Refresh Financial is now part of the Borrowell family!

Have you heard? Refresh Financial has been officially acquired by Borrowell, Canada’s leading credit education company and one of the country’s largest fintech companies. The Toronto-based company has helped over 1.5 million Canadians access their credit score and report, while also providing personalized credit coaching tools and financial product recommendations based on their credit profile. […]...more

Answerbot has the answer to all your questions!

Lately, we have had feedback that the wait times to reach our call centre are too long. In most cases, our care agents are answering calls from clients asking questions that are answered directly within your dashboard! If you have a question about the Credit Builder Loan, the Secured Card, reporting to credit bureaus or […]...more

Introducing Refresh Financial’s Knowledge Base!

We are excited to officially launch Knowledge Base as part of Refresh Financial’s client dashboard. What is Knowledge Base you ask? Well, you would be forgiven for thinking that Knowledge Base is just a fancy name for FAQs, however, we feel it deserves a more fitting name. These aren’t just your run-of-the-mill Frequently Asked Questions. […]...more

Did you know, your credit utilization rate makes up 30% of your credit score?

You probably already know that making your debt repayments on time has the biggest impact on your credit score. When a lender has provided you with credit – whether that’s credit a card, a line of credit, a car loan, even a mortgage – they expect you to pay them back when it is due. […]...more

November Is Financial Literacy Month In Canada

Today, the average Canadian owes about $1.70 for every dollar of income he or she earns per year, after taxes. In the 1990s, the average Canadian owed just 85 cents per dollar they earned. In addition, the average Canadian household debt was $72,950 at the end of 2019 – $23,800 if you take out […]...more

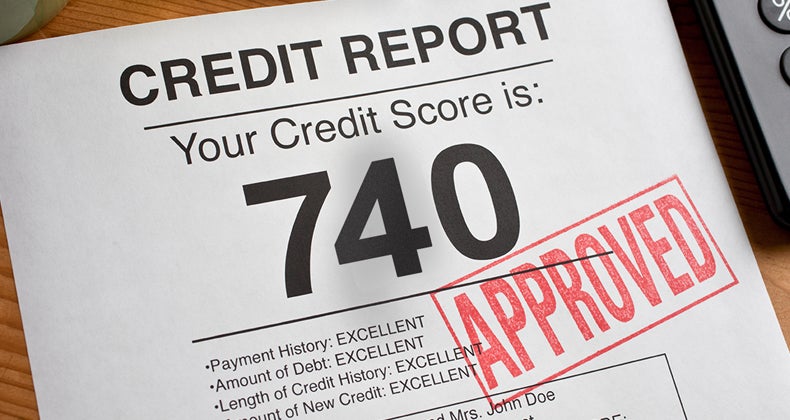

Talking about your credit score can be frightful, but it doesn’t need to be!

Most people don’t know their credit score. Why? In some cases, it’s because the thought of checking their credit score sends chills up their spine, and they are deathly afraid of what they might find. Others avoid looking at their credit score because they’ve been led to believe requesting your credit report will harm your […]...more

How to build credit with a secured card

A low credit score can be the result of many different situations, not just poor financial decisions or habits. For example, you might have been a co-signer on a loan which defaulted. You might have gone through financial difficulties due to job loss or divorce. Or you might simply be a newcomer to Canada starting […]...more

Just Because You’re a Student Doesn’t Mean You Can’t Have Good Credit

Maintaining and building good credit can be a stressful endeavour, especially if you’re a student! Even with a student credit card, the limitations of spending might make it seem even more difficult. But, it is not an impossible task! If taken seriously, many students are able to come out of their degree with good credit, […]...more

Introducing the new Refresh Dashboard

We like to make sure our customers are satisfied. So, we periodically conduct Customer Satisfaction Surveys (CSATs). One of the biggest pieces of feedback we have had recently is that there was not enough transparency in the application process. Once you hit ‘submit’ on your application, what happens next and how long does it take? […]...more

Is your credit card really helping you build credit?

