeseen happens. It’s always easier to complain about finances than it is to be diligent and disciplined. Ultimately, you’re the one who has the most control over your financial well-being. Take charge of your finances!

Whatever your reasons for getting into debt-trouble, let us help you get back out. We have a program that can help you :-)

Leave a Reply