Self-Employed? Here’s What You Can Write-Off On Your Taxes

Self-employment can be pretty tricky at tax time. You have to organize your business expenses and figure out what you can write-off and what you can’t....more

Tax Refund? Here Are The Top 5 Ways To Make Use Of It

It’s that time of year again when we’re all scrambling to get our taxes done. It’s worth it though when you get that tax refund....more

Financial Spring Cleaning – 6 Easy Steps

Spring is just around the corner (we hope!) and while many of you might have your mind on spring cleaning in your home, there is a type of financial spring cleaning that can be far more beneficial. Like all spring cleaning, you will have to get your hands a little dirty. The idea is […]...more

Tax Tips: How To Access Lost or Old T4 Slips

It’s always important to get your taxes done each year in time. It’s not always what happens, but it’s important, nonetheless....more

Free Webinar : Next Date TBD

Join Refresh Academy and Kevin Cochran, Co-Founder of Enriched Academy – an online platform dedicated to delivering inspiring financial education – as we share useful advice and tips each month to help with all aspects of your credit score and finances. Next Webinar: Date: TBD Time: TBD Topic: TBD What is Refresh Academy? Refresh […]...more

Federal Government plans to make EI easier to access following end of CERB payments

Announced last week, Canada’s government plans to make the transition for recipients of the Canada Emergency Response Benefit (CERB) payments to EI a little easier. To date, the CERB has provided income support for more than 8.5 million Canadians whose livelihoods were impacted by COVID-19, including those who would not previously have been eligible for […]...more

CMHC announces higher credit score requirements for mortgage insurance. What does this mean for you?

Being able to borrow money to purchase a home has long been the goal of many Canadians. However, given that it is going to be the biggest purchase you will make in your life, it should not be a decision that is made lightly. Ensuring you can afford the repayments of the loan you are […]...more

My Personal Loan Was Declined: When Can I Apply Again?

What should you do if your personal loan was declined? You don’t want to keep applying away in the hopes of getting it eventually. ...more

Make it through the COVID-19 pandemic with your credit score still intact

A good credit score helps you get approved for credit at much lower interest rates than if you have a poor score. In fact, with a poor credit score, you might not get approved for credit at all! For the many people who have been working hard to create a better financial future for themselves […]...more

COVID-19 Resources: Still working and looking for ways to take advantage of the current climate?

The current economic situation caused by COVID-19 is proving to be incredibly challenging financially for the millions of Canadians that have lost their jobs or who are living on a significantly reduced income. Many others, however, still have their jobs, and others still, such as healthcare workers and other front line workers are working and […]...more

Additional Income? Should You Save It Or Pay Down Your Debts?

Many of us working class Canadians are finding it difficult to save money and pay down our debts at the same time. ...more

4 tips to better your financial situation through COVID-19

Very few of us can say we’ve lived through something as staggering and financially disruptive as a global pandemic. What we are currently living through is so unprecedented—and for many people and businesses, so crippling—that it could never have been predicted. The present situation is proving extremely challenging economically for many Canadians, with more than […]...more

[VIDEO] Building credit during economic uncertainty

While this is an extremely challenging current climate for many Canadians, there is a silver lining—interest rates are at an all-time low, providing a significant opportunity to those who have the financial means to take advantage. This short video is less than 4 minutes long but will show you how to: Take advantage of the […]...more

Overcoming your COVID-19 financial anxiety

Anxiety can sneak up on you and can have the power to render you useless. Unfortunately, personal finances are one of the biggest causes of anxiety, For many Canadians, stress and anxiety will be especially high during this time of economic uncertainty as a result of COVID-19. Money worries can get in the way […]...more

10 ways Canadian immigrants can build credit

If you’re reading this, and you’re a new Canadian immigrant, or you’ve been here a little while as a permanent resident — we want to welcome you!! You’ve likely found out that to build credit as a new immigrant to Canada you need to have a good credit history. If you want to borrow money […]...more

No credit history versus a bad credit score

The hard truth is that having either no credit or a bad credit history creates doubt with lenders when it comes to offering you any type of loan. Even if you have a good income, you are viewed as high-risk mainly because of having no credit or poor credit. Understandably, companies have a difficult time […]...more

10 things you must absolutely know about your credit

We Canadians focus on high school grades to try to get into a great college or university. And when it’s all done, the next and most important grade we get is our credit score. This is your 3-digit score that signifies whether you have good or bad credit. This score ultimately defines your financial life! […]...more

I have bad credit. Help me, what should I do?

Having poor credit doesn’t make you a bad person. It can, however, put a damper on your entire life and affect your ability to get hired, rent or buy a home, and get a low-interest loan. This can feel as though you’re stuck and can’t get ahead. So, if you’re telling yourself “I have bad […]...more

Can I get a credit card without a hard credit check?

Have you ever applied for a credit card and were told that your credit will be checked to see if you are approved, or that there might be a ‘hard’ inquiry? You might be asking yourself, what’s a hard inquiry? Are their soft inquiries? What’s the difference? In this article, we will take a closer […]...more

6 ways Canadians can get out of debt and build credit

With household debt on the rise in Canada, it’s time to take a look at some of the causes. Why do Canadians find themselves buried in debt? How do you manage debt and build up your credit score? Here are some proven ways to take control of your debt and build a positive financial future. […]...more

How to build your credit as a student in Canada?

