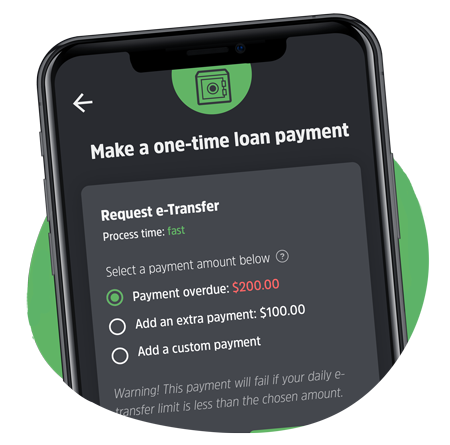

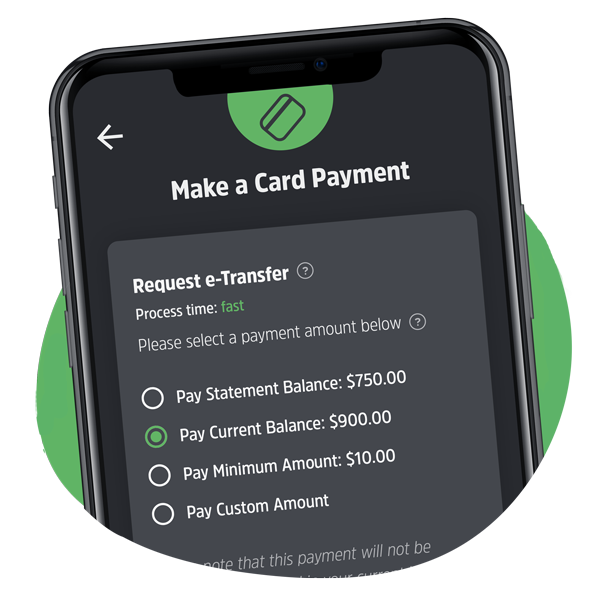

E-Transfer is now available for one-time Credit Builder Loan payments

A few months ago we released a major new update to the Secured Card product, adding e-Transfer Request Money into the dashboard for making faster-secured card balance payments, and for increasing secured card limits. The feedback was overwhelmingly positive and vastly improved the experience Refresh customers had with our secured card product. As a result, […]...more

Are there personal loans for bad credit, and should I get one?

Whether you opt for secured credit products or credit that has been cosigned for, credit is still obtainable to those with bad credit....more

Self-Employed? Here’s What You Can Write-Off On Your Taxes

Self-employment can be pretty tricky at tax time. You have to organize your business expenses and figure out what you can write-off and what you can’t....more

Refresh Secured Credit Cards are back in stock!

Great news! The Refresh Financial Secured Cards are back in stock. We experienced such high demand for the cards at the end of last year we were unable to fulfill all the requests, however the cards are now available again. Refresh Financial’s Secured Card is used just like a regular credit card but you […]...more

Tax Refund? Here Are The Top 5 Ways To Make Use Of It

It’s that time of year again when we’re all scrambling to get our taxes done. It’s worth it though when you get that tax refund....more

Financial Spring Cleaning – 6 Easy Steps

Spring is just around the corner (we hope!) and while many of you might have your mind on spring cleaning in your home, there is a type of financial spring cleaning that can be far more beneficial. Like all spring cleaning, you will have to get your hands a little dirty. The idea is […]...more

How Consumer Proposal and Bankruptcy Affect Your Credit Score In Canada

We all know that bankruptcy doesn’t do your credit score any good. But do you know exactly how it will affect your credit in Canada?...more

Tax Tips: How To Access Lost or Old T4 Slips

It’s always important to get your taxes done each year in time. It’s not always what happens, but it’s important, nonetheless....more

Refresh Financial is now part of the Borrowell family!

