How To Prepare Financially For Buying a Home and Common Mistakes to Avoid

Buying your first home is exciting and rewarding, but it can also be very stressful, especially if you have poor credit and bad money habits. You can, however, reduce the stress of buying a home by ensuring you’re financially prepared to do so. Here are four ways to ensure your finances are in order, before you start the process of buying your very first home:

1. Pay down your debts

Your credit score is going to be front and center during the homebuying process. Whether or not you are approved for a mortgage, and what your interest rate and terms of that mortgage are going to be, entirely depend on your credit score. So, before you start looking for your new home, make sure you’re doing everything you can to improve your credit score. Paying down your debts can be helpful for this, because it lowers your credit usage percentage and shows good repayment habits.

2. Clear up any issues on your credit report

Grab a copy of your credit reports from both Equifax and TransUnion and go over them carefully. Look for problems you can fix. Maybe you paid something off already and it’s not reflected on your report. Perhaps you owe something you don’t recall borrowing. There’s also the chance that someone has got hold of your identity or credit card numbers and run up charges in your name. Clear up as many problems as you possibly can so that your credit score is the best it can be when you go to buy your home.

3. Save your down payment

You need to start saving if you haven’t already. I would suggest making sure you’ve got your credit usage percentage down below 30% as your first priority, and then you need to save. Save every cent you possibly can. Buying a home in Canada has just gotten more complicated with the new stress test rules the Government has put into effect, but the more money you save for a down payment, the easier you’re going to be able to pass this stress test. You see, if the stress test caps the mortgage you can take out at $300,000 and your down payment is $20,000, you’ll only be able to afford a home that’s selling for $320,000. If, however, you have a $75,000 down payment, your budget for a home goes up to $375,000. The more you save, the better off you’re going to be. The best way to get to saving quick is to set up automatic transfers from your chequing account to your high-interest savings account. You might also consider getting a head start with a Refresh Financial credit building program. Click here for more information on that.

4. Determine your budget

You’re going to want to figure out what you can afford as far as house prices go. You’ll need to take the new stress test into consideration. You can use online calculators to figure out what the stress test will let you get away with. Click here for one of those. Beyond the stress test, though, you’re going to have to sort out your own monthly budget and decide how much you can afford to pay for a mortgage each month and still be comfortable. That means taking a critical eye at what you spend each month and deciding where you can and cannot cut back.

Once your credit score is somewhere in the average range or above, you’ve saved enough for a down payment and you know what your budget is, you’re ready to start looking at houses and buying a home. Taking these first few steps to prepare, before you go looking at houses, is going to save you a lot of headaches and eliminate any surprises. It will ensure the mortgage application process goes smoothly and makes for a pleasant and exciting home buying experience.

Common Credit Mistakes Made by First-Time Home Buyers

1. Not Reviewing Your Credit Situation First

Before you decide on a property or approach any lenders, you need to fully understand your credit score. Make sure your report is free from any errors and do everything in your power to increase your score before shopping for mortgages.

With bad credit, lenders will either deny your loan or charge you unfavorable interest rate which can cost you tens of thousands of dollars over time.

You can check your Canadian credit score for free without penalty right here.

2. Not Doing Enough Research

Mortgage mistakes happen when we aren’t making informed decisions. One mistake today could cost you thousands of dollars in the future and perpetuate a poor credit lifestyle. Before you get too close to signing the dotted line, ask yourself the following questions:

- Am I taking advantage of first-time home buyer tax credits and other incentives?

- Have I shopped and compared multiple mortgage rates?

- Should I wait until I’m able to increase my credit score?

- Should I have a realtor to help negotiate terms, price and review the contract?

- Am I working with a sound budget?

- Should I save up for a larger down payment?

- Should I be looking at a condo?

- Am I truly ready for homeownership?

There are many more questions you could ask yourself. If you aren’t confident in any of your answers, it's best to take some time and do more research.

