Did you know, your credit utilization rate makes up 30% of your credit score?

You probably already know that making your debt repayments on time has the biggest impact on your credit score. When a lender has provided you with credit – whether that’s credit a card, a line of credit, a car loan, even a mortgage – they expect you to pay them back when it is due. Making your payments on time accounts for 35% of your credit score.

Fewer people, however, know that 30% of your credit score is influenced by your credit utilization rate.

What is credit utilization rate?

Your credit utilization rate is the amount of available credit you have to your name, compared to how much you have used. For maximum credit building, your credit utilization rate should be under 30%.

- Your credit utilization rate only applies to your revolving credit. Revolving credit is credit that can change each month. For example, with a credit card or line of credit, you would owe a different amount each month, depending how much of the available credit you used that month.

- Your credit utilization rate is not affected by installment credit like loans and mortgages since it is a fixed amount that is owed on an on-going basis.

Let’s take a look at an example:

- Credit Card – Revolving Credit

- Credit Limit: $5,000

- If balance owing is $1000, minimum monthly payment is $25, credit utilization is 20%

- If balance owing is $2500, minimum monthly payment is $65, credit utilization is 50%

- Your monthly payment – and therefore your credit utilization – changes each month.

As mentioned above, credit utilization applies only to revolving credit. However, it is critical to remember that this applies to ALL your sources of revolving credit (credit cards and lines of credit).

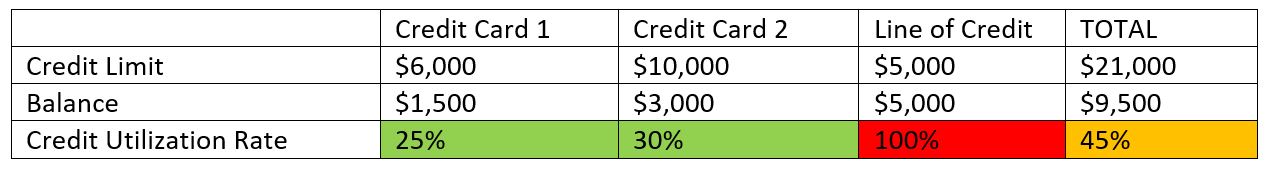

Here’s an example:

As you can see, even though the two credit cards are carrying a balance that makes the credit utilization rate 30% or under, when all three tradelines are combined the credit utilization rate is 45%. In this instance, it would be best to pay down the line of credit as soon as possible.