Have you heard? Refresh Financial has been officially acquired by Borrowell, Canada’s leading credit education company and one of the country’s largest fintech companies. The Toronto-based company has helped over 1.5 million Canadians access their credit score and report, while also providing personalized credit coaching tools and financial product recommendations based on their credit profile. […]...more

Refresh Financial’s Secured Card Wins Best Overall Secured Card Award

Simple Rate has put together a list of the best Secured Cards available in Canada and Refresh Financial is proud to have been rated as the best overall secured card in Canada for no credit check with guaranteed approval. Simple Rate understands that most people’s financial situations are not the same, and therefore there is […]...more

New Feature: Instant Payments is Now Active!

Here at Refresh Financial we are proud of our commitment to ongoing system and process updates that enhance the customer experience for you, our valued clients, and we are constantly innovating to respond to the needs of our clients. Early last year we launched an automated application process for our custom credit building solutions as […]...more

Answerbot has the answer to all your questions!

Lately, we have had feedback that the wait times to reach our call centre are too long. In most cases, our care agents are answering calls from clients asking questions that are answered directly within your dashboard! If you have a question about the Credit Builder Loan, the Secured Card, reporting to credit bureaus or […]...more

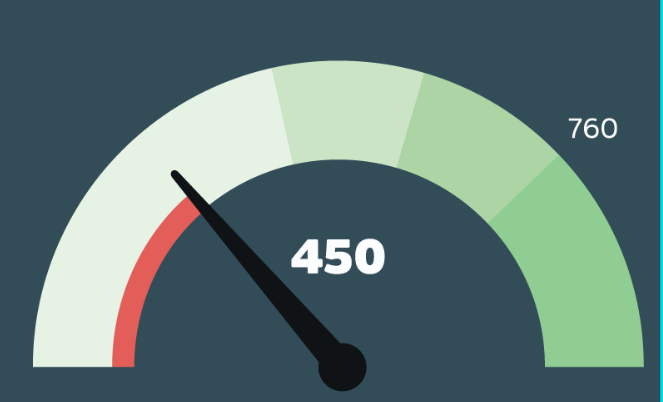

Bad Credit Loans in Canada

Have you heard of bad credit loans? Your credit score is one of the biggest factors – sometimes the only factor – that goes into determining if you will be approved for a loan. In most cases, if your credit score is too low you will be denied a loan as the lender views you […]...more

Will having more credit cards increase your credit score?

This is a question we have often been asked here at Refresh. There is a belief that if you are not using a credit card, the account should be closed to increase your credit score. But is that correct? The short answer is no. In fact, closing a credit card account that you are no […]...more

Improve Your Credit Score – Credit Score Checklist

So many of us tackle credit blind – we have no idea the precise factors that go into a credit score, and just assume that paying our bills is enough to get it growing. ...more

10 Tips For Facing Holiday Bills

The Christmas season can bring an incredible amount of financial stress. We don’t want financial limitations to put a damper on your celebrations, but on the other hand, we don’t want to face astronomical credit card bills in the New Year. If you’ve already thrown caution to the wind and spent to your heart’s […]...more

11 New Year’s Resolutions For Getting Rid of Debt

If this year has been another struggle capping off many years of the same, you might be fed up and ready for a change. You might be ready to turn it around....more

How To Protect Your Credit Over The Holidays

December is a whirlwind of shopping, wrapping, visiting, and enjoying the company of loved ones. So many things seem to fall by the wayside....more

Introducing Refresh Financial’s Knowledge Base!

We are excited to officially launch Knowledge Base as part of Refresh Financial’s client dashboard. What is Knowledge Base you ask? Well, you would be forgiven for thinking that Knowledge Base is just a fancy name for FAQs, however, we feel it deserves a more fitting name. These aren’t just your run-of-the-mill Frequently Asked Questions. […]...more

Free Webinar : Next Date TBD

Join Refresh Academy and Kevin Cochran, Co-Founder of Enriched Academy – an online platform dedicated to delivering inspiring financial education – as we share useful advice and tips each month to help with all aspects of your credit score and finances. Next Webinar: Date: TBD Time: TBD Topic: TBD What is Refresh Academy? Refresh […]...more

Did you know, your credit utilization rate makes up 30% of your credit score?

