10 ways Canadian immigrants can build credit

If you’re reading this, and you’re a new Canadian immigrant, or you’ve been here a little while as a permanent resident -- we want to welcome you!! You’ve likely found out that to build credit as a new immigrant to Canada you need to have a good credit history. If you want to borrow money in Canada, your credit score determines the likelihood of you getting approved for credit products. The good news is that building a credit history as a new immigrant in Canada is easier than trying to improve bad credit history.

A Guide for new Canadian immigrants, and permanent residents

1. Understand how a credit score works.

Your credit score is a 3-digit number between 300 and 900 that represents your creditworthiness. The first thing you need to know is how credit scores are calculated. This will help you prepare the right plan so you can build your score quickly. A good credit score is anything over 660. A credit score is derived from the information on your credit report. A higher score means you have demonstrated responsible credit behavior.

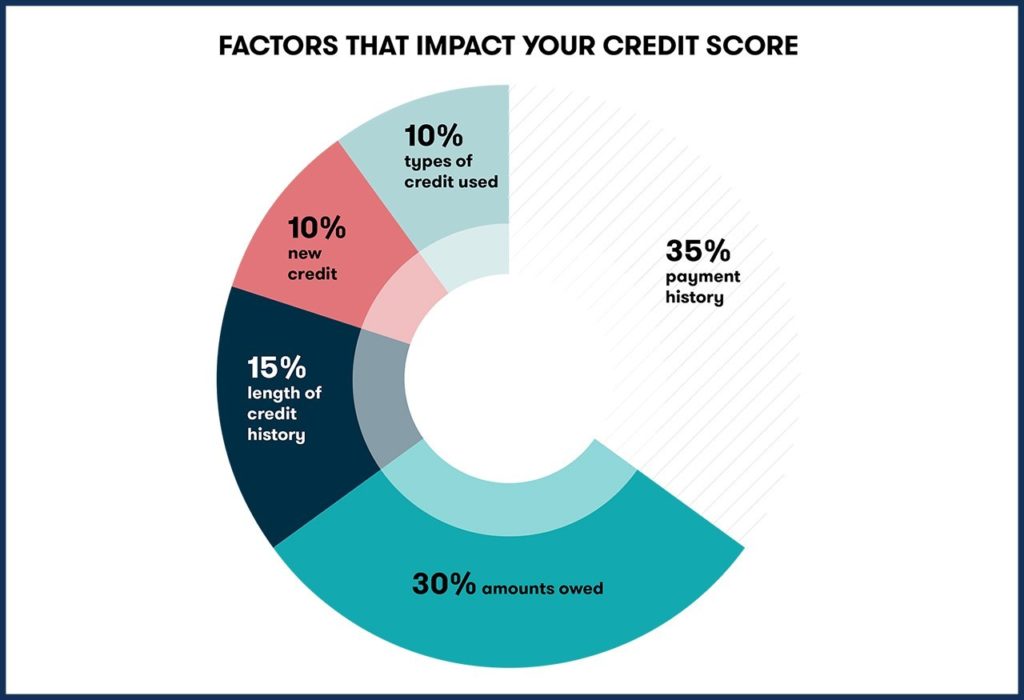

2. Factors that make up your credit score:

• The history of bill payments determines 35% of your score. The best thing you can do as a new Canadian is to make all your payments on time each month.

• The amount of debt accounts for 30% of your score. Stay away from large sums of the debt. It’s better to have more credit available to you than debt. Keep our credit utilization at 30% or less.

• The age of your credit history affects 15% of your score. This shows the duration of experience you have with building credit.

• New Inquiries determine 10% of your score. Each credit application gets reported. A couple of inquiries won’t affect your score much but if you have lots in a short time it affects your score.

• Diversity of credit accounts for 10% of your score. Get a variety of tradelines to show creditors that you understand how credit works. These tradelines can include a loan or a credit card.

Make sure you apply for credit only when you need it. It's important to know what this means for you when you are applying for credit, so check out this great article on a soft credit check versus a hard credit check.