Free credit utilization calculator

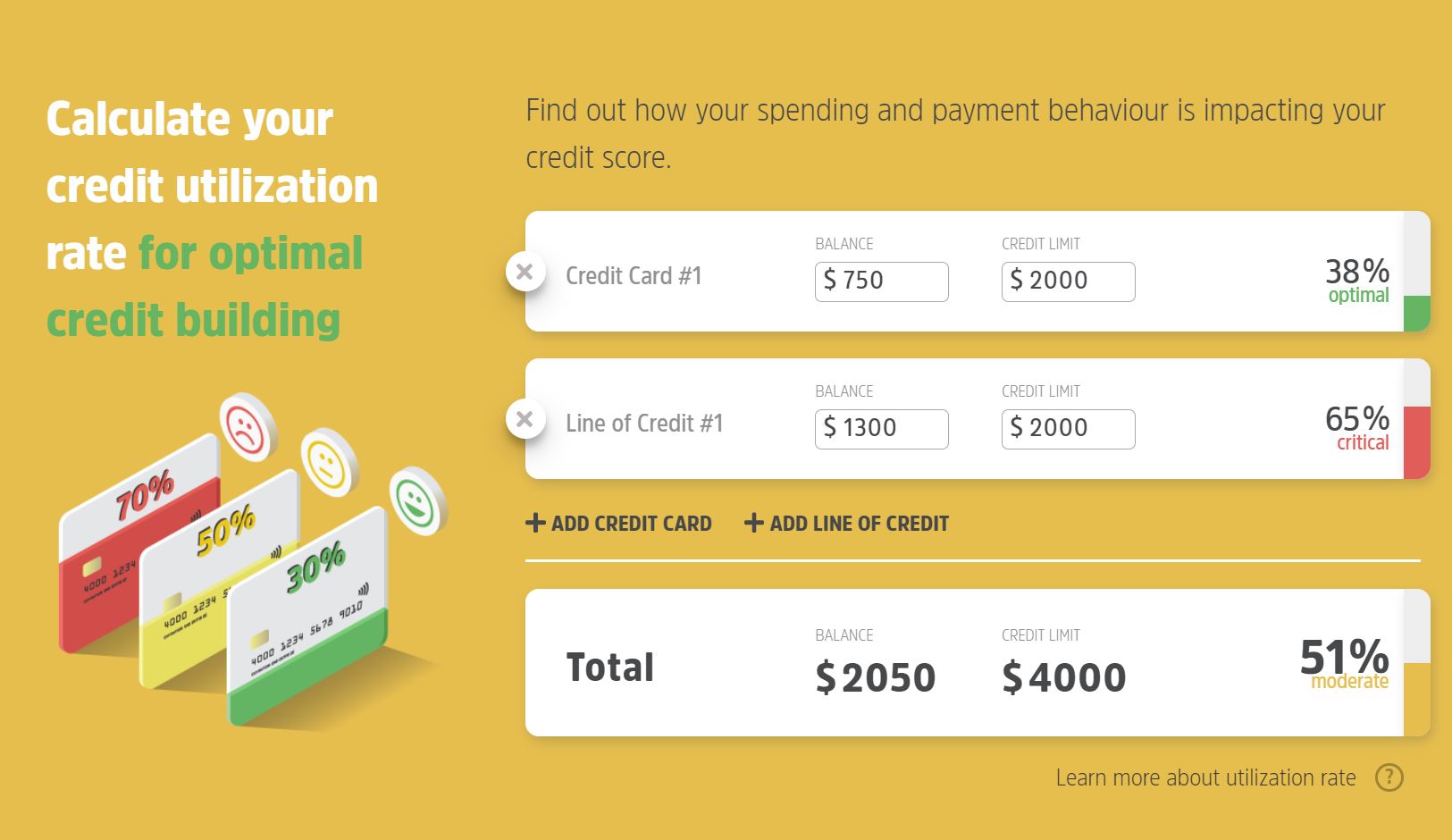

Given the importance of credit utilization rate, we have added a new free feature to our website! With our credit utilization calculator, you can see exactly what your utilization rate is and how much you need to reduce it to get your rate to 30% or less. Find the calculator at https://refreshfinancial.ca/secured-card/

Here you can see the credit utilization rate is 51% when both credit cards are considered:

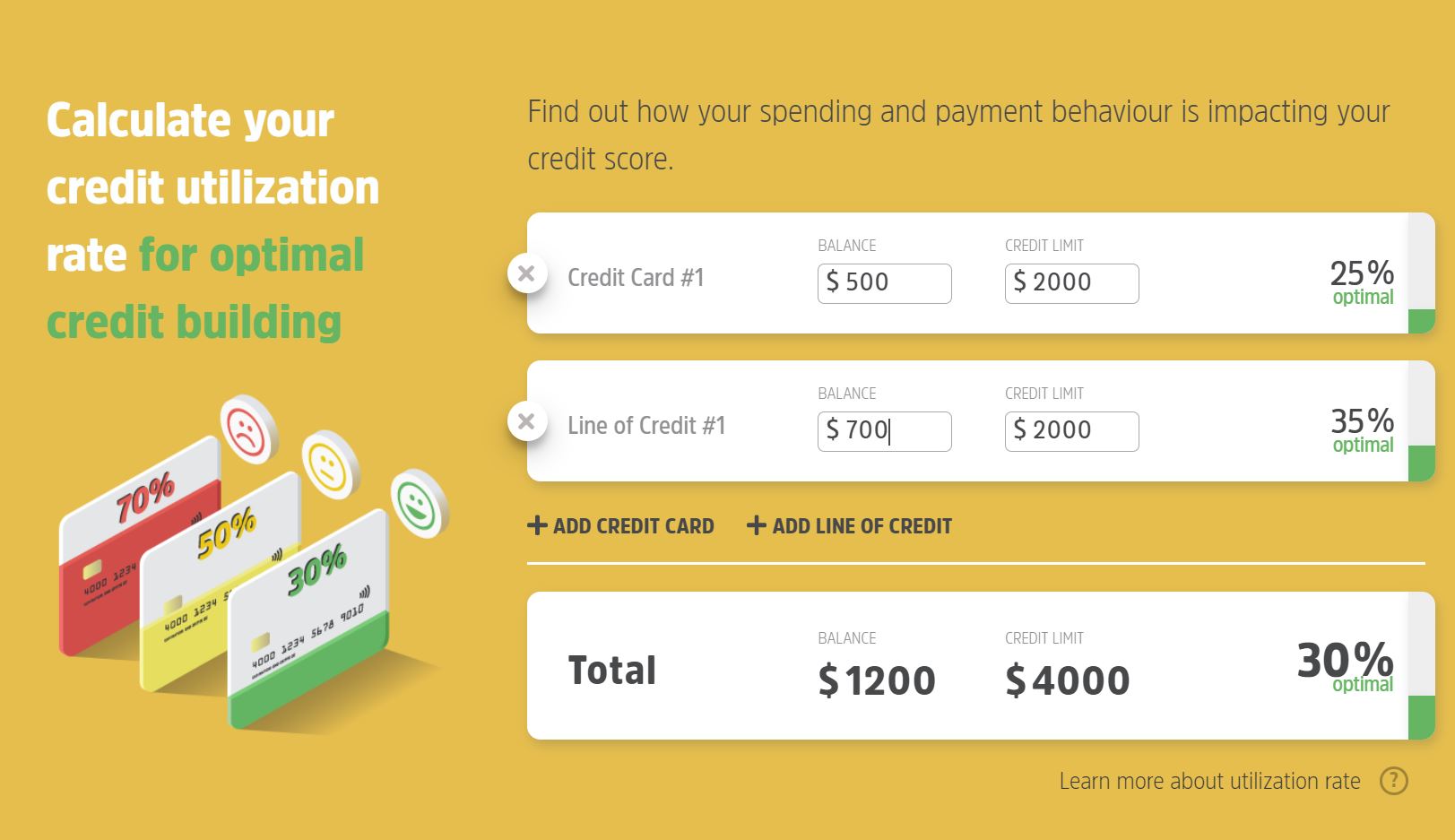

By reducing the balance to $500 and $700, the credit utilization rate drops to 30%.

This tool is free to use and we encourage you to enter all your sources of revolving credit to see what your current credit utilization rate is!

If you do not have a credit card, consider applying for the Refresh Financial secured card. Having a source of revolving credit reporting to the credit bureaus can have a significant impact on your score – not to mention the fact that simply having a mix of both revolving and installment credit impacts 10% of your score!

Leave a Reply