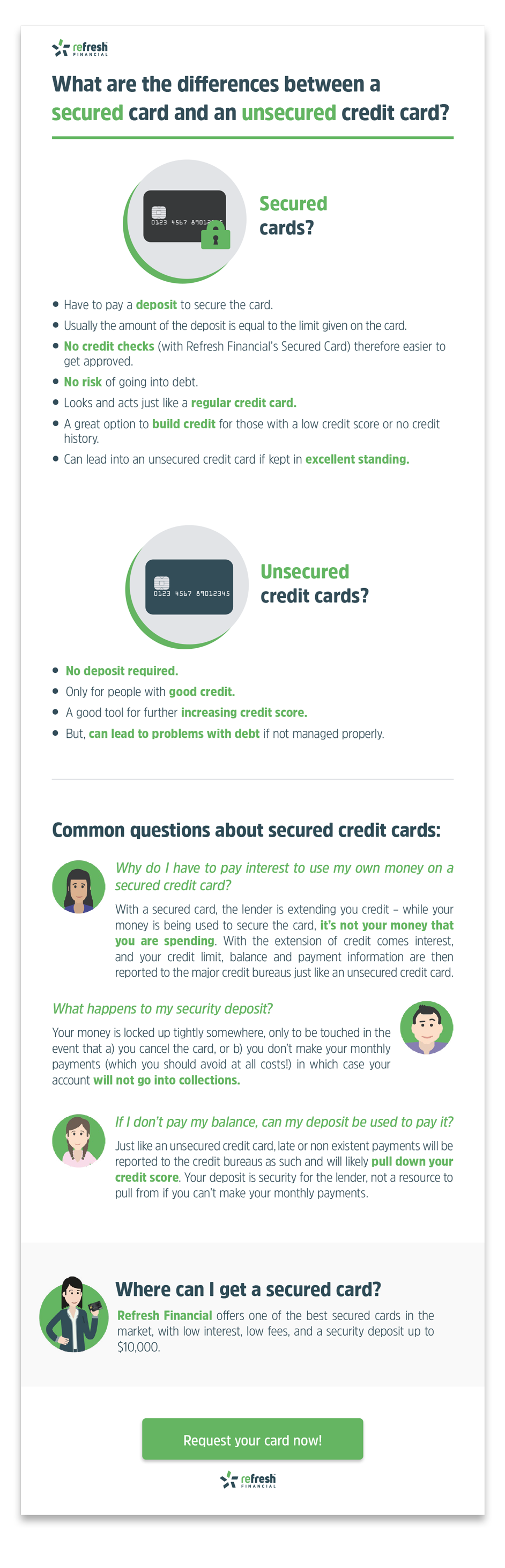

The Differences Between An Unsecured Credit Card and Secured Card

We are often asked, what is the difference between a secured card and an unsecured credit card. Here's the answer!

What is a secured card?

A secured card is different from other credit cards because you have to come up with a deposit to secure your card. Usually, but not always, the amount of the deposit is equal to the limit you will be given on the card and no credit checks are conducted in order to obtain the card. If your credit isn't terrible, you may be asked to provide a deposit that is only a percentage of the limit on the card, however, credit card companies will have to run a credit check to determine if they can take that risk.

In short, a secured card is sort of like a credit card with extra abilities - your secured card holds the power to turn your poor credit into excellent credit and all you have to do is use it and keep it in great standing.

What is an unsecured credit card?

With an unsecured credit card, the credit is simply extended to you without security, as your credit score is good enough that you appear to be a low-risk borrower. People with a better credit score can bypass the security deposit step because they have, in the past, kept all their credit accounts in good standing.

What are the benefits of a secured card?

- It is much easier to get approved for a secured card than it is for a regular credit card. Your collateral secures the card and lowers the risk the lender takes in lending to you. Just in case you default on the credit they’ve extended to you, they can use the funds you’ve used to secure your card to make up for your outstanding balance. These sorts of cards are designed specifically for those who have struggled with credit before, but who want to start fresh and build their credit score from the ground up, or those who have no credit history, such as new Canadians or young adults. If your credit score isn’t as high as you might like and has often prevented you from obtaining credit in the past, a secured card is definitely the way to go.

- Your deposit may also be placed in a savings account by your lender, depending on who you go to, and can accrue interest over the period of time you have your card secured.

- Secured cards are usually only secured for a specific amount of time and if, during that period, you keep your account in excellent standing, your lender may choose to unsecure your card (return your security deposit).

Can people tell by looking at your card that it’s a secured card?

When you use your secured card to pay for items in-store or online, there is no way for merchants to be able to tell your card is a secured card. To everyone else, including the credit bureaus, it just looks like a regular credit card.

Where can I get a secured card?

Refresh Financial offers one of the best secured cards in the market, with low interest, low fees, and a security deposit as low as $200 (most secured card providers require at least $500). Apply quickly and easily online today!

*******

Refresh financial offers custom credit building solutions to help you build your credit score FAST.

Leave a Reply