Building a good credit history as a student is one of the most important things you can do for yourself. When you want to buy a car, get a personal loan and purchase your first home, lenders will look at your credit report. Start with finding the best student credit card to build credit. I […]...more

What’s the average credit rating in Canada?

Your credit rating in Canada is a number between 300 and 900, which represents everything on your credit report. Your score is created by a computer program that reviews what is on your credit report and converts all that information into a score. To see where you stand, you can compare your credit score against […]...more

How to build credit in Canada

Sorry. There’s no magic formula to build credit in Canada. But, you can start taking steps today that will have a positive impact on your score within just a couple of months. It is important to remember that when it comes down to building credit in Canada, everyone’s credit score differs. Some of you […]...more

6 ways to stop living paycheque to paycheque

Did you know that roughly 53% of Canadians live paycheque to paycheque?¹ It seems nearly impossible to stop living paycheque to paycheque. You pay your bills, buy some gas and groceries and BAM – your paycheque is practically all gone. It’s self-defeating when you can’t get ahead. Here are 6 ways to help you get […]...more

5 critical actions a single parent must take to build their credit score

When I was 11 years old, my father became a single parent to me and my 10-year old brother. I saw my father struggle trying to make ends meet and keep his head above water. He worked a full-time job, prepared meals, made sure we got to school and did well in our studies. To […]...more

4 Reasons Why You Shouldn’t Rely On Credit Cards For Emergencies

We all know at least one person who has a credit card “for emergencies”, and it’s definitely an option when it comes to being prepared for the unexpected. So why do financial gurus and top thinkers all push the idea of an emergency fund? Why not use a credit card for unexpected expenses? There are […]...more

8 Resolutions That’ll Change Your Finances In 2019

Forget going to the gym or eating fewer carbs. 2019 is the year of financial resolutions – this year we dedicate ourselves to saving money, ending debt and reducing our financial stresses. To do that, we need to have resolutions that significantly affect our finances. With that in mind, here are some New Year’s […]...more

Poor Credit, High Debt & Rising Housing Costs Robbing Many of Homeownership

While browsing Reddit the other day, I stumbled upon a post where a user had proposed a new millennial version of the popular board game, Monopoly....more

6 Ways You Can Enter The Canadian Housing Market

If you’ve been busy saving up and evaluating the money it would take for you to buy a house in Canada, you’re likely aware that it is becoming more difficult. First time home buyers are forced to find new and creative ways to enter the housing market. Looking for a way to buy a […]...more

Improve Your Financial Literacy: 6 Money Smart Resources

Improving your financial literacy can have a huge impact on your quality of life. Unfortunately, the education system doesn’t always do a great job of giving us the knowledge we need to succeed. As Canadians, we need to take it upon ourselves to gain these skills. Thankfully, many groups have recognized this lack of […]...more

This New Trend Could Threaten Your Financial Future

The results from a recent poll from BMO are quite surprising, and unfortunate. Of the 1500 Canadians surveyed, 40% of respondents said they dip into their retirement savings early. Is there a reason why is such a large portion of Canadians are making withdrawals from their RRSPs? Here is the following data. 27% said they […]...more

6 Reasons To Do Your Own Taxes

Tax season is here, and that means many of you will head to your local accountant’s office to have someone else do them for you. There’s no shame in supporting your local accountant, but we’d like to talk about some of the reasons why you should do them yourself. We know it sounds scary, but […]...more

12 Budgeting Hacks To Improve Your Success

When it comes to the dream of being financially secure, we can’t overstate the importance of budgeting. Lots of us have budgets, but few of us implement them effectively. It’s tough to find the motivation and discipline to stick with it. However, there are a few things you can do to increase your budget […]...more

No Income: Do You Still Need To File Your Taxes?

There are many reasons why some Canadians might not have had an income last year. Stay-at-home parents, job loss, and injury are just a few of the potential scenarios that prevent people from earning an income. But the question, is if you’re one of these Canadians, does that mean you get to skip filing your […]...more

The Easiest Ways To Get Buried In Debt (And How To Avoid Them)

With household debt on the rise in Canada, it’s time we took a look at some of the causes. How do Canadians find themselves buried in debt and how do we avoid it? Here are some of those ways: 1. Misusing your credit card – This is probably the most common cause of consumer debt. […]...more

The Dangers Of Relying On Credit Cards

We all know at least one person who has a credit card “for emergencies”, and it’s definitely an option when it comes to being prepared for the unexpected. So why do financial gurus and top thinkers all push the idea of an emergency fund? Why not use a credit card for unexpected expenses? There […]...more

How The Mortgage Stress Test Works

If you’re in the market for a home in Canada, you’re going to be subject to what is called a stress test. If you’re wondering what that is, look no further! This is how the mortgage stress test works. Simply put, the stress test tells lenders whether or not you could handle mortgage payments […]...more

How Are Canadians Affording Homes In Big Cities?

For many, living in big cities like Vancouver or Toronto can seem out of reach. Even people making above-average income can’t afford to live there, which begs the question: how are Canadians affording homes in Vancouver and Toronto? Who is buying these astronomically priced homes? Unfortunately, there isn’t one single answer to this question. […]...more

Using Your Emergency Fund To Pay Down Debt?