3. Paying the Lowest Down Payment Possible

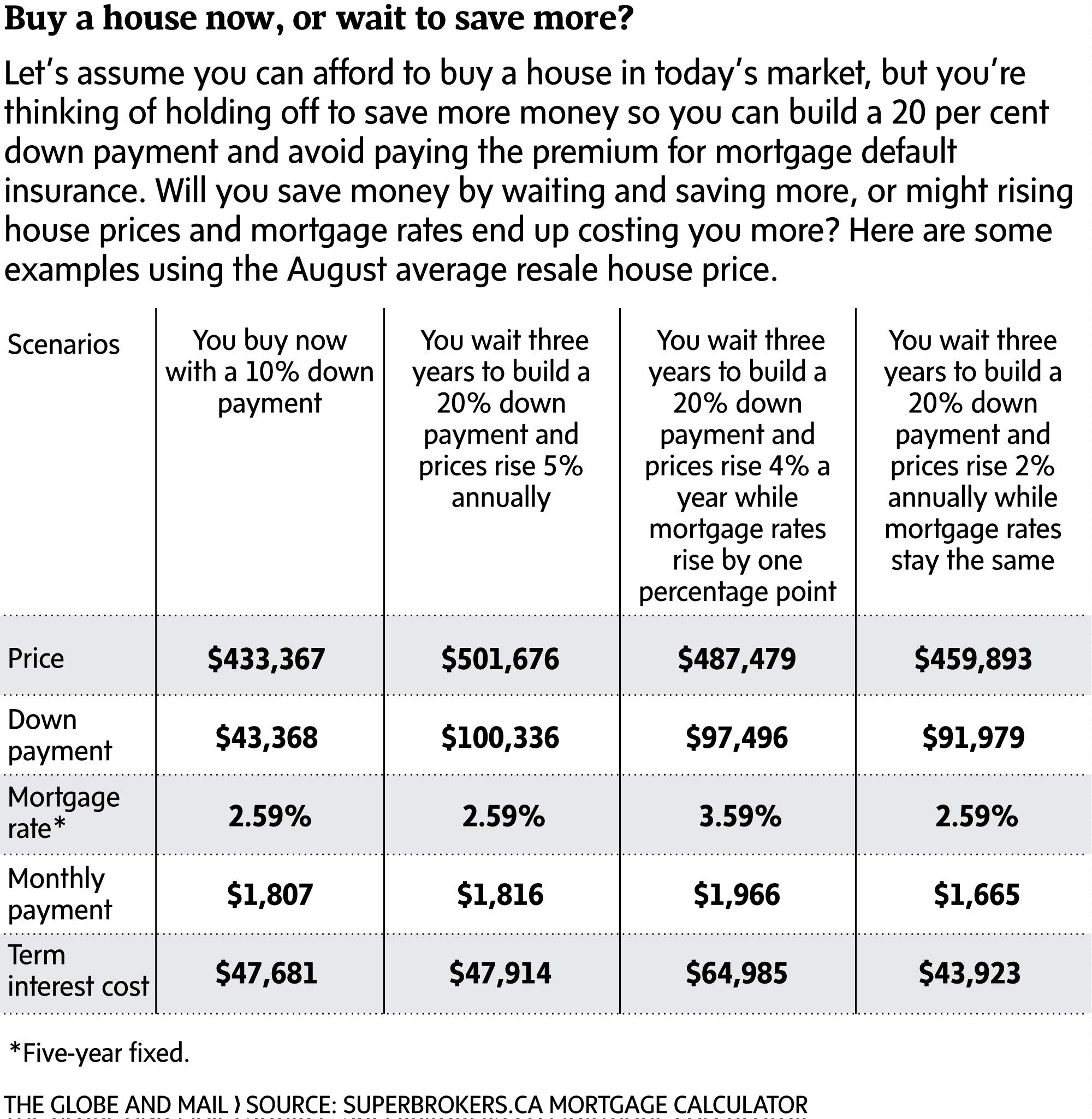

You’ve probably heard that 20% is all you need for a down-payment on a house. It's sound advice, as 20% will give you favorable terms and don't have to pay for mortgage default insurance. Ultimately, the lower down payment you pay (the minimum in Canada is 5%) the less favorable your term and monthly payments will be in the future.

That being said, if you only have 10% ready, it still might be a good call to pull the trigger, provided that you found your dream property at the right price. Since prices will continue to rise, you can't guarantee that you'll find a great deal in the future.

For more information on down payments, check out this great article!

4. Getting a Co-Signer Without Thinking it Through

If you're trying to qualify for a mortgage but are struggling with poor credit, a co-signer might be able to help you out. However, there are a few things you should consider before making this decision. If you ever lose your job or find yourself in a position where you can no longer afford your mortgage payments, your co-signer would be held financially responsible for meeting these obligations. These types of scenarios put a lot of stress and strain on the relationship, so before getting anyone else involved in your mortgage, be as honest and open as possible in regards to your financial situation.

5. You Aren’t Factoring In Future Costs

You won’t be able to call your landlord or rental office if your oven stops working, or you begin to see some water damage. If you're used to renting, this reality can be a huge oversight. Make sure your monthly budget doesn’t stop at just groceries and mortgage payments. Put money away each month so you are prepared for the day when you are forced to call in a plumber, roofer, or HVAC technician.

Related Article - There are several fees, repairs, renovations, property taxes, maintenance, that every homeowner will be subject to. Read about the different bills you can expect to pay in our article: If You’re Buying Your First Home, Make Sure You’re Budgeting for These Fees”.

There are ideal homes and mortgages out there for every first-time buyer. We just need to make sure we are looking in the right places and asking ourselves the right questions. Ultimately, the best thing you can do right now is research, save as much as possible for a down-payment and work at increasing your credit score. At Refresh, we offer a credit building program that does just that...

Leave a Reply