Are there personal loans for bad credit, and should I get one?

Whether you opt for secured credit products or credit that has been cosigned for, credit is still obtainable to those with bad credit....more

How Consumer Proposal and Bankruptcy Affect Your Credit Score In Canada

We all know that bankruptcy doesn’t do your credit score any good. But do you know exactly how it will affect your credit in Canada?...more

Refresh Financial’s Secured Card Wins Best Overall Secured Card Award

Simple Rate has put together a list of the best Secured Cards available in Canada and Refresh Financial is proud to have been rated as the best overall secured card in Canada for no credit check with guaranteed approval. Simple Rate understands that most people’s financial situations are not the same, and therefore there is […]...more

Bad Credit Loans in Canada

Have you heard of bad credit loans? Your credit score is one of the biggest factors – sometimes the only factor – that goes into determining if you will be approved for a loan. In most cases, if your credit score is too low you will be denied a loan as the lender views you […]...more

Will having more credit cards increase your credit score?

This is a question we have often been asked here at Refresh. There is a belief that if you are not using a credit card, the account should be closed to increase your credit score. But is that correct? The short answer is no. In fact, closing a credit card account that you are no […]...more

Improve Your Credit Score – Credit Score Checklist

So many of us tackle credit blind – we have no idea the precise factors that go into a credit score, and just assume that paying our bills is enough to get it growing. ...more

10 Tips For Facing Holiday Bills

The Christmas season can bring an incredible amount of financial stress. We don’t want financial limitations to put a damper on your celebrations, but on the other hand, we don’t want to face astronomical credit card bills in the New Year. If you’ve already thrown caution to the wind and spent to your heart’s […]...more

11 New Year’s Resolutions For Getting Rid of Debt

If this year has been another struggle capping off many years of the same, you might be fed up and ready for a change. You might be ready to turn it around....more

How To Protect Your Credit Over The Holidays

December is a whirlwind of shopping, wrapping, visiting, and enjoying the company of loved ones. So many things seem to fall by the wayside....more

How To Survive Black Friday and Cyber Monday With Your Credit Score Intact

Black Friday is mostly an American phenomenon. It’s the day after their Thanksgiving that really kicks off the holiday shopping season. ...more

How Your Internet Habits Can Slow Your Credit Building

From sending someone a quick note or paying our bills online to performing our jobs & staying on top of the news, the internet is good for many things....more

Will a prepaid credit card build my credit score?

This is a commonly asked question from people looking to build their credit score. Will a prepaid credit card build my credit score? The short answer is no. A prepaid credit card does not have any impact on your credit score simply because they do not report to the credit bureaus. Prepaid credit cards are […]...more

How to build credit with a secured card

A low credit score can be the result of many different situations, not just poor financial decisions or habits. For example, you might have been a co-signer on a loan which defaulted. You might have gone through financial difficulties due to job loss or divorce. Or you might simply be a newcomer to Canada starting […]...more

Loans for bad credit and why you should avoid them

When you see advertising for Loans for Bad Credit, you need to ask yourself, “Is this too good to be true?” The answer is probably yes. There are very few lenders who will approve people for upfront loans when their credit is bad. Why? Well, a bad credit score is usually the result of making […]...more

Are there credit cards for bad credit in Canada?

If you have a anything less than a good credit score (generally speaking, a good credit score starts at around 660) then you might struggle to find credit cards for bad credit in Canada, unless it comes with exorbitant interest rates. The reason lenders charge those with poor credit such high interest rates is to […]...more

10 Tips For Using Your First Credit Card

Ok, so, you’re ready to start establishing some credit history and you’ve got yourself a brand new credit card to do it with. That’s a good start....more

Want a credit card to build credit? Read this first!

If you’ve come across this post, it’s likely you are considering getting your hands on a credit card to build credit. Great news! Credit cards are one of the best ways to build your credit score. Why? They are considered a type of revolving credit which reports to the credit bureaus. There are several pros […]...more

Debt Hacks: Tips and Tricks To Pay Down Your Debt Faster

When you look at your debt, does it feel overwhelming? Do you feel like you’re going to be paying it down for the rest of your life?...more

The Differences Between An Unsecured Credit Card and Secured Card

People who suffer from poor credit and who seek out advice on how to improve their credit, are likely to come across one piece of advice more often than all the rest....more

[Infographic] What is the Average Credit Score in Canada and How Do You Compare?

Often, Canadians want to know how they measure up to their fellow countrymen when it comes to credit score. Is your score better than most?...more

High Interest Rates: The True Cost of Credit

We live in a society driven by credit. Not only used to gain access to funds, your credit history is used to open a bank account, rent a home, and get a job....more

Why is there no credit check with a Refresh secured card?

Secured cards are an excellent option for people with a low credit score who are looking to build their credit. Like a regular credit card, secured cards report to the credit bureaus, impacting your credit score. Many people wonder, however, why there is no credit check with a Refresh secured card? Surely any product that […]...more

How important is your credit score in Canada?

Your credit score may not seem that important to you....more

Never max out your credit card. Here’s why!

If you have an unsecured credit card or a secured card like the one we offer here at Refresh, you’ve got your hands on a great credit-building tool. However, if used incorrectly, any type of credit card can actually damage your credit score rather than increase it. How do you make sure your credit card […]...more

[VIDEO] What is a credit builder loan and how does it build or rebuild credit?

Rebuilding your credit can seem like an insurmountable task. Especially if you’ve had to declare bankruptcy or do a consumer proposal in the past....more

This one thing will have the biggest impact on your credit score!