If you’ve been an avid reader of the Dime Turner blog, you’ll have read many times about the importance of saving an emergency fund. It’s one of the biggest steps towards financial stability. But when should you use your emergency fund? What constitutes an emergency? Does overwhelming debt count? The answers to these questions, […]...more

10 Tips For Preparing For The Tax Season

It might not be the most exciting thing in the world, but it’s time to start preparing for tax season. If you feel like you’re in the dark when it comes to knowing what to do, this blog should help clear things up. Here are some useful tips for preparing for the tax season. […]...more

Protect Your Identity While Applying For Credit Online

Thanks to technology, applying for credit is convenient and nearly instant. But can you trust that your information is safe when filling out online forms? Sadly, not always, but, fortunately, there are a few precautions you can take that will help you protect your identity while applying for credit online. Ensure You’re Using A […]...more

This Task Can Change How You View Your Finances

If you’re looking to improve your financial situation but are having trouble finding the motivation, we might be able to help. In fact, we think that completing this task can change how you view your finances! There’s a story on the Personal Finances Canada subreddit of a woman under username shar_blue, who decided to list […]...more

Consumer Proposal vs. Bankruptcy. Which one is right for me?

For many Canadians who are stuck in debilitating debt, sometimes the only way out is through a consumer proposal or bankruptcy. The differences between these two options is often misunderstood, so if you’re in a tight spot, this blog will help you decide when to choose a consumer proposal vs. bankruptcy. What is the definition […]...more

How a Higher Minimum Wage Can Impact You Financially in 2018

For those who are struggling to pay off debts, the news of rising minimum wages in Canada sounds very exciting. But are there any downsides? Read on for an in-depth look at how a higher minimum wage can impact you financially in 2018. Depending on your news source, you may have heard lots of positive […]...more

How To Prepare For The Changes To Wage, Taxes & Laws

With the New Year comes change which can affect our finances in many ways. Tax laws differ, wages rise and social services can change. Sometimes it’s tough to know if these changes hurt or help us, which is why it’s so important to have an action plan in place. If you’re wondering what you […]...more

Free Online Tools To Help You Manage Your Money

With the New Year fast approaching, some of us are vowing to eat healthier; others might start hitting the gym, but many are thinking about resolutions on how to manage our debt. If you’re one of these Canadians ready to start the new year with a new attitude towards your money, you’re likely looking for some […]...more

How Paying Off Your Mortgage Early Could Hurt You

Typically, paying off your debts as quickly as possible is a great habit to get into. If you’ve found yourself in a position to pay off a debt early, you stand to save money on interest and improve your credit score all at once. But when it comes to your mortgage, it’s not as […]...more

Most Canadians Failed This Basic Quiz – How Do You Stack Up?

Recently, the Canadian Securities Administrators released the results of their annual education study, and the findings are not exactly spectacular. A series of multiple choice questions were given to Canadian participants. The questions were designed to expose the participants’ understanding of basic financial concepts. Over half of the 5000 respondents failed this basic quiz. […]...more

5 Must-Read Financial Books

If you’re an avid reader and you’re looking to improve your financial situation, why not throw some finance-related books on your upcoming reading list? You’ll satisfy your craving for a great book and learn something about your money at the same time! There are so many fantastic books on the topic of personal finance […]...more

Level Up Your Money Intelligence With These Tips

One of the hardest things when it comes to turning your finances around is learning how to manage your money better. What are some of the ways to become more disciplined with spending? How do we maximize the money we save? How do we become smarter with our money? For those of us that need […]...more

Getting Back On Your Feet After A Financial Crisis

‘Life is what happens to you while you are busy making other plans’ it’s a quote from John Lennon, and when it comes to your finances, it fits perfectly. Unforeseen events can wreak havoc on our personal and financial lives. When you’re hit by an unforeseen financial crisis, it can cost us time, employment, […]...more

5 Signs You Should Not Be Considering Bankruptcy

Debt can creep up on us! You’re living your life and then, all of a sudden you discover that you owe an astronomical amount! It’s overwhelming and tough to know where to start if you plan to get rid of it. Luckily, there are safeguards in Canada for people who find themselves in this […]...more

5 Questions To Ask Yourself Before Buying A New Car

Resisting the allure of a new car is difficult, especially if you’ve just had to spend a mint repairing your existing vehicle. It’s easy to convince yourself you need to make this massive purchase, but a lot of us need to be able to talk ourselves out of it. Are you toying with buying a […]...more

Before You Buy Your First Home: Are You Aware Of All The Fees?

Although stressful, becoming a homebuyer for the first time is an incredibly exciting experience. Offers can go back and forth, financing can take forever, and everything has to be done and signed by the closing date. As the closing date approaches, things seem to get more and more hectic. The stress of buying a […]...more

8 Tips To Ensure You Never Forget To Pay A Bill Again

We’ve all done it at one point or another. Forgetting to pay a bill, and only coming to realize it when the payee contacts us. This is no good when it comes to your credit, with each infraction potentially dragging your good credit score down, further and further. So we’ve compiled a list of […]...more

Increase In Child Tax, How To Make Sure You’re Enrolled

Last week, the Liberal government announced an increase in child tax that all Canadian parents are eligible to receive. Although the increase won’t come into effect until July 2018, you should make sure you’re enrolled now, so that you can take full advantage. So, how do Canadian parents ensure they’re getting the child tax […]...more

What’s Getting In The Way Of Your Financial Goals?