You probably already know that making your debt repayments on time has the biggest impact on your credit score. When a lender has provided you with credit – whether that’s credit a card, a line of credit, a car loan, even a mortgage – they expect you to pay them back when it is due. […]...more

How To Survive Black Friday and Cyber Monday With Your Credit Score Intact

Black Friday is mostly an American phenomenon. It’s the day after their Thanksgiving that really kicks off the holiday shopping season. ...more

November Is Financial Literacy Month In Canada

Today, the average Canadian owes about $1.70 for every dollar of income he or she earns per year, after taxes. In the 1990s, the average Canadian owed just 85 cents per dollar they earned. In addition, the average Canadian household debt was $72,950 at the end of 2019 – $23,800 if you take out […]...more

Talking about your credit score can be frightful, but it doesn’t need to be!

Most people don’t know their credit score. Why? In some cases, it’s because the thought of checking their credit score sends chills up their spine, and they are deathly afraid of what they might find. Others avoid looking at their credit score because they’ve been led to believe requesting your credit report will harm your […]...more

Will a prepaid credit card build my credit score?

This is a commonly asked question from people looking to build their credit score. Will a prepaid credit card build my credit score? The short answer is no. A prepaid credit card does not have any impact on your credit score simply because they do not report to the credit bureaus. Prepaid credit cards are […]...more

How to build credit with a secured card

A low credit score can be the result of many different situations, not just poor financial decisions or habits. For example, you might have been a co-signer on a loan which defaulted. You might have gone through financial difficulties due to job loss or divorce. Or you might simply be a newcomer to Canada starting […]...more

Just Because You’re a Student Doesn’t Mean You Can’t Have Good Credit

Maintaining and building good credit can be a stressful endeavour, especially if you’re a student! Even with a student credit card, the limitations of spending might make it seem even more difficult. But, it is not an impossible task! If taken seriously, many students are able to come out of their degree with good credit, […]...more

Loans for bad credit and why you should avoid them

When you see advertising for Loans for Bad Credit, you need to ask yourself, “Is this too good to be true?” The answer is probably yes. There are very few lenders who will approve people for upfront loans when their credit is bad. Why? Well, a bad credit score is usually the result of making […]...more

Are there credit cards for bad credit in Canada?

If you have a anything less than a good credit score (generally speaking, a good credit score starts at around 660) then you might struggle to find credit cards for bad credit in Canada, unless it comes with exorbitant interest rates. The reason lenders charge those with poor credit such high interest rates is to […]...more

10 Tips For Using Your First Credit Card

Ok, so, you’re ready to start establishing some credit history and you’ve got yourself a brand new credit card to do it with. That’s a good start....more

Want a credit card to build credit? Read this first!

If you’ve come across this post, it’s likely you are considering getting your hands on a credit card to build credit. Great news! Credit cards are one of the best ways to build your credit score. Why? They are considered a type of revolving credit which reports to the credit bureaus. There are several pros […]...more

Introducing the new Refresh Dashboard

We like to make sure our customers are satisfied. So, we periodically conduct Customer Satisfaction Surveys (CSATs). One of the biggest pieces of feedback we have had recently is that there was not enough transparency in the application process. Once you hit ‘submit’ on your application, what happens next and how long does it take? […]...more

Is your credit card really helping you build credit?

Credit cards can be an excellent tool to help you build your credit score, but only if used responsibly. Here’s what not to do if you want your credit card to work for you, and help you build credit: Do not forget to pay your credit card bill. Paying bills on time accounts for 35% […]...more