When it comes to building your credit, there is one thing that will have the biggest impact on how quickly you can increase your score. Paying bills on time. It may sound simple, but it’s surprising how many people do not pay their bills on time, and don’t realize how much this is affecting their […]...more

How To Check My Credit Score In Canada?

What counts as a good credit score in Canada? It’s estimated that more than 50% of all Canadians have never checked their credit score....more

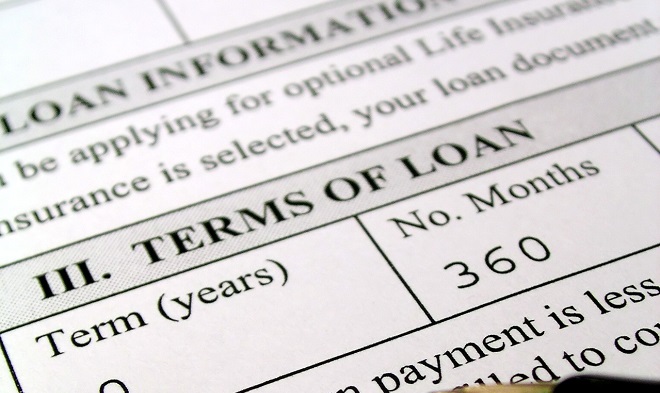

Cheat Sheet – what your credit score should look like to get approved for a mortgage

Getting approved for a mortgage is not the same as getting approved for a loan or a credit card. There are far more rigorous credit checks....more

Store Credit Cards: Good or Bad for Credit?

It’s pretty tempting to sign up for store charge cards, isn’t it? They usually come with free offers or a certain percentage off your first purchase....more

Help! My credit score rating has stopped increasing! Why?

What if your credit score just stalls? What if you’ve been watching it go up and up and up and then suddenly, it just stops and stays still for months?...more

Soft credit check vs. hard credit check – what’s the difference?

You might be asking yourself… Soft vs. hard credit check – what’s the difference? If you have ever applied for a credit card, a car loan or even a new cell phone plan, you’ve probably been told that your credit will be checked, and that it will be a ‘hard’ credit check. We’re going to […]...more

Will My Bad Credit History Cost Me A New Job?

There are so many reasons to care about your credit score and to be interested in learning how to fix it....more

Paying down credit cards but your score is dropping? Why?

So, you’re pouring money into your credit cards, trying to get that balance down as fast as you can. You’ve put your tax return on it, and the bonus you got at work....more

What are the benefits of paying off more than the minimum payment on your credit card?

Here’s a question for you: When you pay your credit card bill every month, do you meet the minimum payment or do you exceed it?...more

How Much Does Your Credit Affect What You Pay For A New Car

Let’s see a show of hands how many of you know that your credit score can actually impact the overall price you pay for a new car?...more

[VIDEO] How does a secured card work to build credit?

Your credit score is affected by 5 main factors: 35% of your credit score comes from payment timeliness on any credit you currently have. If you don’t have any credit products, you need to get some. Sound like a chicken and egg situation? You’re right, it can be hard to obtain credit, without having […]...more

COVID-19 Resources: Still working and looking for ways to take advantage of the current climate?

The current economic situation caused by COVID-19 is proving to be incredibly challenging financially for the millions of Canadians that have lost their jobs or who are living on a significantly reduced income. Many others, however, still have their jobs, and others still, such as healthcare workers and other front line workers are working and […]...more

How To Improve Credit Scores Fast!

If you’re ready to take the leap into homeownership, and are only being held back by your credit score, it can be really difficult to be patient....more

COVID-19 Resources: Lost your job, or on reduced hours?

If you are one of the many Canadians that have suddenly lost their income due to COVID-19, you’re probably scrambling to meet your financial obligations. We’ve pulled together some resources to help you navigate these difficult times, and to help maintain your financial health: Cutting out unnecessary expenses is the number one thing that you […]...more

Sprint, jog, or walk: How quickly do you want to build your credit?

When it comes to building credit, everyone has a pace that works best for them, depending on their current financial situation and future goals. For anyone wanting to make a big purchase such as a house or new car in the near future, building a better credit score should be top of mind in order […]...more

[VIDEO] Building credit during economic uncertainty

While this is an extremely challenging current climate for many Canadians, there is a silver lining—interest rates are at an all-time low, providing a significant opportunity to those who have the financial means to take advantage. This short video is less than 4 minutes long but will show you how to: Take advantage of the […]...more

Late payment? How much will this affect your credit?

Most of us already know that late payments will hurt our credit score. However, we are currently experiencing an unprecedented situation with the coronavirus, and for some people, it’s simply not going to be possible to make all of their monthly bill payments. Nevertheless, it’s critical to be aware how much of an impact […]...more

Which Debts Should You Pay Off First?

Your Guide To Strategic Credit Building When you have a long list of debts to pay off, it can be daunting to say the very least. You might begin to wonder which debts should you pay off first. Reading stats like Canadians now owe roughly $1.76 for every $1 they earn (source: Statistics Canada, March […]...more

Credit Myth: It’s Best To Turn Down a Credit Limit Increase

One day, you get a letter in the mail saying your credit card provider has decided you’re...more

10 Most Commonly Asked Credit Questions & Answers

Credit is complicated. Because of that, we all tend to have a lot of questions about it. ...more

How to Increase Credit Scores: Secured Cards Vs. Credit Building Loan

If you’ve struggled with credit for any amount of time, you’ve probably heard that getting yourself a secured credit card is the best way to build credit fast....more

How to Build Credit Fast!

