4 easy steps to build credit in 20 minutes or less!

A good credit score is one of the most important aspect of your finances. Your credit score can open doors to low interest rates on financial products such as car loans, personal loans, credit cards, and even mortgages. Taking the time to increase your score before you commit to a long-term loan is well worth it as you could potentially save thousands of dollars.

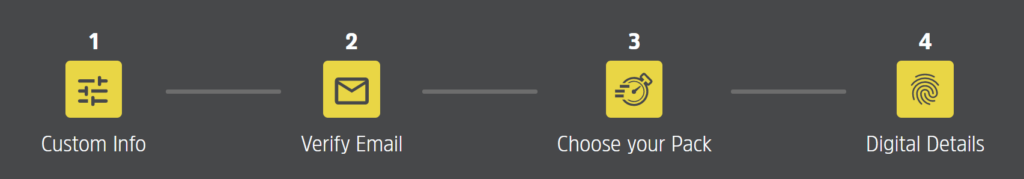

Our platform makes building your credit score a breeze! All it takes is completing 4 easy online steps which takes less than 20 minutes! In no time you will be on your way to a better credit score, and a more secured financial future.

Want to start building your credit? Start your application right here, right now!

Here’s what you will need:

- Your credit score. It’s not mandatory to know your score but we certainly recommend knowing what it is so you can set a goal of where you would like to get to. If you do not know your credit score, you can find it for free at Refreshfinancial.ca/find-credit-score/

- We need a copy of a government-issued ID that has your address on it.

- Your banking details – you will need the institution, transit, and account numbers for your bank. If you do not know them, these numbers can be found on the bottom of a cheque.

- Finally, we ask for proof of your address. We accept government-issued mail (such as a letter from the CRA) or a utility bill addressed to you.

With these important documents ready, you can get started.

4 easy steps to build credit

1. Custom Info

![]()

![]()

This section is all about you. Everyone’s financial situation is unique, and we consider all the following details before recommending the credit-building solution to help reach your financial goals - at the speed that works for you, and within your budget:

- Location

- Credit Score

- Financial Goals

- Income

- Expenses

- Budget

2. Verify Email

![]()

![]()

We need to know your email address so we can get in touch with you! We are serious about helping you build your credit. We will provide you with a custom credit building solution based on the information provided in section one.

3. Choose your Credit Building Pack

![]()

![]()

We offer three different credit building packs, depending on how fast you want to build your credit score.

The Sprint Pack is the fastest option to build credit with blistering speed and includes the credit builder loan and secured card.

The Jog Pack is a more balanced credit building solution combining speed and stamina and includes the credit builder loan.

The Walk Pack is the slow and steady option and consists of the secured card.

What is a credit builder loan and secured card?

![]()

![]()

The credit builder loan. This is our flagship product, and it is one of the fastest ways to build your credit score. The credit builder loan is considered an installment loan (i.e. your payments are for the same amount every month for a specific length of time). Car loans, personal loans, and mortgages are all types of installment loan.

![]()

![]()

The secured card. This is a type of revolving credit (an ongoing source of credit whereby the amount you pay each month changes, and as you make payments more credit becomes available to you). Used by itself, a secured card will slowly and steadily build your credit score. This is not the same as a pre-paid card. To learn the differences, check out this post.

4. Digital Details

![]()

![]()

This is where you need most of the documents listed at the top of this page. We will also ask you a few questions about yourself to check one last time that this is the right credit building solution for you.

After you have completed the 4 sections outlined above, a copy of the agreement will be sent to you electronically to sign, and that’s it! You are on your way to a brighter financial future.

Leave a Reply