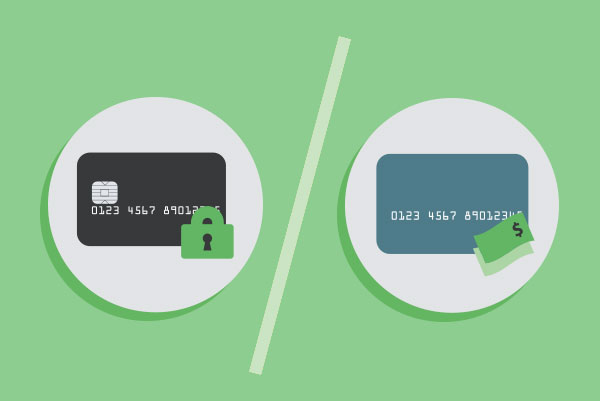

The Differences Between An Unsecured Credit Card and Secured Card

People who suffer from poor credit and who seek out advice on how to improve their credit, are likely to come across one piece of advice more often than all the rest....more

[Infographic] What is the Average Credit Score in Canada and How Do You Compare?

Often, Canadians want to know how they measure up to their fellow countrymen when it comes to credit score. Is your score better than most?...more

High Interest Rates: The True Cost of Credit

We live in a society driven by credit. Not only used to gain access to funds, your credit history is used to open a bank account, rent a home, and get a job....more

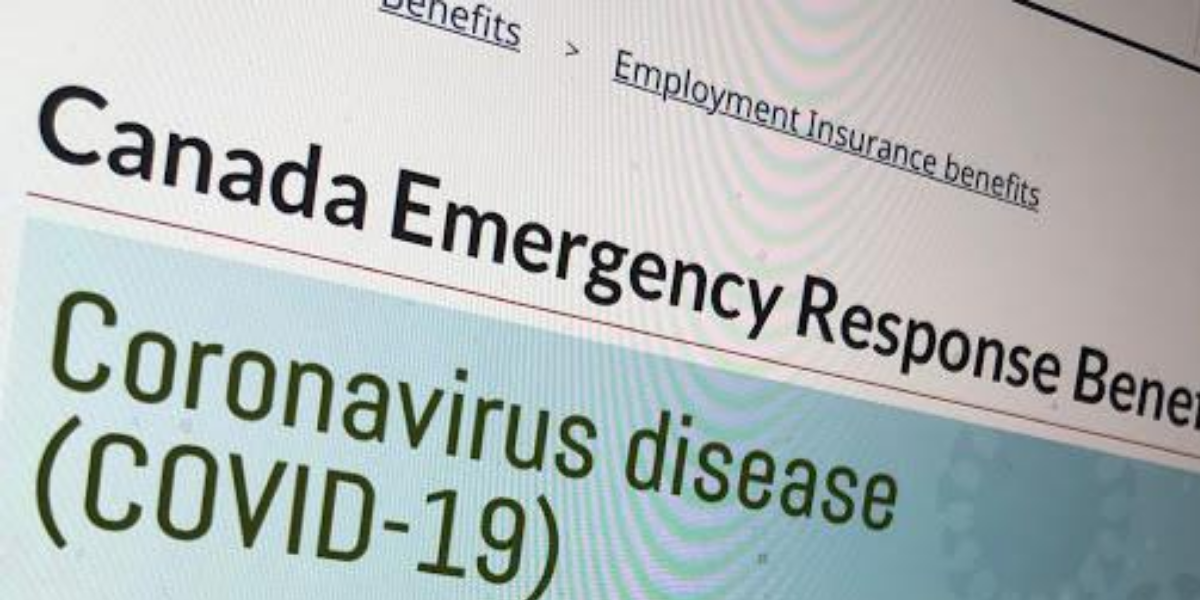

Federal Government plans to make EI easier to access following end of CERB payments

Announced last week, Canada’s government plans to make the transition for recipients of the Canada Emergency Response Benefit (CERB) payments to EI a little easier. To date, the CERB has provided income support for more than 8.5 million Canadians whose livelihoods were impacted by COVID-19, including those who would not previously have been eligible for […]...more

Why is there no credit check with a Refresh secured card?

Secured cards are an excellent option for people with a low credit score who are looking to build their credit. Like a regular credit card, secured cards report to the credit bureaus, impacting your credit score. Many people wonder, however, why there is no credit check with a Refresh secured card? Surely any product that […]...more

How important is your credit score in Canada?