The big question! How to build credit fast? Most people seem to think that it’s always a long, daunting process. However, increasing your credit score isn’t as difficult as you might think! Here are some of the great tips for boosting your credit score! How to build credit fast: get a credit builder loan A […]...more

How to Dispute Errors on Your Credit Report

On Monday, we talked about how to read your credit report. You’ve scanned it and perhaps grimaced as you looked over your...more

10 ways Canadian immigrants can build credit

If you’re reading this, and you’re a new Canadian immigrant, or you’ve been here a little while as a permanent resident — we want to welcome you!! You’ve likely found out that to build credit as a new immigrant to Canada you need to have a good credit history. If you want to borrow money […]...more

No credit history versus a bad credit score

The hard truth is that having either no credit or a bad credit history creates doubt with lenders when it comes to offering you any type of loan. Even if you have a good income, you are viewed as high-risk mainly because of having no credit or poor credit. Understandably, companies have a difficult time […]...more

What is credit and how do I build my credit score?

Have you been denied for loans and credit cards over and over again? Or maybe you’ve been told you don’t have good credit and you won’t qualify for low-interest rate products. If you can relate to this, then keep reading to learn what you can do to build your credit score and your financial future. […]...more

Credit Myths: You Need a Credit Card to Build Credit

If you’re looking to improve your credit score as quick as possible, you might have done some research & found that most people say to get a credit card....more

How to Improve Your Credit Score When Buying a Home

Looking how to improve your credit score so you don’t become a victim of higher interest rates? You’re in the right place....more

10 things you must absolutely know about your credit

We Canadians focus on high school grades to try to get into a great college or university. And when it’s all done, the next and most important grade we get is our credit score. This is your 3-digit score that signifies whether you have good or bad credit. This score ultimately defines your financial life! […]...more

What Is A Credit Check?

And how do credit checks affect me? If an employer, bank, or other institution requests a credit check, it means they are looking to see a copy of your credit report. Your credit report is a detailed history of how you have paid your bills in the past. This includes payment history on current and […]...more

I have bad credit. Help me, what should I do?

Having poor credit doesn’t make you a bad person. It can, however, put a damper on your entire life and affect your ability to get hired, rent or buy a home, and get a low-interest loan. This can feel as though you’re stuck and can’t get ahead. So, if you’re telling yourself “I have bad […]...more

Can I get a credit card without a hard credit check?

Have you ever applied for a credit card and were told that your credit will be checked to see if you are approved, or that there might be a ‘hard’ inquiry? You might be asking yourself, what’s a hard inquiry? Are their soft inquiries? What’s the difference? In this article, we will take a closer […]...more

6 ways Canadians can get out of debt and build credit

With household debt on the rise in Canada, it’s time to take a look at some of the causes. Why do Canadians find themselves buried in debt? How do you manage debt and build up your credit score? Here are some proven ways to take control of your debt and build a positive financial future. […]...more

How to build your credit as a student in Canada?

Building a good credit history as a student is one of the most important things you can do for yourself. When you want to buy a car, get a personal loan and purchase your first home, lenders will look at your credit report. Start with finding the best student credit card to build credit. I […]...more

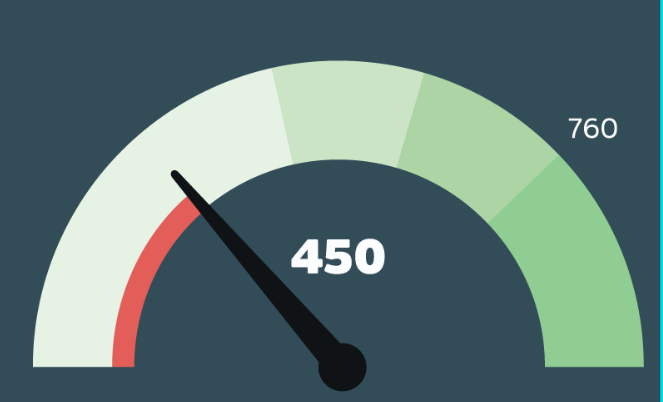

What’s the average credit rating in Canada?

Your credit rating in Canada is a number between 300 and 900, which represents everything on your credit report. Your score is created by a computer program that reviews what is on your credit report and converts all that information into a score. To see where you stand, you can compare your credit score against […]...more

How to build credit in Canada

Sorry. There’s no magic formula to build credit in Canada. But, you can start taking steps today that will have a positive impact on your score within just a couple of months. It is important to remember that when it comes down to building credit in Canada, everyone’s credit score differs. Some of you […]...more

6 ways to stop living paycheque to paycheque

Did you know that roughly 53% of Canadians live paycheque to paycheque?¹ It seems nearly impossible to stop living paycheque to paycheque. You pay your bills, buy some gas and groceries and BAM – your paycheque is practically all gone. It’s self-defeating when you can’t get ahead. Here are 6 ways to help you get […]...more

My credit score: I want to understand more about it!

Sometimes understanding your credit report can be overwhelming or confusing. ...more

10 Signs You Need A Credit Builder Loan

A credit builder loan (also known as a cash secured savings loan) is a credit building program that requires no money upfront. Instead, the loan acts as the security funds. You receive the loan after you have paid it back – it’s a backwards loan. Once you pay the loan down, you will have […]...more

Like A Fine Wine, Your Credit Score Gets Better With Age

What goes into your credit score is a complicated mix of various factors and algorithms. There are many factors taken into account to determine your credit score, but today, we’re going to look at just one of these factors: time, and how your credit score gets better with age. Did you know that the […]...more

5 critical actions a single parent must take to build their credit score

When I was 11 years old, my father became a single parent to me and my 10-year old brother. I saw my father struggle trying to make ends meet and keep his head above water. He worked a full-time job, prepared meals, made sure we got to school and did well in our studies. To […]...more

Can Closing Bank Accounts Have An Effect On Your Credit?