Credit cards can be an excellent tool to help you build your credit score, but only if used responsibly. Here’s what not to do if you want your credit card to work for you, and help you build credit: Do not forget to pay your credit card bill. Paying bills on time accounts for 35% […]...more

Never max out your credit card. Here’s why!

If you have an unsecured credit card or a secured card like the one we offer here at Refresh, you’ve got your hands on a great credit-building tool. However, if used incorrectly, any type of credit card can actually damage your credit score rather than increase it. How do you make sure your credit card […]...more

This one thing will have the biggest impact on your credit score!

When it comes to building your credit, there is one thing that will have the biggest impact on how quickly you can increase your score. Paying bills on time. It may sound simple, but it’s surprising how many people do not pay their bills on time, and don’t realize how much this is affecting their […]...more

Bad credit? Need a loan? It IS possible!

If you’re struggling with bad credit, and you’re looking for a personal loan, chances are you’ve probably been turned down at any major bank you have approached. Banks are very unlikely to give out bad credit loans in Canada. What is considered a bad credit loan? Generally speaking, a loan given to anyone with a […]...more

Working on building your credit score? Don’t close any credit card accounts just yet

If you’re working hard to build your credit score and you have paid off a credit card, should you close the account? In short, the answer is no. But with a caveat. Why you shouldn’t close credit card accounts, even if they are paid off and you no longer use them Closing a credit […]...more

4 easy steps to build credit in 20 minutes or less!

A good credit score is one of the most important aspect of your finances. Your credit score can open doors to low interest rates on financial products such as car loans, personal loans, credit cards, and even mortgages. Taking the time to increase your score before you commit to a long-term loan is well worth […]...more

What’s the Difference Between a Secured Credit Card and a Prepaid Card?

What is a secured credit card? A secured credit card – sometimes referred to as simply a secured card – is just like a regular credit card in that your credit limit, balance and payment history is reported to Equifax and TransUnion and will impact your credit score. With a secured credit card, again, just […]...more

Post-Pandemic: How To Get A Fresh Start On Your Finances

When you’re in financial trouble and buried under a mountain of debt, it’s hard to imagine how it’s possible to fix the situation. Three-quarters of the Canadian population struggle with debt and it can feel impossible to get out of. The COVID-19 pandemic has only exacerbated this situation. If this sounds like you, you might […]...more

CMHC announces higher credit score requirements for mortgage insurance. What does this mean for you?

Being able to borrow money to purchase a home has long been the goal of many Canadians. However, given that it is going to be the biggest purchase you will make in your life, it should not be a decision that is made lightly. Ensuring you can afford the repayments of the loan you are […]...more

Why is interest charged to use my own money on a secured card?

When credit is extended, it comes with interest rates. It’s an unavoidable fact of life. It’s very unlikely that you will find someone willing to loan you money and not charge you any interest! Secured cards are no different. Yes, it’s your money that is being used to secure the card, but it’s not your […]...more

Rebuilding your credit score following insolvency

Rebuilding your credit as soon as you can after insolvency is critical. It ensures a better, brighter financial future. Having a good credit score means access to credit products – from personal loans to car loans to mortgages – at the lowest interest rates, potentially saving you thousands in interest payments over the years. There […]...more

Make it through the COVID-19 pandemic with your credit score still intact

A good credit score helps you get approved for credit at much lower interest rates than if you have a poor score. In fact, with a poor credit score, you might not get approved for credit at all! For the many people who have been working hard to create a better financial future for themselves […]...more

COVID-19 Resources: Lost your job, or on reduced hours?

If you are one of the many Canadians that have suddenly lost their income due to COVID-19, you’re probably scrambling to meet your financial obligations. We’ve pulled together some resources to help you navigate these difficult times, and to help maintain your financial health: Cutting out unnecessary expenses is the number one thing that you […]...more

Sprint, jog, or walk: How quickly do you want to build your credit?