Your credit score may not seem that important to you....more

Never max out your credit card. Here’s why!

If you have an unsecured credit card or a secured card like the one we offer here at Refresh, you’ve got your hands on a great credit-building tool. However, if used incorrectly, any type of credit card can actually damage your credit score rather than increase it. How do you make sure your credit card […]...more

[VIDEO] What is a credit builder loan and how does it build or rebuild credit?

Rebuilding your credit can seem like an insurmountable task. Especially if you’ve had to declare bankruptcy or do a consumer proposal in the past....more

This one thing will have the biggest impact on your credit score!

When it comes to building your credit, there is one thing that will have the biggest impact on how quickly you can increase your score. Paying bills on time. It may sound simple, but it’s surprising how many people do not pay their bills on time, and don’t realize how much this is affecting their […]...more

Bad credit? Need a loan? It IS possible!

If you’re struggling with bad credit, and you’re looking for a personal loan, chances are you’ve probably been turned down at any major bank you have approached. Banks are very unlikely to give out bad credit loans in Canada. What is considered a bad credit loan? Generally speaking, a loan given to anyone with a […]...more

Working on building your credit score? Don’t close any credit card accounts just yet

If you’re working hard to build your credit score and you have paid off a credit card, should you close the account? In short, the answer is no. But with a caveat. Why you shouldn’t close credit card accounts, even if they are paid off and you no longer use them Closing a credit […]...more

4 easy steps to build credit in 20 minutes or less!

A good credit score is one of the most important aspect of your finances. Your credit score can open doors to low interest rates on financial products such as car loans, personal loans, credit cards, and even mortgages. Taking the time to increase your score before you commit to a long-term loan is well worth […]...more

What’s the Difference Between a Secured Credit Card and a Prepaid Card?

What is a secured credit card? A secured credit card – sometimes referred to as simply a secured card – is just like a regular credit card in that your credit limit, balance and payment history is reported to Equifax and TransUnion and will impact your credit score. With a secured credit card, again, just […]...more

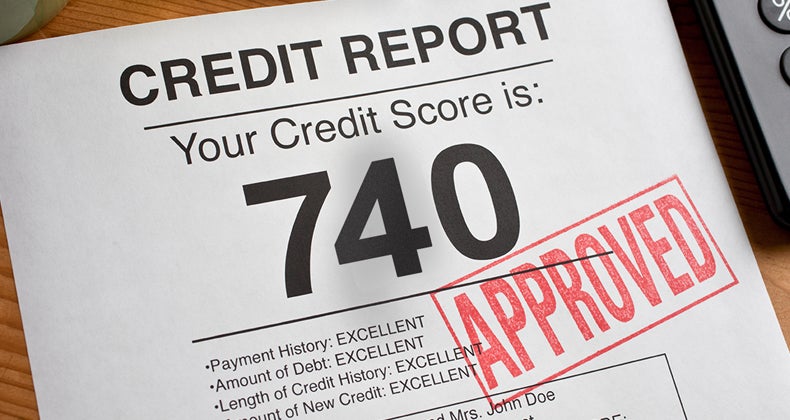

Cheat Sheet – what your credit score should look like to get approved for a mortgage

Getting approved for a mortgage is not the same as getting approved for a loan or a credit card. There are far more rigorous credit checks....more

Post-Pandemic: How To Get A Fresh Start On Your Finances

When you’re in financial trouble and buried under a mountain of debt, it’s hard to imagine how it’s possible to fix the situation. Three-quarters of the Canadian population struggle with debt and it can feel impossible to get out of. The COVID-19 pandemic has only exacerbated this situation. If this sounds like you, you might […]...more

CMHC announces higher credit score requirements for mortgage insurance. What does this mean for you?

Being able to borrow money to purchase a home has long been the goal of many Canadians. However, given that it is going to be the biggest purchase you will make in your life, it should not be a decision that is made lightly. Ensuring you can afford the repayments of the loan you are […]...more

My Personal Loan Was Declined: When Can I Apply Again?

