The Thieves Who Preyed On Our Hockey Heroes

As Canadians, we love our hockey. We idolize our favourite players and look to them for inspiration and entertainment. We follow their careers and don jerseys with their names on them. They are among our national heroes. For us, they are role models and men of skill and sportsmanship and we never seem to stop celebrating them.

To others, though, they appear to make a good mark. Yeah, I said mark, as in someone who is easily conned.

Hockey players tend to come from working class families here in Canada. Moms and Dads across each province working as hard as they can to string together the cash to pay for their kid’s hockey gear. It’s a point of pride for most hockey families and can usually sum up just about everything they’ve got. While the increasing expenses associated with hockey are making this less and less the case, it still remains, most hockey players come from blue collar homes. As such, they tend to have to learn on the fly when their hockey player kid starts bringing in the big bucks: how do we invest intelligently? What do we do with the money he’s making so he still has some when he retires?

These aren’t easy questions to answer for the average Canadian, let alone someone thrown into the public eye and forced to adjust quickly. It’s no wonder some of these players feel victim to one of the largest scams in hockey history.

I guess they’re sort of the Bernie Madoff of professional sports. You see, there were these two schemers, Phil Kenner and Tommy Constantine, who befriended and wined and dined hockey players to ease them into a financial relationship that promised huge returns. In some cases, the two promised their athlete investors that their money would be used to develop property in high demand areas. Other times, the pair would convince the hockey players to open lines of credit, worth upwards of tens of millions, to develop golf resorts or to invest in promising companies. Kenner and Constantine, didn’t invest the money though, instead, they used it to pay for their own extravagant lifestyle.

It started in 2003, and by 2008, Kenner and Constantine had defaulted on the lines of credit. You might think this would be the end of it, but instead, they found a scapegoat, and only managed to get even more money out of these oblivious NHLers. It lasted until 2013, when Columbus Blue Jackets defenceman, Bryan Berard, started paying a little bit more attention to the investments he was supposedly making with Kenner and Constantine. He found enough holes in their stories, to turn all the evidence he had collected into the FBI and they saw fit to open an investigation. In 2013, the FBI arrested the pair of fraudsters. When all was said and done, Berard was out $3 million.

Now, the ex-NHLer wants to warn other hockey players of the risks of falling into the same trap he did. At Refresh Financial, we want to make sure everyone is aware of the risks that are out there, and help you protect your money from dishonest thieves like Kenner and Constantine.

In that spirit, here are ten ways to protect yourself from fraud:

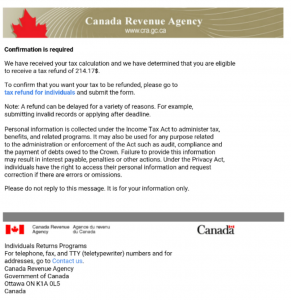

1. Be aware of the scams that are going around. Right now, for instance, there is a new email scam being sent to Canadians that appears to be from the Canadian Revenue Agency. It proposes you might be eligible for a tax return, and looks like this:

Stay on top of the latest scams by making use of sites like this one, from the Federal Trade Commission: FTC Scam Alerts

2. Do your research - if you’re looking to invest or take on a new financial advisor, research the companies and individuals involved. We are living in the information age, where no information about a person is all that hard to get your hands on. So, do it. Find out who you’re dealing with. If you can’t find them after exhaustive searches, the chances are high that they may have given you a fake name. The most important step: check that your investment advisor is licensed.

3. Check the Better Business Bureau if you’re about to do business with a company of any kind. Make sure you’re always dealing with an accredited company.

4. Check consumer reports, reviews on social media spaces, like LinkedIn and employment rating sites like Glassdoor.

5. Ask yourself: does this sound too good to be true? If it does, it probably is.

6. Ask yourself: what would it do to my financial stability if this deal fell through? If it’s enough to destroy you financially, don’t do it.

7. You should be getting statements from the third parties into which your money is being invested. You will not just see statements from your advisor.

8. You should have a good, solid understanding of the investment you’re making. If you don’t understand it, you shouldn’t be pouring your money into it.

9. Did you hear about this investment by word of mouth? If so, scrap it. Do your own searching to find the right investment for you. Don’t be talked into one.

These are the things Bryan Berard hopes his fellow NHLers learn, so none of them fall victim to the same scam that cost him millions of dollars.

Kenner and Constantine were caught. So was Bernie Madoff. They’re all now doing lengthy bits in federal lockup down south. For every caught fraudster though, there are more just like them on the outside, trying to part you from your money. So stay vigilant, keep these points in mind and invest intelligently.

Leave a Reply