When it comes to building credit, everyone has a pace that works best for them, depending on their current financial situation and future goals. For anyone wanting to make a big purchase such as a house or new car in the near future, building a better credit score should be top of mind in order […]...more

Who Can Check Your Credit Score?

As a consumer in Canada, you’ve probably had your credit report checked numerous times. You could be applying for a new credit card, purchasing your first home, or even looking to lease a car. We all know that when we seek new forms of credit, our credit report is reviewed and assessed. So we […]...more

How to cut costs when you’ve lost your income

Cutting unnecessary costs during COVID-19. If you are one of the many Canadians that have suddenly lost their income due to COVID-19, you’re probably scrambling to meet your financial obligations. Cutting out unnecessary expenses is the number one thing that you can start doing today to help you survive this difficult time. There are many […]...more

6 ways to stop living paycheque to paycheque

Did you know that roughly 53% of Canadians live paycheque to paycheque?¹ It seems nearly impossible to stop living paycheque to paycheque. You pay your bills, buy some gas and groceries and BAM – your paycheque is practically all gone. It’s self-defeating when you can’t get ahead. Here are 6 ways to help you get […]...more

5 Reasons Co-op Students should be part of your culture

In British Columbia over 5,000 employers are tapping into a smart hiring solution – cooperative education programs (co-op programs). Co-op programs are managed by colleges and universities to match students who want to have hands-on experience in their field of study while earning an income. Employers receive many advantages to hiring co-op students, and the […]...more

4 ways to protect your credit in divorce

I remember my parents going through divorce when I was 11 years old. There was a lot of stress, resentment, anger and remorse, and I was stuck in the middle of it all. Fast forward 30 years, and the mutual debt my parents incurred still haunts them today. They wish they had been safer and […]...more

How To Unload Your Unwanted Gift Cards For Money

Gift cards are a popular gift item during the Christmas season. For the most part, they’re great, especially if it’s for one of your favorite retailers. But what if you received gift cards for retailers you have no interest in? What are you supposed to do? Instead of re-gifting or letting the cards expire in […]...more

When it comes to a mortgage, should I choose a long or short amortization?

A mortgage is a serious commitment, no matter where in Canada you’re planning to buy a home. The majority of mortgages take 25 to 30 years to pay back completely, that is why it’s so important to be fully prepared – a mortgage is not a short-term commitment. That being said, buying a home can […]...more

Top Tips For Negotiating Your Salary

You could be starting a new job or getting a promotion. Maybe you’ve been with the same company for years without so much as a raise. One thing is certain, however. Negotiating your new salary is an anxious business! You can eliminate much of the fear by having a clear gameplan before you start […]...more

10 Resources For Teaching Your Kids About Money

It’s important to try and lead our children towards a better understanding of finances than we had. But when it comes to teaching money management, where do we start? What can we impart so that our kids have the best tools to avoid the debt trap and achieve financial security? Here are ten resources […]...more

The 5 Most Common Causes Of Poor Credit

Your credit score depends on many different factors. How you repay your bills, how much of your credit you’ve used and much, much more. These different variables go are calculated using an algorithm to determine how much of a risk you pose to lenders. A strong credit score means that in all the different […]...more

Why The Idea Of A Starter Home Is Outdated

We’ve all heard real estate agents and mortgage brokers talk about starter homes. It’s the idea that the first home you buy could be a tiny little bungalow, good enough for you and your significant other. Down the line, when the plan begins to include little ones, you would sell your starter home and […]...more

5 Reasons Why Strata Fees Aren’t So Bad

With the prices of houses in Canada as high as they are, many Canadians are considering purchasing townhomes or condos that come with strata fees. At first glance, most of us will roll our eyes and groan, “I don’t want to deal with strata”. They mean monthly fees and nosey neighbors, right? Sure. In some […]...more

Strategies To Weather The Rising Cost Of Living In Canada

Canada is one of the most desirable places to live, but it comes with a hefty price tag. Depending on your location, the cost of living can seem astronomical, and it’s only getting worse. As middle-class Canadians, how can we sustain our lifestyle and what are strategies to weather the rising cost of living in […]...more

Which Loans Should I Pay Off First?