What should you do if your personal loan was declined? You don’t want to keep applying away in the hopes of getting it eventually. ...more

How To Save Money Quickly: The 50/20/30 Rule

There’s this idea many people have that saving money is difficult. It’s something that seems unattainable, but it’s really not. Enter the 50/20/30 rule....more

Why is interest charged to use my own money on a secured card?

When credit is extended, it comes with interest rates. It’s an unavoidable fact of life. It’s very unlikely that you will find someone willing to loan you money and not charge you any interest! Secured cards are no different. Yes, it’s your money that is being used to secure the card, but it’s not your […]...more

Soft credit check vs. hard credit check – what’s the difference?

You might be asking yourself… Soft vs. hard credit check – what’s the difference? If you have ever applied for a credit card, a car loan or even a new cell phone plan, you’ve probably been told that your credit will be checked, and that it will be a ‘hard’ credit check. We’re going to […]...more

Rebuilding your credit score following insolvency

Rebuilding your credit as soon as you can after insolvency is critical. It ensures a better, brighter financial future. Having a good credit score means access to credit products – from personal loans to car loans to mortgages – at the lowest interest rates, potentially saving you thousands in interest payments over the years. There […]...more

Paying down credit cards but your score is dropping? Why?

So, you’re pouring money into your credit cards, trying to get that balance down as fast as you can. You’ve put your tax return on it, and the bonus you got at work....more

What are the benefits of paying off more than the minimum payment on your credit card?

Here’s a question for you: When you pay your credit card bill every month, do you meet the minimum payment or do you exceed it?...more

Make it through the COVID-19 pandemic with your credit score still intact

A good credit score helps you get approved for credit at much lower interest rates than if you have a poor score. In fact, with a poor credit score, you might not get approved for credit at all! For the many people who have been working hard to create a better financial future for themselves […]...more

How To Stay Motivated to Pay Off Your Debts After the Pandemic

Many Canadians have the goal to pay off their debts, and were probably working to achieve their goal when the pandemic hit, throwing a wrench in the works. However, once the pandemic is over, and life has somewhat returned to normal, it’s important to get back on track, and stay motivated to continue paying off […]...more

Spending Less During the Pandemic? You’re Not Alone

Many Canadians lucky enough to still have an income of any kind are discovering they’re actually saving money during the pandemic. With bars, stores, spas, movie theatres, restaurants and more closed due to COVID-19, there’s simply nowhere for people to spend their money. Plus, many people are now working from home, saving on their […]...more

[VIDEO] How does a secured card work to build credit?

Your credit score is affected by 5 main factors: 35% of your credit score comes from payment timeliness on any credit you currently have. If you don’t have any credit products, you need to get some. Sound like a chicken and egg situation? You’re right, it can be hard to obtain credit, without having […]...more

COVID-19 Resources: Still working and looking for ways to take advantage of the current climate?

The current economic situation caused by COVID-19 is proving to be incredibly challenging financially for the millions of Canadians that have lost their jobs or who are living on a significantly reduced income. Many others, however, still have their jobs, and others still, such as healthcare workers and other front line workers are working and […]...more

Additional Income? Should You Save It Or Pay Down Your Debts?

Many of us working class Canadians are finding it difficult to save money and pay down our debts at the same time. ...more

COVID-19 Resources: Lost your job, or on reduced hours?

If you are one of the many Canadians that have suddenly lost their income due to COVID-19, you’re probably scrambling to meet your financial obligations. We’ve pulled together some resources to help you navigate these difficult times, and to help maintain your financial health: Cutting out unnecessary expenses is the number one thing that you […]...more

Sprint, jog, or walk: How quickly do you want to build your credit?

