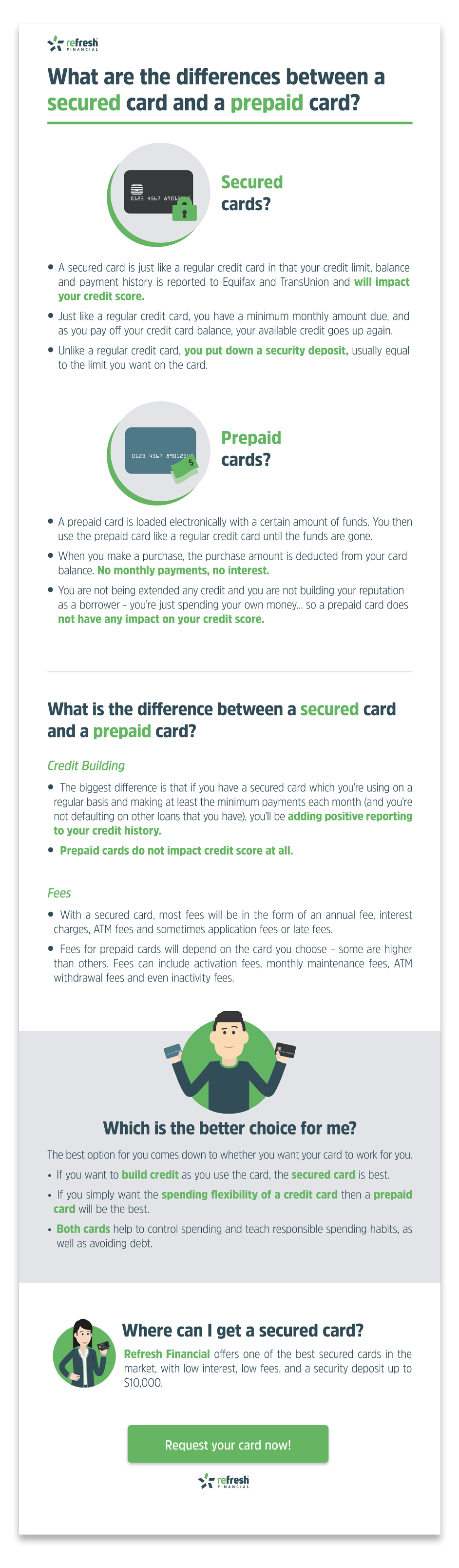

What’s the Difference Between a Secured Credit Card and a Prepaid Card?

What is a secured credit card?

A secured credit card - sometimes referred to as simply a secured card - is just like a regular credit card in that your credit limit, balance and payment history is reported to Equifax and TransUnion and will impact your credit score. With a secured credit card, again, just like a regular credit card, you have a minimum monthly amount due, and as you pay off your card balance, your available credit goes up again.

The difference between a secured card and an unsecured credit card is that for the secured credit card, you put down a deposit, usually equal to the limit you want on the card.

What is a prepaid card?

A prepaid card is loaded electronically with a certain amount of funds. You are then free to use the prepaid card like a regular credit card until the funds are gone. No monthly payments, no interest. When you make a purchase, the purchase amount is deducted from your card balance, much like a debit card – you’re not borrowing money from the card issuer as is the case with a secured credit card or regular credit card. Ultimately, because you are not being extended any credit, a prepaid card does not have any impact on your credit score. Why? Because there is no payment history to report – you are not building your reputation as a borrower – you’re just spending your own money.

What is the difference between a secured credit card and a prepaid card?

- Credit Building

Both a secured card and a prepaid card are usually utilized by people with a low credit score who cannot yet access unsecured credit cards. The biggest difference is that if you have a secured credit card which you’re using on a regular basis and making at least the minimum payments each month (but more is always better), then you’ll be adding positive reporting to your credit history. Prepaid cards often carry the Visa or MasterCard logo (because these are the companies that process the payments), which can cause people to think they are just like a regular credit card, however, prepaid cards do not impact credit score at all.

Keep in mind, however, that if you are defaulting on other loans that you have, you will not see an increase in your credit score. A good credit score is built by regular, on-time repayments of loans. All it takes is one loan that you’re defaulting on to undo all your hard work.

- Fees

Both cards will come with some form of fees. For the secured card, most fees will be in the form of an annual fee, interest charges, ATM fees and sometimes application fees or late fees (to name a few – be sure to check out all the fees that come with a card before applying). While some of these fees are unavoidable, fees like interest charges, ATM fees etc. can be avoided if you use your card responsibly. The fees for prepaid cards will depend on the card you choose – some are higher than others. Fees can include activation fees, monthly maintenance fees, ATM withdrawal fees and even inactivity fees. Other prepaid cards are completely free so do your research before getting one of these cards!

Refresh Financial offers one of the best secured cards in the market, with low interest, low fees, and a security deposit as low as $200 (most secured card providers require at least $500). Apply quickly and easily online today!

Prepaid card vs secured credit card: which is the better choice for me?

Ultimately, which card works best for you depends entirely on your financial situation. Both a secured credit card and a prepaid card require funds to be put down. The best option for you comes down to whether you want your card to work for you. If you want to build credit as you use the card, the secured credit card is best, however, if you simply want the spending flexibility of a card when a debit card won’t do, and then a prepaid card will be the best.

Both cards help to control spending and teach responsible spending habits, as well avoiding debt.

What can I do if I have no money to put down?

Unfortunately, if you have poor credit and no money to put down on a credit card, but you’re looking for the spending flexibility of a credit card (i.e being able to buy items on line, and other situations when a debit card doesn’t work) then your credit card options are limited. Nearly all credit cards require either good credit to be able to get an unsecured credit card, or access to funds to put down on a secured card or a prepaid card.

Our recommendation is that you work on building your credit score so that you are not limited in your options in the future.

Refresh Financial has a Cash Secured Savings Loan does just that and requires no money up front.

Leave a Reply