If you are trying to pay off the money you owe but you’re unsure of where to start, you’re in the same boat as many Canadians. It can be hard to decide which one to focus on. Some people will say that you should pay off your biggest loan first while others say your […]...more

New Job? Tips & Tricks For Maintaining That Income Stream

So you’ve landed a brand new job? Congratulations! You’ve just made a great step towards financial security. The first few weeks of employment will establish what sort of employee you will be. If you want your employer to feel that you’re an asset to the company and that they’ve made the right decision in […]...more

10 Skills That Are Making People Money On YouTube

One of the best ways to reduce debt is to increase your income and the internet can been a great source of extra income. Whether you’re selling your favorite wares, offering webinars or you’ve launched a new channel on YouTube, the possibilities are endless. YouTube alone has hundreds of thousands of creators that are finding […]...more

Netflix Hiking Rates: Is It Still A Good Deal?

Netflix recently announced that it will be raising costs in Canada and it begs the question… As we see Netflix hiking rates: is it still a good deal? The quick answer? Yes! Let’s take a closer look at recent television trends to see why streaming services are the way to go. The Costs […]...more

Credit Card vs. Line of Credit: What’s The Difference?

Ever asked yourself, credit card vs. line of credit? If so, you’re on a great track at understanding these two different credit products. At face value, these two credit products can be tough to differentiate. They’re both classified as ‘revolving credit’ (which means as your available funds are freed up as you pay back your […]...more

With Tap & Apple Pay, Could Cash Become Obsolete?

Many Canadians have tap enabled debit and credit cards. Some of you probably make use of Apple Pay or Android Pay with your smartwatches and smartphones. Slowly but surely, cash is being used less and less frequently. What does this mean for us as consumers and what new risks do we face because of […]...more

9 Bad Credit Card Habits That Stall Credit Recovery

Getting yourself a credit card always seems to feel a little bittersweet. There’s always that threat of growing debt looming over your head....more

Your Winter Road Trip Checklist

With your trunk full of gifts, you’ll head through mountains and along stretch after stretch of icy highways....more

A Dozen Ways To Cook With Pumpkin

It seems this time of year, everywhere you look are pumpkins....more

5 Tips To Save Money Playing Hockey

A lot of moms across Canada secretly hope their kids will be into soccer instead of hockey. ...more

10 Pinterest Hacks For A More Organized Life

A cluttered life makes your to-do list feel endless and can lead to feeling discouraged about getting the truly important stuff done....more

How To Make Difficult Decisions

As adults, we all have to face difficult decisions. Sometimes, it feels like they never really end. Once you face one, another presents itself....more

12 Stress Reduction Tips That Never Fail

If you’re like me, stress manifests itself in my life in ways that only create more stress. It’s a sort of snowball effect....more

The Perks of Pet Ownership

Those little furballs with paws add an extra expense, and multiple chores to your to do list, so is it really a good idea to adopt a pet?...more

20 Facts About Canada That Should Surprise You

In a country so vast as our own, you might expect that some weird things might happen here and there. If you did expect this...more

10 Alberta Day-Hikes You Have To Check Out This Summer

Alberta boasts some of the most breathtaking natural settings in all of Canada, so it’s no wonder people enjoy a good hike in this...more

3 Killer Salads That Will Survive a Picnic

Summer is salad time, but if you’re like me at all, you have trouble finding tasty, unique salads that last. And what picnic is complete...more

12 of the Strangest Festivals in Canada

When you think festival, you usually think a stage with some folk or rock music, perhaps a few food trucks, and maybe a bouncy...more

Canadians: A World Of Prizes Awaits You

Canadians: a world of prizes awaits you. There’s a subculture on the internet that perhaps you’re aware of, but probably not....more

10 Can’t-Miss B.C. Trails That Take Under A Day

Do you love hiking but find all the best trails take too long? You’ll be happy to know, that there are plenty of day trails all across BC....more

Challenge: Can You Name This Canadian Company?