Can closing things like a bank chequing or savings account impact your credit score? Like most credit-related questions, the answer depends on circumstance. Your Account Standing If you’re closing a bank account that is in good standing, there is no reason that it should affect your credit score. You can freely move to a […]...more

4 ways to protect your credit in divorce

I remember my parents going through divorce when I was 11 years old. There was a lot of stress, resentment, anger and remorse, and I was stuck in the middle of it all. Fast forward 30 years, and the mutual debt my parents incurred still haunts them today. They wish they had been safer and […]...more

Top 10 credit tips for 20-somethings

Top 10 credit score tips for 20-somethings If I could relive my twenties again I would manage my credit differently, starting with listening to my mom’s advice about money. I wish I had learned more about my credit score. It would have really helped me out with my car purchase, my first home and the […]...more

4 Reasons Why You Shouldn’t Rely On Credit Cards For Emergencies

We all know at least one person who has a credit card “for emergencies”, and it’s definitely an option when it comes to being prepared for the unexpected. So why do financial gurus and top thinkers all push the idea of an emergency fund? Why not use a credit card for unexpected expenses? There are […]...more

The three types of people with bad credit: which one are you?

Bad credit is something that can happen to almost anyone, no matter their current financial situation. If you’re reading this and thinking “well bad credit isn’t ever going to be a problem for me”, you might be wrong. At Refresh, we’ve identified three main types of people with bad credit – bad credit by blindside, […]...more

What is Good Debt vs Bad Debt?

Most of us hope to be debt free at some point and join the 25% of Canadians who aren’t burdened with that weight. In order for that to happen, we need to deal with the debt we have incurred. Both the good debt and the bad debt. But what’s the difference between good and bad […]...more

Take The No-Credit Christmas Challenge

Does the title sound a little scary to you? Bear with us. The no-credit Christmas challenge could save you a world of post-holiday stress. The Stress Of The Holidays It’s that time of year again when holidays rear their expensive head. It’s exciting, but many of us are secretly recoiling in fear. Stress levels […]...more

[Infographic] Do You Understand Your Credit Score?

Do you know how your credit is broken down? I wanted to take a moment to explain the different areas that are taken into account....more

How To Recover From Bankruptcy or Consumer Proposal: A Step By Step Guide

So, you’ve gotten yourself into a little bit of credit trouble. You’ve got no other way out but to declare bankruptcy or go through a consumer proposal....more

Infographic: What is Credit?

Credit. We’ve all heard the word used, and used it ourselves. You might have a little credit yourself. So what is credit?...more

Benefits Of Using Credit Building Programs

Increasing your credit score is much easier than you think. If you’re trying to improve your credit, you’ve probably considered various credit building programs. Sometimes consumers talk themselves out of these types of programs because of the costs associated with them. The thing is, hiring a credit building company to help you boost your credit […]...more

How it Affects Your Wallet: The Bank of Canada Interest Rate

You may have heard in passing conversation with friends, coworkers, or heard on the news that the Bank of Canada Interest Rate was raised to 1.25% earlier this year. While millions of Canadians don’t keep up with this sort of news, they are definitely feeling it in their wallets. According to the Huffington Post, one-third […]...more

Will Closing Your Bank Account Affect Your Credit?

With so many factors playing a role in your credit score, it’s easy to worry about every financial change you make. How will this look on my credit report? Am I shooting myself in the foot by making this move? We tend to second-guess ourselves whenever we make a change related to our finances. […]...more

Mystery Charges On Your Credit Card Statement

It’s not uncommon for credit cardholders to be stumped when it comes to some charges on their monthly statement. Not all merchants are recognizable on your statement – they could be using their parent company name, or they could have their name abbreviated. If you have mystery charges on your credit card statement, how […]...more

Choosing a Credit Card: What Matters Most?

Are you in the market for a new credit card? Do you feel a little overwhelmed with all the different factors to consider? Let us help you make the choice that’s right for you! When choosing a credit card, we need to look at what matters most. Interest rate – If you tend to carry […]...more

Are Credit Cards With Tap Safe To Use?

When it comes to credit cards, it seems as though everyone is using tap technology nowadays. The old swipe style cards are all but obsolete as more and more financial institutions are issuing cards with tap ability. The technology increases convenience and saves us time whenever we’re at the cash register. But a question […]...more

How To Save With Debt

When we’re handling our finances, particularly when it comes to debt and savings, our focus tends to be on debt. Debt comes with interest, so it’s always a good idea to prioritize it, but it doesn’t mean that saving should be neglected. Saving money is just as crucial to achieving financial wellbeing as eliminating […]...more

4 Alternatives To The Now-Extinct Chase Amazon Visa

Were you an Amazon Visa holder? The news of accounts closing was a major disappointment for many cardholders. However, we want to explore four alternatives to the now-extinct Chase Amazon Visa. The Amazon Visa from Chase was one of the most loved cards by its users. The reasons for this are twofold: 1. The waived […]...more

5 Reasons To Consider A Secured Card

A secured card requires you to put money down before you can use it, so why would anyone choose a secured card over a traditional credit card? Usually, it’s their only option. Because secured cards are easier to get approved for, they are an opportunity for many people who have bad credit, or no […]...more

Do You Have These Common Credit Card Perks?

