10 things you must absolutely know about your credit

We Canadians focus on high school grades to try to get into a great college or university. And when it’s all done, the next and most important grade we get is our credit score. This is your 3-digit score that signifies whether you have good or bad credit. This score ultimately defines your financial life!

That’s why we're sharing the top 10 things you must absolutely know about your credit. These are things to know about credit because they will drastically change the trajectory of your financial health.

1. Get your free credit report

The first thing lenders and creditors do before they decide to give you any money are that they to check your credit history. To get approved for any loan amount, you need to make sure to stay on top of your credit score before applying for any credit. It's a good idea to get the latest copy of your credit report, which shows your major payment activities on your credit cards and loans. Your report will also show whether you have filed for a consumer proposal or bankruptcy. By federal law, you can request your free credit report once a year.

2. Spend less by improving your interest rate

A poor credit score costs you a lot more money because lenders don’t trust you and view you as a credit risk. So, if you end up getting approved for any type of loan, it will come with higher interest rates, costing you a lot of money in interest. On the flip side, if you have a good credit score, you will be approved for a loan with lower interest rates, saving yourself a lot of money. So, don’t wait any longer—let's improve your credit score.

3. Fix errors on your credit report

When you review your credit report, make sure to look at the details and check for any possible errors. Some of these mistakes could include late credit card payments or missed loan payments. You may even find accounts showing on your credit report that aren’t yours. When you find these errors, make sure to report them immediately and have them scrubbed from your credit report.

4. Learn the difference between a 'hard credit' check and 'soft credit' check

There are two types of credit checks. When an employer, landlord, select financial institution or insurance agency run a credit inquiry, this is called a soft credit check and it doesn't hurt your score. However, when you apply for a car loan or personal loan, a hard credit check is performed. This affects your score because it represents the number of times you have asked to borrow money. Learn more about the difference between a hard versus soft credit inquiry.

5. Landlords and employers check your credit score

At some point in your life, when you apply for a job or an apartment, your credit is checked. Some employers will do a deeper check before hiring and look into your credit history; it depends on the employer and the type of job you’ll be doing. Employers must ask your permission before doing a credit check. If they decide not to hire you based on your credit, this information must be shared with you.

Landlords aren't required to get your permission before doing a credit check, but they do have to let you know if they are denying your application because of your credit.

6. Check your credit score for free

If you don’t know your 3-digit credit score or simply haven’t checked it in a while, then you can check your credit score for free with us at Refresh Financial. You can check your own score at any time without impacting your credit, it’s called a ‘soft credit check’. Also, keep in mind that you get a copy of your free credit report annually. We really recommend that you do.