Let’s start the week off this week with some trivia, shall we? This one is going to be a tough one. Got your thinking caps on?...more

15 Inventions You Never Knew Were Canadian

Quick, off the top of your head, name five Canadian inventions! Surprisingly, most people asked can’t think of more than three...more

Origins of The Names Of Canadian Provinces and Territories

British Columbia, Nova Scotia, Manitoba… the names of Canadian provinces are all so different from each other, it seems. Where...more

Bathtub Races Are A Canadian Thing, Too!

Bathtub races are a Canadian thing, too! When you think of Canada, you think of strange quirks, different foods and odd sports… like...more

The Thieves Who Preyed On Our Hockey Heroes

The thieves who preyed on our hockey heroes. As Canadians, we love our hockey. We idolize our favourite players and they are among...more

The Ultimate Canada Day Playlist

Canadian music rocks and I’ve got the list to prove it....more

Unique Canada Day Celebrations Across Canada

Unique Canada Day celebrations across Canada: there’s the annual Steveston Salmon Festival, where salmon is the guest of honour....more

The History of Canada Day

The history of Canada Day: it seems we have always loved our pyrotechnics, our flowing ale, and our good old Canadian tunes....more

An Adirondack Chair By Any Other Name…

An Adirondack Chair By Any Other Name: They’re sturdy. They can withstand the elements. Their slanted backs are comfortable...more

Refresh Canadiana: The Unbelievable Tale Of The Flying Bandit

Refresh Canadiana: The Unbelievable Tale Of The Flying Bandit. Less than a week before...more

Must-Haves For Your Carry-On

You’ve packed a carry-on, I’ve packed a carry-on, she’s packed a carry-on… But what are must-haves for your carry-on?...more

The Case For Travelling Solo

The case for travelling solo: is there an upside to travelling alone? Can you get more out of your travels if you go it solo?...more

6 Guerilla Travel Tips That Work In 2016

My brother gave me a book years ago, and In it were some of the best travel tips. In that spirit, here are six guerilla travel tips for the 2016 traveller....more

The Case For Leaving The Kids At Home

The case for leaving the kids at home. As parents, we devote most of our time to our kids, don’t we? Should our vacations really be devoted to them too?...more

The 5 Best Kid Friendly Destinations in Canada

If you’re a parent, you know how difficult it is to find places that cater to your kids AND you. So here are the 5 best kid friendly destinations in Canada....more

10 Hilarious Tourism Ads

10 hilarious tourism ads. I love the internet. Not just for its vast expanse of information, but also because it never lets you forget anything....more

How To Find Hiking Trails Near You

Hiking! It’s the third most popular pastime for us Canadians (after hockey and apologizing). So we’ve created a guide on how to find hiking trails near you....more

A Step By Step Guide To Being A Tourist In Your Own Home Town

So, you’ve chosen a staycation this year. Now what? How do you fill your time? ...more

10 Reasons You Should Consider A Staycation This Year

Yesterday, we gave you the scoop on some of our fave celebs who love a staycation. Today, we have 10 reasons you should consider a staycation this year....more

6 Celebs Who Chose A Staycation

Photo: Wiki Commons If you don’t know what a staycation is, you can probably guess. The dictionary defines it as a vacation that is spent either in your home country rather than heading out of state, or a vacation spent specifically in your home. We all love vacations, but you have to admit, that sounds […]...more

The Top Five Vacation Destinations In Canada

We’re lucky we live in the most beautiful place on Earth, aren’t we? Today we have the top five vacation destinations in Canada for you!...more

The 5 Most Popular Vacation Destinations For Canadians

We Canadians do love to travel, but do you know where we travel the most?Here are the top five most popular travel destinations for Canadians....more

The Royal Family: Drain or Gain? You Might Be Surprised

The royal family: drain or gain? You might be surprised. So, what does the royal family actually cost the average person?...more

Check out our products.