Does your credit card have perks attached to it? We’re not talking about rewards, that’s different. Perks are bonuses you get just for being a cardholder. Some common credit card perks include discounts and access to exclusive events. Most credit cards come with built-in perks that you have access to from day one. Here […]...more

Tips for Lowering Interest Payments On Credit Cards

If you’re a credit card holder, you already know that interest is what gets you. Let your balance get too high, and all of a sudden your interest charges are through the roof. Paying on time doesn’t seem to get you any closer to shrinking your credit card debt. It feels like you’ll be […]...more

The Risks Of Co-Signing For Credit

When it comes to the idea of co-signing for a loved one, you’ve probably read a handful of financial blogs or magazines that have warned against the idea. At the Dime Turner, we’ve said it a few times as well. Co-signing can be a risky road that often turns sour. With that said, we’d […]...more

Hidden Credit Card Fees You Should Look For

Have you ever looked at your credit card statement, only to be baffled at some of the charges? Like your wireless bill and your cable or internet bill, your credit card statement can be filled with fees and charges you weren’t expecting. It’s always best to go over all the finer points of your […]...more

5 Things To Consider When Choosing Your Next Credit Card

Deciding to grab a credit card is a great way you can continue building your credit score. However, sifting through all the available credit cards in Canada can be a daunting task. How do you determine which card is right for you? If you’re looking at picking up a credit card for yourself, don’t […]...more

Tips For Lowering The Cost Of Your Credit Card

Credit cards cost you in interest, annual fees, and other hidden fees, but they’re also an integral part of building credit. If you’re a credit card holder, you already know that interest is what gets you. Let your balance get too high, and all of a sudden your interest charges are through the roof. […]...more

7 Mistakes First-Time Credit Card Users Often Make

You might be someone who’s just beginning their credit journey, or perhaps you’re trying to recover from poor credit. When it comes to credit, there are a few mistakes first-time credit card users often make. Your credit card is one of the best tools you have to build your score, so the sooner you […]...more

Tips For Establishing Credit For The First Time

Establishing and building credit for the first time can be difficult. How can you be trusted with credit products, if you don’t have any credit history? How are you supposed to get started? Luckily, there are some easy ways around this dilemma. Here are some great tips for establishing credit for the first time! […]...more

Why You Should Stay Away From Cash Advances

When used carefully, credit cards can be a fantastic tool for boosting your credit and managing your money. These little pieces of plastic have lots of beneficial features when used responsibly. It’s important, however, to use them carefully and avoid one of their features altogether. Here’s why you should stay away from cash advances. […]...more

Check Out These Common Mistakes On Your Credit Report

One of the reasons it’s important to monitor your credit score is to check for errors. They can be as simple as a wrong address or as costly as having someone else’s debt listed on your report. It happens more often than you think. Continue reading for our list of common mistakes on your […]...more

6 Signs That You Need Professional Debt Help

How a professional’s advice may turn your debt situation around As adults, one of the most common things we struggle with is admitting when we need help. When you’re drowning in debt, you’ve got to find a way to throw out a lifeline and ask for help. If you don’t, the problem will only intensify. […]...more

5 Attributes to Adopt In Order to Eliminate Debt

Are you looking to eliminate debt but finding it difficult? Or constantly losing focus and getting sidetracked? Eliminating your debt can be a tall task, and in many cases, it could require a lot of personal transformation. Our blog has featured several tips and tricks to get Canadians (who are strapped with on average over […]...more

10 Reasons Why You Should Check Your Credit Report

It’s estimated that more than half of Canadians never check their credit score. Many of us still believe the misconception that checking your credit score will negatively impact it. The truth is, checking your credit score is crucial to improving your credit. Here are 10 reasons why you should check your credit report: 1.Fraud […]...more

Protect Your Privacy While Shopping Online

‘Tis the season for online shopping, which also means it’s a season where your credit card information is most at risk. The increase in online commerce is met with an increase in identity theft, credit card fraud, and account hacking. Online shopping is convenient, and for many items, it’s the only way we can get […]...more

What Is A Line Of Credit And How Can It Help?

You’ve probably heard us talk a lot about lines of credit, mortgages and credit cards. You’ve also probably heard us talk about the importance of a credit mix (having a healthy combination of different credit products). Today we’re going to focus on lines of credit. What is a line of credit and how can […]...more

Credit Card Debt After A Gap Year? Here’s how to fix it

Taking a break from post-secondary school can be a necessary change for some people. You’ve been in school every year of your life since you were 4 or 5 years old – taking a breather before the most intense education of your life can help you reset and come back more motivated than ever […]...more

How Fixing Your Credit Can Relieve Stress

The stats are there. According to an American survey, the number one thing Americans stress about most is money. As next-door neighbors, with similar lifestyles, values, and demographics, it’s safe to assume this is a top stressor for Canadians, too. Another survey suggests that 57% of divorces are the result of money stresses. We’re here […]...more

The Dangers Of Borrowing Money From Your Family

When it comes to money, it’s tough to admit when you’re in over your head. We tend to grasp at anything that can help us once we start feeling the growing weight of debt. When we need financial help, the first people we usually turn to is family, but this can be a bad idea. […]...more

7 Credit Myths And Why They’re Wrong

Your credit score can affect many things in your life: your ability to obtain meaningful employment or rent a home. At affects your chances of being approved for a car loan, a mortgage or any other sort of credit. The list goes on. It’s an important number for every Canadian to understand and yet […]...more