Have You Defined Your Financial Goals? What are your financial goals? Maybe you want to save to improve credit so you can buy your first home. Perhaps you’re hoping to purchase a car in the near future. Maybe you’re tired of debts hovering over your head. Do you have a clear idea of what your financial […]...more

How Changes to Mortgages by CCB Will Affect Canadians

Buying Homes With The New Mortgage Stress Test When it comes to buying a home in Canada, there are several processes you should prepare for. There are new rules and legalities that Canadian home buyers should be aware of. Buying a home is one of the most important decisions you can make in your life. […]...more

How To Come Out Of An Interest Rate Increase Unscathed

It’s important to have some wiggle room in your finances in case of emergencies or interest rate increases. If you’re only $200 away from not being able to meet your financial obligations, even the slightest increase on your mortgage’s interest rate could send you over that line. How do you prepare yourself so that […]...more

The Cause of Money Stress And How To Fight It

Life in Canada means money stress. For most of us, anyway. We lose sleep over it, we end up in arguments over it; it’s a source of anxiety, worry and more. There aren’t many of us who are lucky enough to be able to get through life without worrying about money very much. Even the […]...more

How This Habit Can Completely Change Your Financial Situation

Life is busy. There are so many things that fight for our attention and it becomes so easy to forget healthy financial habits. Admit it, most of us go through life without regularly checking our debt and credit statements. Reviewing your statement with a fine-toothed comb is an excellent habit that can completely change […]...more

Variable vs. Fixed Mortgages: Are You Sure You’ve Chosen The Right One?

There are so many decisions to make when it comes to buying a house. One of these decisions is deciding to go with a fixed or variable rate mortgage. Which is the better option? If you’re wondering about the differences of variable vs. fixed mortgages, this blog will cover the upsides and downsides for […]...more

10 Ways A Secured Savings Loan Can Work for You

When it comes to building credit, nothing is as powerful or cost-effective as a cash secured savings loan. It will build your score quickly and allow you to save some money for the future. It’s like a loan in reverse. Instead of getting the money up front, it’s yours at the end of the […]...more

The Benefits of Having Life Insurance

You’ve probably had the opportunity to buy life insurance before and if you’ve decided against it, it could be due to affordability reasons – who wants another monthly payment, especially when it’s not mandatory. Maybe you haven’t enough time to look into it. Continue reading for some of the main benefits of having life […]...more

Tips For Managing School And Debt At The Same Time

Post-secondary school is a challenging experience. The coursework is exhausting and the mornings are early. If you add debt to the mix, the situation can feel totally overwhelming. How are you supposed to deal with everything on your plate, and the stress of this season of life? Here are some great tips for managing school […]...more

10 Tips To Lower Your Risk of Hacking and Identity Theft

News of the recent Equifax hacks is bound to make people nervous about the security of their financial accounts. While modern banking and financial systems have fairly robust security, it’s your responsibility to do your due diligence and safeguard as best you can, your money, credit, and identity. Here are 10 tips to lower your […]...more

8 Things Teens Need To Know About Money

You’d think that by 2017, there’d be a robust and well-rounded financial element to high school curriculum, but unfortunately, there isn’t. Many high-school graduates leave the classroom without a healthy understanding of finances. Luckily, the […]...more

Canadians Are Getting Better At Making Their Mortgage Payments – Here’s Why We Still Need To Worry

Many Canadians tend to cut it close when it comes to their financial margins. Nearly half of us are only $200 away […]...more

When To Consider Taking A Pay Cut

“More money, more problems…” We’ve all heard the saying, but is there any truth to this classic cliché? Money is important in our modern world, but believe it or not, there are a few scenarios when taking a pay-cut can actually be beneficial. So, how do we know when to consider taking a pay […]...more

Rent or Buy? How To Know What’s Right For You

With housing costs being as high as they are, many Canadians find themselves debating whether it makes sense to rent or buy. It’s a reasonable question to ask, so let’s take a look at the possible solutions. Affordability – For many, the question of renting or buying comes down to affordability. Is it financially viable […]...more

New Homeowners: What are CMHC Fees And Will You Be Charged Them?

Buying a home in Canada can be a frustrating and daunting task. So many rules, so many different options. It can feel nearly impossible to be fully informed as you embark on this journey towards owning your own home. One of the most overlooked aspects of buying a house is CMHC fees. Let’s take […]...more

How To Maintain Good Credit While Unemployed

How to keep your current credit situation intact on little to no income Did you know that 6.3% of Canadians are struggling with unemployment? Even with benefits like disability insurance, it can be difficult to make ends meet, especially if you have debt. How you can maintain good credit while being unemployed? Here are […]...more

How Your Credit Score Is Affected By Other People’s Bills In Your Name

It’s one thing to stay on top of your own bills, but it’s different when we’re responsible for someone else’s. We can sometimes find ourselves in this situation when a loved one needs help signing up for utilities or maybe a phone. They might have poor credit or are unemployed and need someone to […]...more

Tips For Settling Financial Disputes With Your Spouse

Few things are as stressful as financial concerns, yet arguments between spouses tend to be related to money more often than not. There are several ways to improve your situation and to be proactive about one of the top causes for divorce. Here is our list of tips for settling financial disputes with your […]...more

Didn’t File Your Taxes? What You Need To Know

We all forget to do things every once in a while. We get busy and caught up with day-to-day life, and certain things can slip our mind. But what happens when you realize that you didn’t file your taxes? What you need to know can be found on this blog! In Canada, forgetting to […]...more