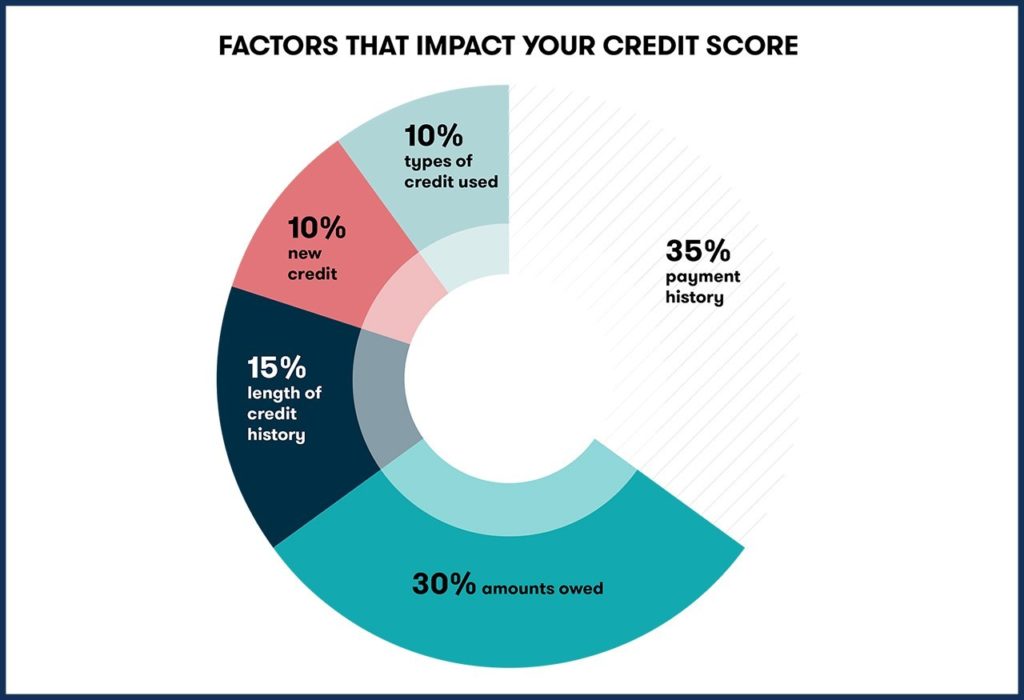

7. Learn the main factors that affect your credit

- Your payment history affects your credit in a big way. This accounts for 35% of your entire score. Your payment history is a report of all your on-time and missed payments.

- Credit utilization is the second biggest factor, which accounts for 30% of your score. This is how much of your credit limit you have available to use versus how much you have used. Make sure you keep your credit card use to 30% of your total available balance.

- Length of credit history accounts for 15% of your score. Essentially, the longer you have been using credit, the better it is for you. Not having a credit history makes you a higher risk borrower.

- The Credit mix accounts for 10% of your score. It's best to have a variety of accounts, including revolving debt (like a credit card) and installment loans (like a mortgage, a student loan, or a car loan). Having a credit mix shows that you are a knowledgeable borrower and that you can manage different types of credit.

- New credit accounts for 10% of your score. Watch out for this one. Avoid trying to get a lot of new credit in a short amount of time; spread it out if you need to. You don't want to look like you're desperate to borrow money.

8. Learn the things that DON’T affect your credit

Yes, surprisingly, there are things that do not affect your credit score. Some of these include:

- The amount of money you make. This has no bearing on your credit score. You can make a lot of money or very little money, and your credit score won't change regardless. Still, your income can indirectly impact your access to credit and your credit score.

- For instance, a credit card provider will ask you for your income. Then they'll use it in conjunction with your credit report to decide whether or not to give you a card and what the terms are going to be.

- Your net worth. You could be a movie star with big earnings living in a mansion. This would be fantastic, but it doesn't affect your credit score. What does affect your score is whether you made the payments on your nice mansion on time and in full.

- Whether you're on welfare. If you receive income assistance from the government or disability, this has no effect on your credit score.

- The ivy-league you did or did not attend. This information doesn't get published on your credit report and it doesn't factor into your credit score.

- Whether you've been to jail. Your credit score doesn't change if you've been to jail. Your credit is impacted if you're sued and owe money, or if your payments are not made while you’re in jail.

- The type of financial institution or financial services you use. It doesn't matter if you have your finances with a bank or a credit union. As long as you have a credit history, it doesn't matter where you do your banking.

9. Learn the simple ways to improve your credit score

We talked about the main factors that affect your credit score, and those are very important to keep in mind. Here’s a summary of the top three areas you can focus on when building your credit score:

- Pay your bills on time, every time. If you have debt, consistently put money towards your debt to pay it off, even if it means making minimum payments. In case this is not possible, seek a debt consultant or support program to help you.

- If you were approved for a credit card, make sure that you keep your credit usage at 30% of your available limit.

- The other big thing is to build your credit. You can do this by having mixed credit accounts, such as a credit card and a loan. If you currently have poor credit start by getting a secured card and a secured credit-building loan product with Refresh Financial. Here are just a few reasons why a secured card is your best solution.

10. Stay on track and keep fraud at bay

Once you have your credit building products we recommend that you invest in credit monitoring service. This will help you reach your credit goals faster and it will help you detect any identity theft so you can keep your personal information safe. Most credit monitoring services come with extra benefits and perks. Once you sign up with a Refresh credit building product, you can try a 30-day free trial of Refresh Financial's credit monitoring services and get serious about taking control of your credit score.

Now that you are aware of the 10 things you must absolutely know about your credit you can start implementing them one at a time and get set on your road to saving and building wealth, not debt.

To continue to learn about managing your debt and credit score wisely, follow Refresh’s Financial Blog.

*******

Refresh financial offers custom credit building solutions to help you build your credit score FAST.

Leave a Reply