When it comes to building credit, everyone has a pace that works best for them, depending on their current financial situation and future goals. For anyone wanting to make a big purchase such as a house or new car in the near future, building a better credit score should be top of mind in order […]...more

4 tips to better your financial situation through COVID-19

Very few of us can say we’ve lived through something as staggering and financially disruptive as a global pandemic. What we are currently living through is so unprecedented—and for many people and businesses, so crippling—that it could never have been predicted. The present situation is proving extremely challenging economically for many Canadians, with more than […]...more

[VIDEO] Building credit during economic uncertainty

While this is an extremely challenging current climate for many Canadians, there is a silver lining—interest rates are at an all-time low, providing a significant opportunity to those who have the financial means to take advantage. This short video is less than 4 minutes long but will show you how to: Take advantage of the […]...more

How to cut costs when you’ve lost your income

Cutting unnecessary costs during COVID-19. If you are one of the many Canadians that have suddenly lost their income due to COVID-19, you’re probably scrambling to meet your financial obligations. Cutting out unnecessary expenses is the number one thing that you can start doing today to help you survive this difficult time. There are many […]...more

Overcoming your COVID-19 financial anxiety

Anxiety can sneak up on you and can have the power to render you useless. Unfortunately, personal finances are one of the biggest causes of anxiety, For many Canadians, stress and anxiety will be especially high during this time of economic uncertainty as a result of COVID-19. Money worries can get in the way […]...more

Late payment? How much will this affect your credit?

Most of us already know that late payments will hurt our credit score. However, we are currently experiencing an unprecedented situation with the coronavirus, and for some people, it’s simply not going to be possible to make all of their monthly bill payments. Nevertheless, it’s critical to be aware how much of an impact […]...more

Which Debts Should You Pay Off First?

Your Guide To Strategic Credit Building When you have a long list of debts to pay off, it can be daunting to say the very least. You might begin to wonder which debts should you pay off first. Reading stats like Canadians now owe roughly $1.76 for every $1 they earn (source: Statistics Canada, March […]...more

Credit Myth: It’s Best To Turn Down a Credit Limit Increase

One day, you get a letter in the mail saying your credit card provider has decided you’re...more

How to Increase Credit Scores: Secured Cards Vs. Credit Building Loan

If you’ve struggled with credit for any amount of time, you’ve probably heard that getting yourself a secured credit card is the best way to build credit fast....more

10 ways Canadian immigrants can build credit

If you’re reading this, and you’re a new Canadian immigrant, or you’ve been here a little while as a permanent resident — we want to welcome you!! You’ve likely found out that to build credit as a new immigrant to Canada you need to have a good credit history. If you want to borrow money […]...more

No credit history versus a bad credit score

The hard truth is that having either no credit or a bad credit history creates doubt with lenders when it comes to offering you any type of loan. Even if you have a good income, you are viewed as high-risk mainly because of having no credit or poor credit. Understandably, companies have a difficult time […]...more

What is credit and how do I build my credit score?

Have you been denied for loans and credit cards over and over again? Or maybe you’ve been told you don’t have good credit and you won’t qualify for low-interest rate products. If you can relate to this, then keep reading to learn what you can do to build your credit score and your financial future. […]...more

10 things you must absolutely know about your credit

We Canadians focus on high school grades to try to get into a great college or university. And when it’s all done, the next and most important grade we get is our credit score. This is your 3-digit score that signifies whether you have good or bad credit. This score ultimately defines your financial life! […]...more

I have bad credit. Help me, what should I do?

Having poor credit doesn’t make you a bad person. It can, however, put a damper on your entire life and affect your ability to get hired, rent or buy a home, and get a low-interest loan. This can feel as though you’re stuck and can’t get ahead. So, if you’re telling yourself “I have bad […]...more

Can I get a credit card without a hard credit check?

Have you ever applied for a credit card and were told that your credit will be checked to see if you are approved, or that there might be a ‘hard’ inquiry? You might be asking yourself, what’s a hard inquiry? Are their soft inquiries? What’s the difference? In this article, we will take a closer […]...more

6 ways Canadians can get out of debt and build credit

With household debt on the rise in Canada, it’s time to take a look at some of the causes. Why do Canadians find themselves buried in debt? How do you manage debt and build up your credit score? Here are some proven ways to take control of your debt and build a positive financial future. […]...more

How to build your credit as a student in Canada?