8 Signs You’ve Been A Victim of Identity Fraud

Overcoming identity fraud is a stressful and time-consuming process. It can be scary because you’re never sure of how far the theft goes. It’s extremely important to monitor your statements and credit reports for any signs of identity theft so that you catch it before any real damage is done. If you’re not sure […]...more

The Pros and Cons of Borrowing From Loved Ones

We’ve all been in a tight bind before. The sort of bind that leaves us with nowhere to turn but our loved ones for financial help. There aren’t many of us who haven’t borrowed from family or lent to friends. If you find yourself in this situation, is it really the best route to go […]...more

5 Lessons From The Sears Severance-Free Layoffs

In June, Sears Canada announced it would be filing for creditor protection. As part of the company’s court-supervised restructuring, Sears has been forced to let 2,900 members of its staff go across Canada. Sears won’t pay out any severance packages because they have filed for creditor protection, which protects the company from lawsuits while they […]...more

Rapid Decline In Toronto: Is The Real Estate Bubble Bursting?

There is no doubt home sales have slowed significantly in Toronto over the past few months. Some say it’s because homeowners are rushing to get the big bucks for their properties before a dreaded crash. Others say it has something to do with new regulations by both the federal and the Ontario provincial governments. There […]...more

The Pros and Cons Of Digital Vs. Traditional Banks

You’ve probably seen ads for banks like Tangerine and PC Financial. They boast about their low-fee or no-fee chequing accounts and entice clients with higher interest rates on savings accounts, but are they all that they’re cracked up to be? Are there any downsides to banking with these virtual banks? When it comes to […]...more

5 Things That Could Prevent Your First Home Purchase

So you’ve saved up for a down payment on your first home and you’re officially in the market, but before you talk to a real estate agent, there are several things to consider. Here is a list of 5 things that could prevent your first home purchase and jeopardize your plans. 1. Proving The […]...more

Two Types Of Credit That Young People Are Drawn To

In Canada, the average consumer debt is rising. On average, we now owe a massive $22,000, not including our mortgages. We’re seeing that young people are taking on more debt than the older crowd and it’s not all credit card debt. There are two types of credit that young people are drawn to. It’s […]...more

How To Get Approved For A Car Loan

You’ve probably seen the ads on television or popping up in your social media feed promising great car loans for people with bad credit....more

7 Reasons To Put Off Buying Your First Home

You’re tired of renting, we get it. You’re thinking about biting the bullet and buying your first home, but is it the right time?...more

Priorities: What To Do With Your Money First

As long as there has been money, there have been money gurus. There have also been those who’ve created wealth from seemingly nothing....more

Collateral and Conventional Mortgages: What Are The Differences?

Buying a house, especially your first, can be a scary and exciting time. It’s almost like a crash course in finance and lending....more

8 Tips For Getting The Most When Selling Your Old Car

So you’ve decided to sell your old clunker. That’s a great idea! Especially if you’re doing it to pay down your debts....more

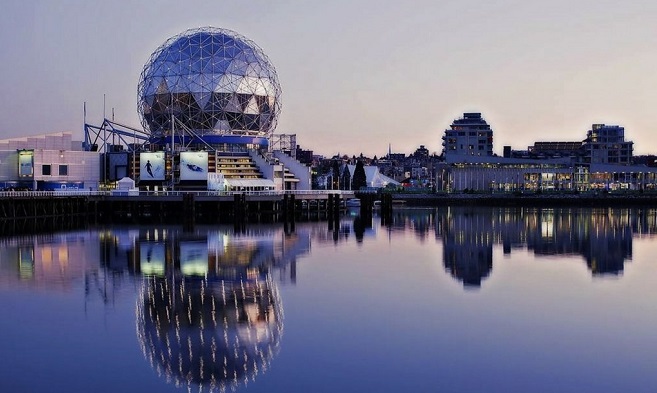

House Sales On The Rise Again In British Columbia – Here’s Why

From April to May 2017, the number of house sales in the Greater Vancouver Regional District climbed to a whopping 22.8%. In just one month!...more

Android and Apple Pay – Pros and Cons

Recently, it was announced that Android users can now use Android Pay (like Apple Pay) in Canada....more

Do Mortgage Helpers (Legal Suites) Count With The New Stress Test?

Mortgage helpers are legal suites in your home that you can rent out, bringing in extra income to help pay your mortgage....more

Buyer’s Market? Why There’s Been A Sudden Influx of Properties For Sale In Toronto

What’s caused the sudden change in the real estate market? Why the sudden jump in numbers of properties for sale in Toronto?...more

Should They Stay or Should They Go: When Should Your Children Become Financially Independent?

Kids are expensive. Adult kids are even more expensive. When should they fly the coop and become financially independent?...more

Canada’s Astronomical Housing Prices: Could a Bubble Burst Be In The Future?

This current state of affairs in Canada makes you wonder – what would happen if interest rates rose? Enter the housing bubble burst....more

Identity Theft: A Step by Step Guide To Getting Your Identity Back

So you’ve taken our advice and obtained your credit report. You’ve skimmed through it and noticed some odd things you don’t recognize....more

Just Married? How To Manage Your Finances After The Big Day

With the vacation bliss at an end, it’s the perfect time to sit down and look at the new marriage and money situation you and your spouse are working with....more

For Half Of Canadians, Just $200 Is The Difference Between Paying Bills And Not

How much money do you have left over each month after paying bills and meeting your expenses? A few hundred dollars?...more

Mortgage Brokers: What Are The Pros And Cons

Mortgage brokers always seem to have their fingers on the pulse of the housing market. They’re connected with more lenders than you even knew existed....more

Red Hot Real Estate: Ontario’s New Measures To Curb Rising Housing Market

Ontario’s housing market is out of control, much like South Western British Columbia. Even renting in Canada’s major cities is unaffordable for the vast majority of us....more

Financing a Car: Does The Size Of Your Down Payment Matter?

