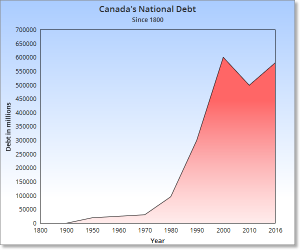

The History of Canada’s National Debt

Above is a graph of Canada’s National Debt in millions since 1800. I don’t know about you, but to me, that looks like a cliff face on the chilly side of Mt. Everest. Somewhere between 1970 and 1980, Canada’s debt was growing so massive, it feels insurmountable.

So, what happened then? What was it that triggered such huge growth in our national debt in the 70s? Sure, it was a decade of excess, but I don’t really think Canada bought enough disco balls to accumulate that much debt, do you? No, if you’re thinking something big - internationally big - happened in the mid-70s, you’d be right.

I’ll make a long story short, and leave out the jargon. Basically, what happened was that a bunch of bankers and money guys from around the world got together and decided that the Bank for International Settlements Group of Ten (G10) countries members would change the way they borrowed. We’re just going to conveniently overlook, for the sake of clarity, the fact that the G10 now includes eleven countries, and get right to what the G10 agreed on in the 70s. These ten member countries decided to resist borrowing from each of their own central banks, which offered them zero-interest borrowing, and instead, member countries were to borrow from other credit sources… sources which charged interest in a time when interest rates were skyrocketing.

Prior to this agreement, Canada’s debt rose between five and ten percent per year. After this agreement, it blew up, and steadily increased over twenty percent per year until the late 80s. Canada was now borrowing with interest, and it was having a devastating effect.

As of this writing, Canada’s National Debt is at 626,865,291,419.33, which is nearing a number I can no longer pronounce. This seems scary, doesn’t it? I mean, it feels like it should be putting a bit of a wrench in the works, right?

Well, it’s actually not as bad as it seems. While it’s not the best case scenario, when you take into consideration our debt-to-GDP ratio, we’re doing better than all six of the other G7 countries. Adjusted for inflation, our debt has shrunk significantly since the 90s as well.

It does affect you, though. Each province carries its own debt, as well as the Federal government, and each of these institutions is paying billions every year in interest. Just imagine the sorts of things your provincial government could do with a sudden influx of tens of billions being poured back into their budget. Imagine your life debt free - what would that mean for you? Huge things, no doubt. Huge, happy things. Well, the same goes for our federal and provincial government.

If you want to learn more about the national debt, or your own province’s debt, or you want to send a message to either letting them know you’re all for clearing up that debt, you can head over to debtclock.ca and watch the numbers soar like it’s Buzz Aldrin headed to the moon.

Do you think Canada should clean up its debt? Let us know in the comments, and be sure to sign up for your own Refresh loan to help clear up your own debts… which suddenly seem… well, more manageable, don’t they?

Leave a Reply