What is credit and how do I build my credit score?

Have you been denied for loans and credit cards over and over again? Or maybe you've been told you don’t have good credit and you won’t qualify for low-interest rate products. If you can relate to this, then keep reading to learn what you can do to build your credit score and your financial future.

What is a credit score?

Your credit score is a number between 300 and 900. This score represents everything on your credit report. Your credit score is an important number that can cost or save you money throughout your lifetime. The lower your score, the lower your chances of getting approved for financial products. However, this also means you have a greater opportunity to build your credit score and improve your credit history.

You can sign up for Borrowell to find out your credit score for free. Checking your score with Borrowell won't hurt it.

Why is a credit score so important?

A credit score allows lenders to predict the likelihood for you to pay your bills and loans. This scoring metric essentially identifies your credit trustworthiness. Your credit score is a critical number that allows you to get approved for a credit card, a car loan, a mortgage, and much more. This 3-digit number changes regularly, so it's essential to stay on top of managing your money by carefully budgeting and only applying for credit you need.

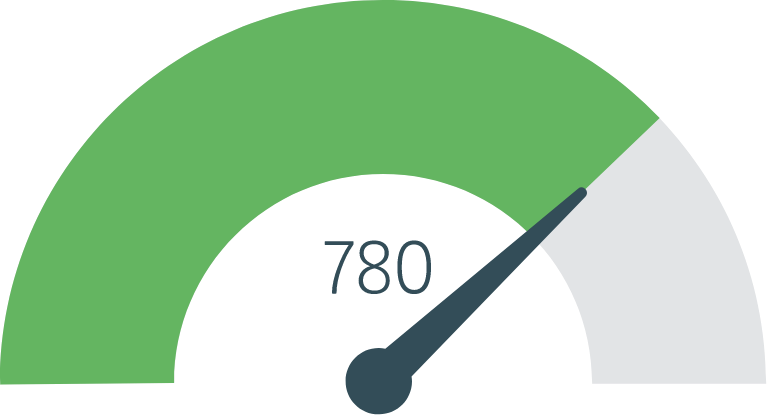

Your credit score ranges

Here are the credit score ranges and what they all mean.

Also, learn more about what the average credit score is in Canada.

- 800-900: You have an excellent score and you can get approved for any product at low rates.

- 720-799: You have very good credit! You will have a lot more credit options to choose from.

- 650-719: You have a good credit score. Lenders will qualify you for lower interest rate products.

- 600-649: You have a fair credit score. You'll need to work on your repayment history so you can demonstrate that you can be financially responsible.

- 300-599: You'll need to actively work on building your score.