If you’re looking to finance a car, and you’re working hard to save your down payment, you might be wondering just how long you should keep saving. ...more

12 Tips For Talking About Money With Your Spouse

Money is stressful. Even talking about money can bring a heightened state of irritability....more

Hooked on Online Shopping? Beware These Common Scams

Shopping online is easy. With the click of a button, you can have anything you need, delivered right to your door in just a few days....more

Ontario Piloting Financial Literacy Program In High Schools

Most of us grew up without much of a financial education. We graduated high school barely knowing how to cash a cheque....more

Choosing a Mortgage – The One Big Mistake You Should Avoid

We are creatures of habit and we all like to turn to the same familiar faces when we need something, including banking....more

12 Income Boosters With Skills You Already Have

One of the best ways to boost your credit score, is to find income boosters and pay down your debts faster with the money you earn....more

Why Millennial Homeowners Are Feeling Regret

Angus Reid recently conducted a survey for CIBC where they reached out to millennial homeowners to find out what their attitudes were towards their home purchase. Their answers might surprise you....more

The Top 10 Reasons Why You Need An Emergency Fund

Most financial gurus these days are going to tell you that there are two first steps to financial security: pay down your debts and save an emergency fund....more

Credit Unions Vs. Banks – What Are The Differences?

If you’ve been banking for years with one of Canada’s big banks, you might wonder what you’re missing because you’re not at a credit union and vice versa....more

New or Used Car: Which Is The Best Option Financially?

If you’re in the market for a car, you’ve probably found yourself wondering the same question we all do: which is better? A new car or a used car?...more

Should You Let Your Teens Have a Job? The Pros and Cons of Working Teens

The older kids get, the more expensive their tastes seem to be. And it seems like every time you turn around, they’re asking for something else....more

To Marry or Not To Marry – The Financial Difference Between Common Law & Legal Marriage

As more and more Canadians opt out of marriage, you have to wonder, are they putting themselves at a financial disadvantage by staying common law?...more

Apple Wallet – Why You Don’t Need To Carry All Those Points Cards Around Anymore

Being members of loyalty points clubs means you probably have a fat wallet bursting at the seams with club cards, right? You don’t have to, though!...more

High Pressure Banking – Things You Should Know

It’s important to note that this isn’t necessarily how things operate across all bank branches in Canada. But just in case, here’s how you protect yourself....more

Why Buying A Home In Canada Is Becoming Harder and Harder

That’s right, Canucks… the Canadian housing market just doesn’t seem to be getting any easier to navigate for first-time buyers....more

How Much Should You Save For Emergencies? Factors To Consider

By now, you know that you should be saving an emergency fund. Tucking away a few months worth of expenses is a good practice....more

Gifting A Pre-Paid Credit Card: You Might Be Paying More Than You Realize

Buying a gift is not always the easiest task, especially when you’ve got a really busy schedule and you don’t know the recipient all that well. ...more

How To Prepare Financially For Buying a Home and Common Mistakes to Avoid

Buying your first home is exciting and rewarding, but it can also be very stressful, especially if you have poor credit and bad money habits....more

What Happens To Your Pay When Your Workplace Goes On Strike

If you are a member of a union, strikes are a thing that can and do happen and you need to know what to expect if a strike happens at your workplace....more

10 Reasons Why You Should Have A Last Will And Testament

Nobody wants to think about their will. It’s morbid and scary to have to face our own mortality. It is, though, an important fact of life....more

Why Your TFSA and RRSP May Not Be Enough For Retirement

It’s not always the easiest thing to focus on saving for retirement with your RRSP when you have so many expenses right now. ...more

11 Things We Forget To Do That Could Change Our Money

We all get busy, wrapped up in the business of day-to-day life. Making dinners, doing laundry. We hardly have any time to sit down and look at our money. ...more

Parents: Make Sure You’re Claiming These Benefits This Tax Year

Being a parent in Canada is expensive. It seems like every time you turn around, there’s another huge expense on the horizon....more

10 Facebook Pages That Every Money-Conscious Canadian Should Like

Facebook can be frustrating. With all those videos, memes and so many ads, it’s difficult to find what truly interests you. And we can hardly disconnect....more

Co-signing: Risks You Should Consider

You’re not likely going to get through life without being approached for some financial help at some point or another. Moms and Dads especially....more

Tips and Tricks To Max Out This Year’s RRSP Contribution

March marks a new year for RRSP contributions, which leaves you little time to max out this year’s additions to your Registered Retirement Savings Plan....more

Kids No Longer Pay For MSP In BC – How Much Will You Save?

