I have bad credit. Help me, what should I do?

Having poor credit doesn't make you a bad person. It can, however, put a damper on your entire life and affect your ability to get hired, rent or buy a home, and get a low-interest loan. This can feel as though you're stuck and can't get ahead. So, if you're telling yourself "I have bad credit what should I do?", the best way to combat this is to find out your current score. Once you know your current score, next learn what your score means, and finally start using a credit building program to improve it.

What is a bad score?

Your credit score is a 3-digit number that's between 300 and 900. Your score is calculated based on many factors. This 3-digit number represents your credit risk or in order words the likelihood of you paying your bills on time.

Your score is calculated using the information from your credit report. Your report looks at your payment activities, the amount of debt you have, the length of your credit history, and a few other things (see infographic below for a full picture).

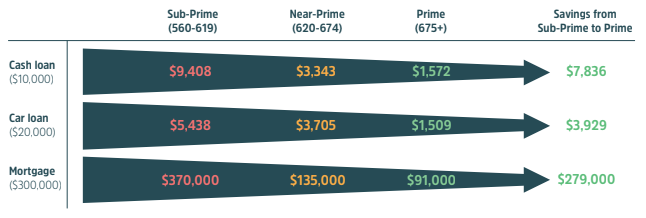

The higher your score is, the greater your chances of getting the financial products you want at low-interest rates.

Here are the score ranges:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Good

- 740-799: Very good

- 800-850: Excellent

Things you can’t access with a bad credit score:

- Any kind of credit (cash and car loan)

- Make big purchases (home and car)

- A low-interest rate (this is impossible to achieve. All your financial products will come with higher interest rates, therefore, costing you more money). See the infographic below to see how much interest you might be able to save with good credit

- Low insurance premiums (your annual fees may be through the roof when it comes to insurance products)

Why do I have a bad score?

There are many things that can contribute to your bad score. Some of these include a filed consumer proposal, bankruptcy, negative payment history, a large amount of debt to credit ratio, or errors on your report. If your score is low because of missed payments, then it will take more time to improve your score. However, if it's low because of errors on your report, then make sure to consult with the reporting agencies within 30 days and get these issues corrected immediately.

What's a good score?

A good score is anything above 670. The good news is that there are plenty of ways to increase your score. Firstly, start by checking your score. When you check your own score, it’s called a soft credit check, and it doesn’t hurt your score.

Secondly, if you don't have a good score, you can start building it with a Refresh Secured Card or a Cash Secured Loan program.

Lastly, on a yearly basis, get a copy of your report from the credit bureaus—this is what lenders consider when they review your applications.

How do I get a good score?

Once you know your starting score, here are a few things you can do to improve it to the Good, Very Good or Excellent categories:

- On-time payments—the best way to improve your score is to pay your bills before their due date and pay off debt as soon as you can. If you decide to pay off your debt gradually, make sure you're making a dent in it by paying the principal. If you have various types of debt, check out this article on how to prioritize your debt payoffs. Pay close attention particularly to medical and utility bills, and don't let them go to collections. Your payment history makes a huge difference in your score, it accounts for 35% of your total score.

- Credit Utilization—any credit usage over 30% will harm your score. This doesn't mean you have to spend less—it means you should pay off your card balances multiple times per month so you’re on top of it. This makes up 30% of your overall score.

- Credit Age—if the age of your credit is bringing down your score, hold off on closing any of your credit cards. You may think this will help close any debt, but quite the contrary. This accounts for 15% of your score.

- New Application—applying for too many accounts in a short time period can hurt your score. Because every time you apply for a regular credit card there is a hard credit check. Stop applying for new credit until your score has increased. This accounts for 10% of your score.

- Types of Credit Mix—it’s a good idea to diversify your accounts. Start with a revolving product, which is a credit card, and then add a loan, which is an installment tradeline.

With a poor score, it’s difficult to get approved for a low-interest card or a loan. Therefore, we recommend signing up for a pre-approved Refresh Cash Secured Card and a Refresh Cash Secured Loan.

How long does it take to clear up a poor credit history?

Even if you raise your score, your report may show some negative items that simply take longer to come off. Take a look below:

- Bankruptcy—10 years from the filing date

- Consumer Proposal—3 years from the filing date

- Collection accounts—180 days plus 7 years after the first payment was missed on the original account

- Credit inquiry—2 years after the inquiry was authorized

- Debt settlement—7 years after the final date of discharge

- Defaulted federal student loan—7 years from the first date of delinquency, or until you bring the loan current

- Foreclosure—7 years from the date when the account first became delinquent

- Late payments—payments 30+ days late are reported and can remain for 7 years

- Missed child support payment—7 years from the original delinquency date

- Unpaid tax lien—can remain indefinitely, and may be removed after 15 years

- Unpaid court judgment—may remain indefinitely

Learn more about managing your debt and credit score wisely, follow Refresh’s Financial Blog.

*******

Refresh financial offers custom credit building solutions to help you build your credit score FAST.

Leave a Reply