Lied on A Credit Application? Here’s What You Can Expect

Applying for credit is pretty straightforward. After you apply, the lender will check your credit score and determine how risky of a borrower you are. But how much weight does your application carry, and can a great application outshine a damaged credit score? Can you lie your way to a new credit card? Here’s […]...more

7 Reasons To Answer That Call From Collections

If you have a debt that’s gone to collections, it can be a stressful experience. You get threatening letters so often that just checking your mail gives you anxiety. You avoid answering phone calls from numbers you don’t recognize because you know it could be someone asking you to pay your debts. Although it […]...more

5 Easy Pointers For Getting Rid Of Debt Quick

Sometimes debt can feel so overwhelming that it seems futile to even try to get rid of it. Even though you’re making your payments on time every month, the debt never seems to shrink. If you’re feeling hopeless regarding your debt situation, don’t give up! There’s good news, and eliminating debt might be easier […]...more

What You May Not Know About Credit Card Rewards Programs

Credit card reward programs can be pretty enticing. There are so many seemingly great deals that it’s difficult to choose just one. Do you opt for loyalty points at your favorite grocery store? Perhaps you envision yourself jetting around the world on your travel miles, or maybe you want to earn free gas with […]...more

How High Should Your Credit Score Be To be Approved For A Mortgage?

So, you’ve decided it’s time to own your own home. Good for you! Instead of paying someone else’s mortgage with your rent money, you’ll be paying your own and building your net worth as you do. Despite the high housing costs in Canada, becoming a homeowner is a great step forward! After saving up […]...more

5 Ways To Combat The Credit Card Debt Cycle

How does one break out of the debt cycle? You can transfer your balance to a new card for that oh-so-enticing 0% introductory interest rate, or you can get a consolidation loan or maybe even borrow money from reliable mom and dad. It’s never enough, though is it? For some of us, credit card […]...more

Avoid The 0% Interest Trap

As you improve your credit, you’ll begin to notice more and more offers coming your way. Financial institutions want to do business with people who have strong credit scores. You might start getting offers in the mail, or the occasional phone call from their sales reps. Some of the offers will be enticing. There […]...more

Five Ways To Boost Your Credit Without Going Into Debt

Sometimes it seems like the only advice on how to build your credit involves more debt. Methods like using your credit card or taking out a loan with a cosigner are effective credit boosters, but they also come with risk. Is there any way to improve your credit that doesn’t involve taking on more […]...more

How Credit Card Chargebacks Are Designed To Protect You

Did you know that your credit card has a feature that’s designed to protect you from scams, poor quality products or shoddy service? Have you ever wondered how credit card chargebacks are designed to protect you? Online Shopping Imagine that you’re shopping online and you see an ad for a painting that would look great […]...more

How International Debt Can Affect Your Credit In Canada

If you’ve ever lived abroad, you’ve had to open bank accounts and forms of credit in other countries. You might have opened a mobile or internet account, or you could have had utilities in your name. What happens if you default on bills, tickets or credit in other countries, and then come back to […]...more

A Common Misconception About Your Credit Report That Could Change Everything

You’ve heard it a hundred times. Your parents probably believed it, your mortgage broker, even your financial advisor. At one point or another, this common misconception about your credit report is that your accounts will only stay on your report for up to 7 years. But is this always true? You’d be surprised to know […]...more

How Often Should You Check Your Credit Report And Score?

We know that it’s important to check your credit report, but how often should you check your credit report and score? Many people tend to look at their report on an annual basis, but there are several situations where you may want to check it more often. 1. Your Information Has Been Compromised – […]...more

The Pros And Cons of Accepting Pre-Approved Credit

It feels pretty flattering when your bank notifies you and lets you know that you’ve been pre-approved for some form of credit. It’s a sign that lenders are viewing you as a low-risk client. Stay on the path you’re on, and you’ll continue to unlock better interest rates and more borrowing opportunities. In the meantime […]...more

5 Common Credit Mistakes Made by First-Time Home Buyers

Important Credit Advice Before Your Sign That Mortgage There are several larger investments that we will make in our lives. None likely as big as buying your first home. For those looking to get into the Canadian housing market for the first time, there are several important questions you need to ask yourself. Am I […]...more

Four Ways To Rebuild Your Credit After Bankruptcy

Bankruptcy is no small thing, and for months you’ll have to live with someone breaking down your neck and scrutinizing every dollar you spend. Plus, the loss of privacy and added stress will make you count the days until you’re discharged. Unfortunately, that’s when the real work begins. Rebuilding your credit score after a bankruptcy […]...more

10 Ways Canadians Find Themselves In Credit Trouble (And How To Avoid Them)

As Canadians continue to take on more and more debt, experts are suggesting that we’ve reached a “critical threshold”. This means many of us will not be able to cope with any sort of interest rate increase and would cause many to descend into foreclosures and bankruptcies. Here’s a list of 10 ways Canadians find […]...more

What to Do When Collections Show up on Your Credit Report

Congratulations on taking the first step towards building your credit score by checking it! You’ll probably see lots of different things on your report, even things that could’ve fallen into collections. Did you know that roughly one-third of Canadians have debt that’s in collections? This blog will discuss what to do when collections show […]...more

Tips For Reapplying For A Credit Card You Were Denied

Have you ever been declined for a credit card that you really want? What can you do to make yourself more attractive to the lender? How can you ensure that the next time you apply, you’ll be approved? How soon can you reapply for the same credit card? Here are some tips for reapplying […]...more

