Introducing the new Refresh Dashboard

We like to make sure our customers are satisfied. So, we periodically conduct Customer Satisfaction Surveys (CSATs). One of the biggest pieces of feedback we have had recently is that there was not enough transparency in the application process. Once you hit ‘submit’ on your application, what happens next and how long does it take? Is there anything you still need to do to keep your application moving forward?

We are extremely excited to have just launched our latest Refresh Dashboard updates that include messages via email and SMS:

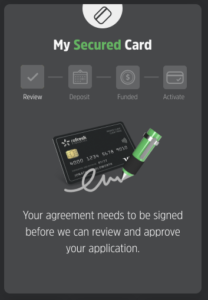

In the dashboard, we let you know when we are waiting on your signature to review your Credit Builder Loan and Secured Card applications:

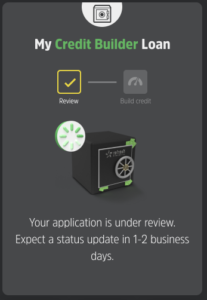

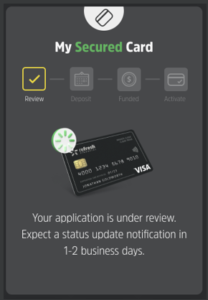

We will let you know when your Credit Builder Loan and Secured Card applications have been received and are being reviewed:

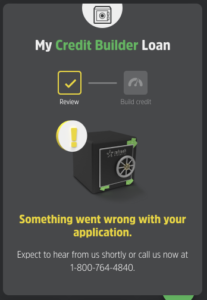

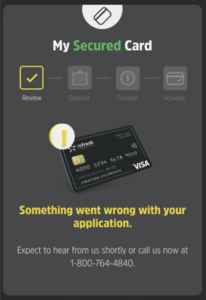

If there is something missing or incorrect in your Credit Builder Loan and Secured Card applications, we will let you know in the dashboard and with a message:

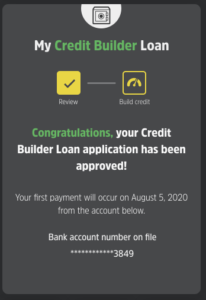

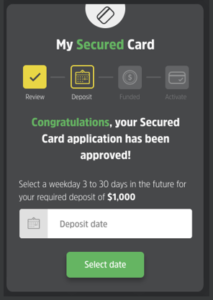

Once your Credit Build Loan application has been approved, the work is done and you can start building credit. There are a few more steps required for the Secured Card application, such as choosing a date for your security deposit:

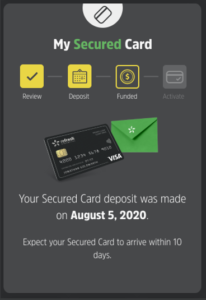

Check the Refresh Dashboard after the deposit date and you will see that your Secured Card is on its way!

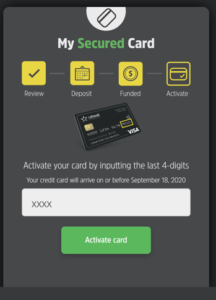

Finally, you can activate your Secured Card on the Refresh Dashboard once you have received it:

With these new updates, you will always be able to see what stage your application is at!

In addition, we have also introduced new credit usage percentage visibility to the dashboard for our secured card clients. Using over 35% of your card’s limit can start to negatively affect your credit, so we’ve made it really clear to our clients when then have hit that danger zone and need to make a payment towards their balance. Learn more about that new feature here.

Refresh Financial is in the business of helping Canadian’s build their credit score, so when our clients ask us to make it easier for them to do so, we try to do our best to make it happen.

Do you have any other suggestions as to what we could do to make the client dashboard and overall experience even better? Message us on Facebook and let us know!

Leave a Reply