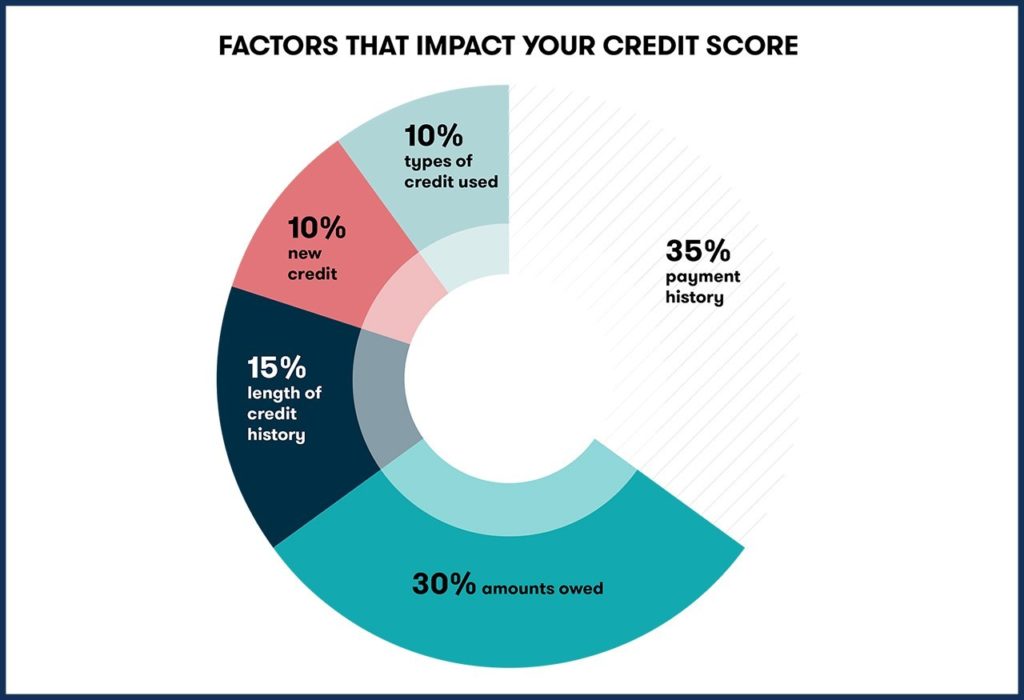

Factors that affect your credit score

To actively build your credit score, study this list—it's your bible for improving your score.

- Payment history makes up 35% of your total score. This report shows your missed payments and your on-time The best practice is to make all your payments on time and in full, including your credit card debt, loan payments, and any other bills.

- The utilization ratio makes up 30% of your score. Credit usage percentage is the total amount of credit you have to your name versus how much of it you have used. It's best practice to keep your credit usage below 30%. Anything above this will hurt your score.

- The length of credit makes up 15% of your score. If you've been making steady payments (on-time and in-full) towards a car loan or a personal loan for several years, it indicates that you are a responsible borrower, and your score will reflect this. This is exactly why you should start building credit as soon as you can, even if you're going through bankruptcy or consumer proposal.

- 10% of your score comes from having a variety of credit types. You may think that having many credit cards with higher credit limits to your name is the best way to build credit, but it's not. It's better to have a variety of credit types, so, we always recommend getting a credit card and a loan. Credit cards are considered revolving credit, and loans are installment lines of credit with a fixed repayment amount each month.

- Credit inquiries make up 10% of your score. Every time someone does a 'hard credit check', your score takes a hit because it looks like you're desperate to find a source of credit. Hard credit inquiries should be limited, especially if you're declined after the first one.

What are hard credit checks done on:

- Cash loans

- Credit cards

- Cell phones

- Electricity bills

- Car loans

Tips for rebuilding your credit

- Get the latest copy of your credit report and your credit score. Your credit report will show you why you have bad credit. Knowing why will help you avoid making the same mistakes.

- Review your credit report at least once a year. This will help you stay on top of your score and help you identify any incorrect information on your file.

- If you have missed payments, get on top of them quickly by making at least your minimum payments; it's better than not paying them at all. If you need help with getting on top of your payments, contact your creditors to see if they can work with you to get things back on track.

- Once you're on top of correcting your credit score, don't wait for the negative information to fall off your report — start building your credit immediately. In addition, consider applying for the Refresh Cash Secured Card. This type of credit card will help you spend money responsibly while building your credit score. With a secured card, your money is held as security for the limit on your credit card. Also, all your activities are reported to the credit bureaus to help build your score. Furthermore, if you fail to make payments, your account is closed and paid off using your own money.

- Diversify your credit tradelines by applying for the Refresh Cash Secured Loan. With this credit-building program, you can arrange to make affordable payments, which makes it flexible on your wallet. Each payment you make carries a small interest component. With the interest you pay on each on-time payment, we can report your loan program as an installment loan to the credit bureau. Learn more about the Refresh credit building loan product.

Apply for the Refresh Cash Secured Card

How long does negative information stay on your credit report?

Unfortunately, negative information cannot be removed from your credit report; only incorrect information can be disputed with the credit bureaus. The only way negative items can come off your credit report is by waiting it out or by filing a complaint with The Financial Consumer Canada Agency of Canada.

- Accounts in collections can stay on your credit report for up to 7 years.

- Late payments will remain on your report for 7 years.

- Consumer proposals remain for 3 years once the proposal has been completed.

- Bankruptcies stay on your report for 6-7 years, and if you have a second bankruptcy, it will take about 14 years to be removed from your report.

- Auto repossessions can also stay on your report for up to 7 years.

We hope that this article has provided you with plenty of information about what credit is, why a credit score is so important and how you can improve your score.

To continue to learn about managing your debt and credit score wisely, follow Refresh’s Financial Blog.

*******

Refresh financial offers custom credit building solutions to help you build your credit score FAST.

Leave a Reply