5 Ways Debt Can Actually Help You

No one enjoys being weighted down by a heavy debt load. Debt is often discussed is a negative light, and conventional wisdom tells us to stay away from debt and get out from under it as fast as you can, but are there any benefits to have some debt? The answer is yes, here a […]...more

Check my credit score in Canada! Here are 3 easy ways to do it…

Is it important to check my credit score in Canada? YES! It’s the first step towards a better financial future and the key to building credit! Here are three easy ways Canadians can check their own credit score: 1. Check my credit by sending in for a free credit report TransUnion and Equifax will […]...more

Top 7 Signs You’re Headed For Credit Trouble

Prevent Yourself From Drowning In Debt Life can be hectic enough without having to worry about your credit situation. According to Equifax, Canadians are carrying an average debt load of around $22,081 excluding mortgages. Let’s take a look at the top 7 signs you’re headed for credit trouble 1. You have no wiggle room Living […]...more

Are These Hidden Credit Card Fees Costing You?

Don’t let surprise fees stall your credit recovery As you try and focus on rebuilding your credit, it can be frustrating when the credit card companies seem to be working against you. There’s a ton of advantages to having a credit card in this day and age, but you might have noticed a lot of […]...more

“What is Credit?” And Other Common Questions

Your credit score represents your reliability as a borrower. The score is between 300 and 900 and the higher your score is the better. When you consistently repay your debts in full and on time, you will develop a higher credit score, and a lower score will reflect a poor payment history. Trying to […]...more

When Are Companies Able To Run A Credit Check?

Know when those hard and soft credit inquiries are coming In the information age, your credit history follows you wherever you go and is something can have a profound impact on your life. So, when are companies able to run a credit check against you? This blog will identify who and why your credit score […]...more

How To Build Your Credit As A Student

Important Debt Advice Before You Blow That Student Loan The purpose of furthering your education is to open up opportunities for yourself. It’s to ensure your financial future is secure and bright, but sadly, many students in Canada are finding that post-secondary is doing the opposite. It’s landing them in more debt and hurting their […]...more

4 Tips That Will Boost Your Credit Score Almost Overnight

When you think about increasing your credit score, you might assume a long and drawn out process that requires lots of self-discipline and sacrifice. For the most part, this is quite true. However, it’s not always the case. Here are 4 tips that will boost your credit score almost overnight. 1. Pay Off Big […]...more

5 Things To Look For on Your Credit Report

Acquiring your credit report is a great first step towards improving your credit score! If you find your credit report confusing and you’re not sure what to look for, we have some great tips for you! Here is a list of 5 things to look for on your credit report. 1. Usage Percentage – […]...more

9 Reasons To Keep All Your Credit Cards

Sometimes when we land ourselves in debt, we might second guess our credit cards and even toy with the idea of getting rid of them. But is this the best thing to do? Are there any repercussions to your financial position or credit score? Generally speaking, it’s far better to teach yourself self-control than […]...more

Credit Mix – How This Often Overlooked Factor Affects Your Credit

Most of us have a basic understanding of what goes into calculating our credit score. Factors such as late payments, maxed out credit cards, or any collections debt are all common knowledge. There is, however, one credit calculation that often goes unnoticed. Read further to learn about credit mix – how this often overlooked […]...more

When To Apply For A New Credit Card

A new credit card comes with many risks along with benefits, and it’s not always wise to apply for one. Looking at our financial situation and weighing out the pros and cons is a great first step if you’re wondering when to apply for a new credit card. Bad reasons for getting a new […]...more

Beware The Bogus Questions When Verifying Your Identity For Credit Bureaus

So you’re taking the plunge and ordering your credit report! There might be things you don’t want to see on there, but you also know that it’s time to do some serious adulting. The road to great credit and a secure financial future begins with reviewing your credit report. Congratulations on taking this first […]...more

Credit Recovery Tips – How to Stop Spending!

Struggling with lots of debt is not a death sentence. The road to credit recovery can be a lot less steep when you have the right tools working for you. ...more

Higher Interest Rates Could Be In Canada’s Future – How To Ensure You’ll Survive Them

The problem with interest rates hikes is that more than half of Canadians are just $200 away from not being able to meet their financial obligations....more

10 Ways Your Bad Credit History Will Get In The Way Of Life

The road in front of a consumer with poor credit is littered with obstacles that just aren’t there for people with good credit. Even in areas of your life that you’d never guess would be affected by poor credit are....more

10 Reasons Why Your Credit Card Application Was Denied

Credit card application denied? Applying for a credit card can get a bit tricky. Follow these steps and never get denied again!...more

Delinquency Rates Have Declined In Canada But Here’s Why We Should Still Be Concerned

The first three months of 2017 saw Canada take on more debt and the average consumer debt increase to $21,696. This number does not include mortgages....more

8 Tips To Avoid Being Victimized By Predatory Lending

When the phrase, “predatory lending” is mentioned, what most people think of is payday loan companies....more

Should I Pay For My Credit Report?

As a Canadian, you are entitled to one free credit report per year from each credit bureau operating in Canada....more

10 Tips For Dealing With A Collection Agency

It’s not fun dealing with a collection agency. We can ignore the phone calls and letters, but it’s really not going to make the problem go away....more

How To Protect Your Identity, Credit and Money While Travelling

It’s true that your risk of identity theft increases when you travel. It can be even more of a risk depending on where you go. ...more

Mortgages: How Your Credit Score Can Affect Your Monthly Payment

We already know that our credit score can have a huge impact on whether we get approved for mortgages....more

Life without Credit: Why You Should Reconsider

Young adults are, more than ever before, opting not to make use of credit. This is a great way to avoid getting yourself in over head in debt, but is it the best thing for your financial security?...more

Did You Know? There Is A Statute of Limitations for Debt

One of the biggest surprises you can get when you spend years avoiding collections calls, is that one day the calls may suddenly stop....more

Why Cancelling Your Credit Cards May Result In A Lower Credit Score

While paying down your debts and being responsible with credit is always a great way to tackle poor credit, cancelling your credit cards may not be. ...more

Student Loan Debt Advice – Pay It Off!