Building a good credit history as a student is one of the most important things you can do for yourself. When you want to buy a car, get a personal loan and purchase your first home, lenders will look at your credit report. Start with finding the best student credit card to build credit. I […]...more

What’s the average credit rating in Canada?

Your credit rating in Canada is a number between 300 and 900, which represents everything on your credit report. Your score is created by a computer program that reviews what is on your credit report and converts all that information into a score. To see where you stand, you can compare your credit score against […]...more

6 ways to stop living paycheque to paycheque

Did you know that roughly 53% of Canadians live paycheque to paycheque?¹ It seems nearly impossible to stop living paycheque to paycheque. You pay your bills, buy some gas and groceries and BAM – your paycheque is practically all gone. It’s self-defeating when you can’t get ahead. Here are 6 ways to help you get […]...more

My credit score: I want to understand more about it!

Sometimes understanding your credit report can be overwhelming or confusing. ...more

7 Smart Ways To Save Money Fast

Saving money never goes out of fashion. While this year is already more than half-way through, it’s never too late to start setting money aside and saving for the rainy day. Here are some of the strategies you can use to save money every month. Use a Budget App The first step in getting your […]...more

5 Reasons Co-op Students should be part of your culture

In British Columbia over 5,000 employers are tapping into a smart hiring solution – cooperative education programs (co-op programs). Co-op programs are managed by colleges and universities to match students who want to have hands-on experience in their field of study while earning an income. Employers receive many advantages to hiring co-op students, and the […]...more

5 critical actions a single parent must take to build their credit score

When I was 11 years old, my father became a single parent to me and my 10-year old brother. I saw my father struggle trying to make ends meet and keep his head above water. He worked a full-time job, prepared meals, made sure we got to school and did well in our studies. To […]...more

4 ways to protect your credit in divorce

I remember my parents going through divorce when I was 11 years old. There was a lot of stress, resentment, anger and remorse, and I was stuck in the middle of it all. Fast forward 30 years, and the mutual debt my parents incurred still haunts them today. They wish they had been safer and […]...more

Are you an impulse shopper? 5 ways to build your savings.

I am definitely an impulse shopper and enjoy purchasing things such as shoes and clothing. Even though I have enough of each, I keep buying more. There are things that set off my impulse shopping, and I’ve been finding ways to cope and start to build my savings. Here are some potential causes that may […]...more

Top 10 credit tips for 20-somethings

Top 10 credit score tips for 20-somethings If I could relive my twenties again I would manage my credit differently, starting with listening to my mom’s advice about money. I wish I had learned more about my credit score. It would have really helped me out with my car purchase, my first home and the […]...more

The three types of people with bad credit: which one are you?

Bad credit is something that can happen to almost anyone, no matter their current financial situation. If you’re reading this and thinking “well bad credit isn’t ever going to be a problem for me”, you might be wrong. At Refresh, we’ve identified three main types of people with bad credit – bad credit by blindside, […]...more

[Infographic] Do You Understand Your Credit Score?

Do you know how your credit is broken down? I wanted to take a moment to explain the different areas that are taken into account....more

How To Recover From Bankruptcy or Consumer Proposal: A Step By Step Guide

So, you’ve gotten yourself into a little bit of credit trouble. You’ve got no other way out but to declare bankruptcy or go through a consumer proposal....more

Infographic: What is Credit?

Credit. We’ve all heard the word used, and used it ourselves. You might have a little credit yourself. So what is credit?...more

Benefits Of Using Credit Building Programs

Increasing your credit score is much easier than you think. If you’re trying to improve your credit, you’ve probably considered various credit building programs. Sometimes consumers talk themselves out of these types of programs because of the costs associated with them. The thing is, hiring a credit building company to help you boost your credit […]...more

Check out our products.