While we, as Canadians, take pride in the fact that we have universal healthcare, some of us make the mistake of calling it free health care....more

How To Know When It’s The Right Time To Ask For A Raise

Asking for a raise is a delicate thing. You ask too soon, or for too much and you might send the wrong message....more

So, You’re Finally Debt Free. What To Do Next

It finally happened. You made your last payment on your last debt and you’re debt free! Free to do as you please with a brand new influx of cash....more

Unexpected Cash: What You Should Do With Your Windfall

If you’re lucky enough to have come into a large chunk of money, some unexpected cash, you want to use this to your best advantage. ...more

Canadian Banks Are Raising Fees – How You Can Avoid Them

Scotiabank has announced that it will raise the fees it charges for a few of its products. This is just one instance in the trend of rising banking costs....more

Self-Employment Financial Checklist

Intuit, the financial software giant, has recently reported that they believe 45% of all Canadians will be self-employed by the year 2020....more

7 Reasons To Go Through Your Credit Card Statement Every Month

If you are struggling with debt, you probably find dealing with money fairly stressful. Sometimes, when we find things stressful, we avoid them....more

How The Rise of CMHC Insurance Premiums Affects You

This past week, the third rate hike in the last two years was announced. Once again, Canadians, your CMHC insurance premiums are going up....more

5 Money Subreddits You Should Be Subscribed To

If you don’t know what Reddit is, allow me to present you the birthplace of viral. Reddit is a global forum where users can post content & have it voted on....more

Launch of New Interest-Free Loans in BC

Starting today, BC residents who are first-time homebuyers and have at least half of their down payment saved already, will be eligible for a new program....more

With Money, There is No Such Thing as Luck

Happy Friday the 13th, money savers! Every Friday the 13th, we hear someone mention how unlucky it is....more

Finland Launches Basic Income – Should Canada Follow Suit?

Finland has launched an experimental program to get a real idea of what happens if people receive a Basic Income....more

2017 Canadian Tax Changes: Will You Be Affected?

2017 arrived fast, and with it, the federal and provincial governments are bringing in lots of changes. ...more

Money Trends to Look out for in Canada in 2017

2016 saw many things change for Canadians. Purchasing a home became quite a bit more difficult, foreign investors face new taxes, and interest rates rose....more

10 Ways Our Money Changed In 2016

Here’s a quick recap of some of the major changes we saw take place, more than one of which likely affected you personally....more

What To Consider When Choosing A Bank

If you’re working towards a better credit score, getting out of debt and saving money, chances are you’re wondering which financial institution is best....more

12 Must-See Movies About Money

The holidays are here and you’re looking to relax this weekend. You just want to sit back with some eggnog and relax....more

10 Ways Saving Money Can Better Your Life

Saving your money can mean cutting other things down or out of your life and that is never a fun thing to do....more

New Canadian Debt Trends and What They Mean for You

Here’s a surprising fact: the majority of consumers in Canada are now decreasing their debt load, according to a study by the credit bureau, Equifax....more

5 Ways To Make Online Shopping Safer

Some say the best way to avoid all the traffic, the parking lots, and the line-ups during your holiday shopping is to simply shop online....more

Weekend Challenge: Go Credit Free

Black Friday and Cyber Monday are in the past, but most people are now in full holiday shopping mode....more

Millennials Drawn To Payday Loans

We’ve talked a lot here on the Refresh Financial blog about the struggles millennials face with credit and borrowing....more

How to Spot Fake News and Bad Advice Online

Today we’re explaining how to figure out whether to trust your source on the internet. This will protect you from following bad advice about your money....more

TD Has Raised its Mortgage Rates – Will Others Follow?

One of Canada’s largest banks, TD, surprised many when it raised its prime lending rate for variable mortgages....more

10 Canadian Tax Credits and Deductions You Might Not Know About

Many of us can take advantage of tax breaks if we keep good records of our spending throughout the year....more

12 Financial Gurus To Follow On Twitter

If you’re an avid Twitter user, chances are it’s where you go to get the latest in everything that interests you. ...more

Payday Loan Regulations Tighten In British Columbia

Right now, in British Columbia, the cost to borrow $100 must not exceed $23. But starting in 2017, that will be lowered to $17. ...more

The Light At The End Of The Tunnel: Why The New Mortgage Rules Could Be A Good Thing

We’ve heard our fair share of the doom and gloom following the new mortgage rules that came into effect in Canada just a couple of weeks ago....more

7 Banking Fees That Might Surprise You

Banks. Some of you winced when you read that, didn’t you? There can be good reason for that....more

Would You Move For A Job? Canada’s Top Job Markets

If you’re struggling to find work where you are, these five cities could be Canada’s best options for you....more

5 Podcasts To Listen To Over the Weekend That Are Good For Your Wealth

Podcasts are huge these days and there is one for every interest, every hobby, every topic. Finance, of course, is no different....more

Why You Might Be Having Trouble Paying With Credit at Walmart

From October the 24th 2016, Manitobans might begin to find it difficult to pay for their Walmart purchases with their Visa cards....more

7 Things to Consider Before Hiring a Financial Planner

You’re finally ready to jump into real financial change. You’ve been reading our blog for a while now, and you’ve implemented some of our tips. ...more

3 Canadian YouTube Channels That Will Change The Way You Look At Money

Some people seem to look at YouTube and see a kid’s toy. It’s nothing but funny cat videos and music; there’s certainly nothing of substance there. ...more

Weekend Reading: 6 Books That Will Make You Richer

Someone who has been there, done that, is going to impart the best tricks of the trade so that maybe one day, you can be as financially secure as they are....more

Canadian Pension Plan Changes: What That Means For You

Just recently, on October 4th, British Columbia confirmed with the federal government that they are on board with building a stronger Canadian Pension Plan. ...more