3. Get a secured card right away, as a new immigrant

Apply for Refresh Cash Secured Card. With a secured card you are guaranteed approval and your credit activities will be reported to both the credit bureaus. There are various financial institutions that offer a secured card. The way the secured card works is that you use your own money as the security deposit on the card and this is the credit amount you have available to use. Using your own funds to build your credit is less risky for creditors while at the same time it helps you manage your money better.

4. Apply for a secured loan program.

It's important to get a variety of lending products. It shows lenders and creditors that you can borrow money using a variety of credit mix. Having a variety of lending products demonstrates that you are knowledgeable about credit. Refresh Financial offers a secured loan credit building program that uses your own funds to help you build your credit score.

5. Apply for an unsecured credit card.

Not everyone who applies for an unsecured card gets approved, especially if you don’t have a credit history in the country you live in. There is a strong chance that the credit card you get approved for will come with a high-interest rate.

Make sure you apply for credit only when you need it. Here’s a great article on a soft credit check versus a hard credit check. It’s important that you know what this means for you when you are applying for credit because different types of credit checks affect your credit score.

6. Get a cell phone.

There are lots of phone carriers that don't require credit history, and they will report your paid bills to the credit bureaus. Make sure you are getting a monthly plan that is not pre-paid. You want to get one that you pay off every month as opposed to a one-time pre-paid card. This shows that you are reliable with your monthly recurring bills.

7. Apply for a car loan.

You’re going to need a car to get around town. The public transit system won’t get you everywhere you need to on time. When you get a car loan you are building your credit history every time you make payments on your loan.

Here are three ways you can apply for a car loan:

• You can apply for financing through a dealer. If you qualify you will likely have a higher interest rate on your loan. It’s okay to start by paying more because this gives you the opportunity to build your credit score.

• You can also ask your financial institution for a car loan.

• Alternatively, you can talk to an independent finance company that specializes in car loans.

8. Pay your bills on time.

The best way to build credit as a Canadian immigrant is to make sure you pay your bills on time. This is what creditors and lenders pay the most attention to. It’s the most important way to build trust. Lenders look to see that you are paying your bills on time and in-full. With credit card payments pay more than your minimum payment. As a new Canadian, you likely don’t have debt or items in collections, but it’s good to know that these things affect your credit score.

9. Keep on top of your credit score through credit monitoring.

All your efforts to build credit as a Canadian immigrant will pay off if you are diligent about it. Stay on top of your score each month by checking your own credit score. Checking your own credit score is classified as a soft credit check, so it doesn’t negatively impact your score. Credit monitoring will alert you if any fraudulent activities take place on your accounts. If you know about them early enough you can address these issues right away.

10. Get your full credit report on a yearly basis.

How often you check your credit report is a bit of a tricky question. As a rule of thumb, you want to check on your credit report at least once a year, to see if there are any errors in your report. To fix any errors you will have to contact either of the two credit bureaus in Canada: Equifax Canada and TransUnion Canada.

How long does it take to start using your credit history?

To build credit as a Canadian immigrant will take you a bit of time. Financial institutions will usually start using your credit history after about 18 months. Other factors that different lending or financial institutions consider include your savings, your net worth, income and ability to provide a security deposit or a down payment on a big purchase such as a home. These are all strategies that go a long way towards building a Canadian credit history for new immigrants.

If you take the necessary steps we’ve talked about, you’ll start to see a real difference in the rates you pay and you’ll see how easy it is to get credit. Plus, you’ll be a more disciplined spender and more of a saver.

Bookmark this page!

When you’ve built your credit history, come back here and do your free credit check with Refresh Financial.

Another great resource is the Government of Canda website - they have free workshops from time to time on how to build credit as a Canadian immigrant.

To continue to learn about managing your debt and credit score wisely, follow Refresh’s Financial Blog.

*******

Refresh financial offers custom credit building solutions to help you build your credit score FAST.

Leave a Reply