Education is expensive in Canada. If you earned a degree or attended post-secondary learning of any kind, chances are, you’ve found yourself under a heavy student loan debt. ...more

How Many Credit Cards Are Too Many?

If you’ve been reading our blog, you know how to build your credit, different ways to save money each month, how to make best use of your credit cards, and other great money saving tips....more

Why Is My Credit Score Not Increasing – and Could it Be Costing Me Money?

Have you researched how to increase your credit score and still can’t seem to figure out how to build credit?...more

Credit Myth: Once You Are Divorced, Your Ex Has No Effect On Your Credit

It is often assumed that severing ties with someone you were once married to, will free you from any negative effects they will have on your credit....more

10 Ways Millennials Can Improve Their Credit in 2017

Recently, we found out that a very small number of millennials have excellent credit. This is for many reasons. ...more

How Long Does It Take To Build Credit Plus Tips for Boosting your Score Overnight!

When discussing how to build your credit, it’s important to note that no two people are the same....more

Credit Myth: Having a High Income Helps Your Credit

It seems logical that having a great, reliable income each month is something that can help boost your credit score....more

5 Hidden Factors Affecting Your Credit & 5 Ways To Improve Your Credit Score

There are many ways you can find yourself in financial trouble and struggling with a poor credit score, but rebuilding is not as scary as you may think....more

Why Millennials Have Trouble Building Credit

Remember that feeling you had about your parents while you were growing up? The feeling they had everything under control and could handle anything?...more

Americans: What You Need To Know About Credit If You Want To Move To Canada

So maybe you’re thinking of joining us up here in the Great White North for a little poutine instead of staying in the US of A....more

Why You Might Be Declined For Loans

You’ve sat through the application process and provided all the necessary paperwork. You’re waiting, nervously, for an answer....more

How To Have A Great Credit Score Without Going Into Debt

You need to have and maintain credit in order for there to be something to assess your creditworthiness. But does that mean you have to go into debt?...more

Credit Myth: Having No Credit Proves You Can Manage Debt to Lenders

Nothing seems to confuse people more than a credit score of zero. Credit scores usually span from about 350 to 850, so how can someone have a score of zero?...more

Credit Myth: Married Couples Share the Same Credit Score

You do pretty much everything together: you eat together, you watch movies together, you make big purchases together, and you raise your kids together....more

How Much Credit Is Too Much Credit?

The Canadian Payroll Association recently found out that nearly half of all working Canadians are living paycheck to paycheck....more

How to Read Your Credit Report

You’re lucky you stopped by here today, because today is the day you learn what each part of that credit report means for you....more

The Four ‘P’s of Spending for Good Credit

Maxing out your credit cards isn’t going to help your credit rating, but that’s a no brainer....more

Credit Myth: You Only Have One Credit Score

Since you first started borrowing money and using credit, you’ve known you have a credit score and a credit report....more

6 Reasons Why We Need to be Talking About Credit

Most people don’t know their credit score. Many of those people avoid looking for fear of what they might find....more

How Your Credit Score Can Be Costing You Money

Did you know that your credit score directly affects the interest rates you’re eligible for? This can have a huge impact on your...more

These Things Are Damaging Your Credit, Canadians

Do you know everything that will damage your credit score? Sadly, the answer is no, most of us don’t know everything that can...more

Credit Myth: Timely Bill Payments Boost Your Credit

It’s pretty common to come across someone who says their credit is being built by paying their bills on time (it isn’t). So how do you boost your credit?...more

5 Smartphone Apps to Help Rebuild Your Credit

Actively working towards a better credit score can be a lot of work. Luckily we live in the day and age we do, because there is tons of...more

Don’t Let Pokémon Go Get You Into Credit Trouble

If you live in a populated area, you’ve probably noticed the sudden influx of people trudging along like zombies, staring at their...more

Demar DeRozan is Building Credit

“It’s like we always got the short end of the stick. I always took pride and passion in wanting to change that.” In a lot of ways, we all feel like Demar....more

What Credit Means For Your Vacations

What credit means for your vacations. If you don’t have credit and you want to travel, you know how frustrating and difficult it can be....more

What Causes Bad Credit? 5 Common Causes of Credit Trouble

Yesterday, we counted down the best ways to get out of credit trouble. Today, we’re looking at the 5 most common ways Canadians get into credit trouble....more

The 5 Easiest Ways To Build Credit As A Canadian

I don’t know anyone who hasn’t had some credit trouble at one point or another. So what are the 5 easiest ways to rebuild credit as a Canadian?...more

A Song of Debt and Credit

A Lannister always pay his debts, but what about the other houses? Who has the best credit score? Let’s take a look at ‘A song of Debt and Credit’....more

Credit Reporting and Financial Security

Credit reporting is more important than ever. But what happens when the credit profile you see isn’t really your information at all?...more

Why Refresh

Like many ideas, Refresh was conceived to solve a simple problem. I was applying for financing to purchase our first home when the unexpected occurred....more

Check out our products.