More Than Half Of Canadians Living On The Brink Of Debt Overload

What would happen if your monthly income dropped by $200? Would you still be able to make ends meet? Would any of your bills go unpaid?...more

Canadian Household Debt at Record High: How This Affects You

There have been many measures taken by governments across Canada to slow the growth of household debt, but it still rose 2% in the second quarter for 2016....more

Federal Government To Take On Credit Card Fees

Two years were given to Visa and Mastercard to prove they had lowered the fees they charge to merchants in Canada....more

Foreign Investment Tax in BC: How It’s Impacted Us So Far

This past August, the British Columbia provincial government implemented a foreign investment tax, adding 15% to the sale of homes in the Greater Vancouver area for foreign nationals. The goal was to force housing prices to drop....more

Debt Success Stories: Cheryl Strayed

Recently, I had the pleasure of sitting down and watching the flick, Wild, with Reese Witherspoon. The movie was written by Cheryl Strayed, who lived it....more

If You’re Buying Your First Home, Make Sure You’re Budgeting for These Fees

Congratulations, first time home buyer! This is a huge step in your life. ...more

Millennials Defaulting on Their Debts at an Alarming Rate

It’s brutally obvious that the cost of living in most parts of Canada is skyrocketing. Homeownership is getting further and...more

5 Mistakes Parents Make When Giving Their Kids An Allowance

It seems these days that the majority of kids don’t get a regular allowance from their parents. Instead, they seem to just be bought...more

Debt Success Stories: President Barack Obama

Whether you’re an Obama-supporter or not, the man is a polished symbol of self-confidence and achievement....more

How To Start Saving At Any Age – A Step-by-Step Guide

If you’re not a Redditor, you really ought to be. This site has information on just about anything you can imagine, including...more

Is It Possible To Live Without Money Stress?

For some of us, money stress can be a touchy subject. The topic is avoided, and so is monitoring how much money is leaving your hands....more

Alberta Enacts Bill To Protect You From Predatory Lenders

For decades, predatory lenders have taken advantage of the financially desperate, and customer service at payday loan outlets is designed to be confusing....more

Early Retirement and No Mortgage: Yes, It is Possible!

Canadians who strive for homeownership will struggle to reach that goal, and struggle further to maintain it. Is there an alternative...more

11 Easy Steps To Improving Your Finances

Changing your financial situation can seem like an uphill path riddled with obstacles. This tends to discourage people from taking that...more

Debt Success Stories: Cyndi Lauper

You always think of your favourite successful rockstar as always being successful. Although most of them struggled on the way....more

A Step-By-Step Guide For Requesting A Raise

Do you deserve a raise? Have you been loyal, reliable and worked hard at the company you’re with for a long time and seen no increase...more

Debt Success Stories: Walt Disney

If you grew up in the western world, chances are your childhood was shaped and moulded by the visions of Walt Disney....more

Snowball vs. Avalanche Method of Repayment

We’ve all had those moments where we sit down and take stock of our debts and feel overwhelmed. Some of us more often than others....more

Debt-to-Income Ratio: What Is It & How Can You Find Out Yours?

Your ratio is definitely something you should know, especially if you’re looking to be considered by lenders for loans...more

7 Tips For Teaching Your Kids About Money

Most of us have wished at one time or another that we’d been taught more about financial responsibility in our youth....more

Debt Success Stories: ShayCarl

You probably know someone like him. He is a devoted dad, who got married and quickly had three kids, and then found himself over his head in debt....more

Canadian Millennial Unemployment: How We Can Help

Canadian millennials are living under their parents’ roof longer and longer, unable to find jobs. Like any problem though, there...more

The History of Canada’s National Debt

The history of Canada’s national debt. Basically, what happened was that some people got together and decided to change...more

‘The Surprise’ Hits You Right in the Feels

I was at my local movie theatre last night when I saw ‘The Surprise’- a short story/commercial from INTERAC*....more

Here’s What You Do If You Lose Your Wallet While On Vacation

Probably about ten years ago, I lost my wallet while in Mexico. So here’s what you do if you lose your wallet while on vacation....more

Google Says No To Payday Loans and So Should You

Google says no to payday loans and so should you. Google will no longer let these companies advertise with them, because of their predatory nature....more

Four Tips To Know Before You Get Your First Credit Card

Having a credit card might be a concept that seems alluring with its sense of freedom and adulthood, but have you ever looked at the fine details? ...more

Tips for Managing Your Student Debt

So you’ve made it through your degree and now you’re faced with real-world problems. Don’t worry, it happens to the best of us...more

5 Tips for Teaching Your Kids About Money

It might seem like an impossible task to successfully teach your children about money when you’re still struggling to do so as an adult. ...more

Money Myths – Part 5

I always pay my bills on time, and I check my bank account and credit card statements often. I don’t need to check my credit report....more

Money Myths – Part 4

Myth: Holding a credit balance is good for your credit. I actually believed this was true until I did some more research on the topic....more

Money Myths – Part 3

Every day there is new advice on how to manage your finances. From credit score education to consumer proposals, there is a lot of information available....more

Money Myths – Part 2

Every day there is new advice on how to manage your finances. From credit score education to consumer proposals, there is a lot of information available....more

Money Myths – Part 1

Money Myths – Part 1 – How debt can affect anyone, regardless of income....more

Canadian Federal Budget 2015

On April 21 2015, the Conservative government released the 2015 federal budget. ...more

Check out our products.